Today is the last day of the week and, in fact, the end of the trading month (excluding Monday, May 31st). The dollar is traded higher, while the DXY dollar index rallies and is likely to end this week in positive territory, albeit with minimal gains. The DXY dollar is traded near 90.10 mark as of this writing, 10 pips above the previous week's close, which in turn is in line with early-year levels when the DXY hit a multi-month low of 89.16 and then moved higher.

Recent new statements from some Fed officials sounded like a dissonance to the general “chorus of voices” from the Fed, which makes market participants “keep their ears open” when selling the dollar.

So, last Wednesday, a member of the Fed's Board of Governors and Deputy Head for Banking Supervision Randal Quarles said that the leadership of the US central bank may consider the possibility of discussing the issue of reducing the purchase of assets at one of the next meetings. "If in the coming months my expectations for economic growth, employment and inflation are met, and especially if these indicators turn out to be stronger than I expected, then, as stated in the minutes of the last Fed meeting, it will be important for the FOMC to start discussing the change. the pace of asset purchases at future meetings", Quarles said.

Although short-term interest rates will remain near zero, positive expectations for economic growth make it possible to start curtailing the program of purchases of government bonds and mortgage bonds, Quarles said. Now the amount of their monthly purchases made by the Fed is $ 120 billion. If the Fed really begins to curtail the quantitative easing program, this could lead to an increase in the yield of US government bonds, as well as to the strengthening of the dollar.

Nevertheless, despite the strengthening of the dollar, the prices of commodities, in particular oil, are on the rise. The oil market is currently dominated by optimism associated with expectations of a further recovery in the global economy, both against the backdrop of the unfolding vaccination against coronavirus in Europe and North America, and the extra soft policy of the world's largest central banks.

In addition, oil prices were supported by reports published earlier this week by the American Petroleum Institute (API) and the US Department of Energy (EIA), according to which oil reserves in the United States in the reporting week of May 15-21 fell by 0.439 million barrels and by 1.662 million barrels, respectively. Gasoline inventories also fell 2 million barrels, according to the API, and 1.7 million barrels, according to the EIA.

Investors have so far ignored the prospects for Iranian oil to return to the world market, which will create additional supply and pressure on the oil market, focusing more on improving oil demand in the United States and Europe. The summer season of active road trips will begin in the US next week, which may contribute to further growth in oil demand in the country, oil market experts say.

In addition, India, the third-largest oil consumption country in the world, has seen a decline in the number of new cases of coronavirus in recent weeks, and authorities may ease quarantine restrictions in June, experts add.

Next week the next OPEC meeting will take place. In the format of a conference call, representatives of the OPEC+ countries will discuss the prospects for the current agreement on production volumes, which will be in effect until the end of July. The Joint Technical Committee and the OPEC+ Ministerial Monitoring Committee will meet on May 31, prior to the June 1 meeting.

Under the current agreement, OPEC+ plans to gradually increase production by 1.2 million barrels per day until early August. It is possible that a decision will be made to adjust the current agreements, however, in which direction it is not yet clear. At the same time, participants in the oil market should take into account the OPEC+ assessment regarding the impact on the Iranian oil market in their trading plans.

Iran currently has 60 million barrels of unsold oil in its reserves. If sanctions are lifted from Iran, then all this volume will rush to the market if there are buyers.

In addition, according to some analysts, it will take Iran only a few months to reach the level of production of 4 million barrels per day.

The total volume of world oil production is estimated at about 80 million barrels per day. Iranian oil in the volume of 4 million barrels per day, of course, is not comparable with the current daily volume of world oil production. However, it can significantly affect oil prices. At the same time, if the OPEC+ countries at the upcoming meeting refrain from increasing production volumes (given the likelihood of Iranian oil entering the market), this fact is likely to have a positive impact on oil quotes.

From the news for today, investors and participants in the oil market will pay attention to the publication of the weekly report of the American oilfield services company Baker Hughes (at 17:00 GMT). The week before last, the number of active drilling rigs in the United States amounted to 356 units (against 352, 344, 342, 343, 337, 324, 318, 309, 310, 309, 305 in the previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Their next growth will also have a negative impact on oil quotes. However, it will be short-lived. In general, at the moment, long positions in oil seem to be more preferable.

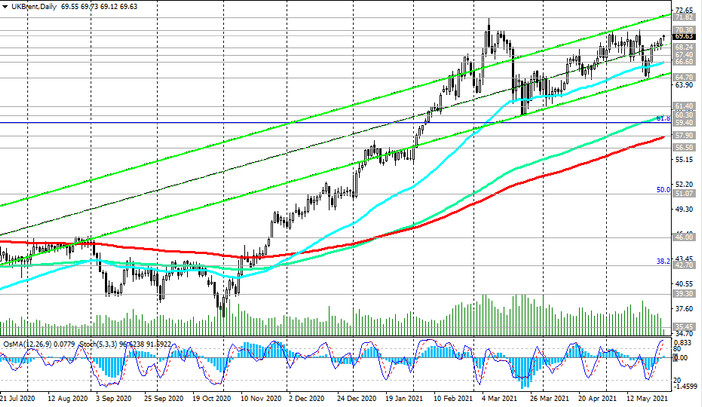

At the beginning of today's European session, oil futures began to rise again. As of this writing, Brent oil futures are traded near 69.60 mark and the nearest local resistance level 70.30.

Its breakdown will be a confirming signal for a build-up of long positions in Brent oil futures (see Technical Analysis and Trading Recommendations).

Market participants today are also awaiting information on the budget proposed by President Biden (expected at 18:00 (GMT) Joe Biden will propose $ 6 trillion for federal spending for fiscal 2022), as well as publication (at 12:30 GMT) inflation indicators for personal income / spending of Americans, which the Fed takes into account when determining its policy.