The dollar strengthened on Tuesday and today continues to develop positive dynamics, having received support from yesterday's publication of positive macro statistics. The PMI Markit in the US manufacturing sector rose from 61.5 to 62.1 points in May, which was better than the forecast of 61.5. A similar indicator from ISM strengthened to 61.2 (against the previous value and forecast of 60.7).

On the eve of the publication on Friday of data on the US labor market for May, according to which a steady growth in the number of new jobs and a decrease in unemployment is expected, investors will study the report on the labor market from the ADP on the level of employment in the private sector of the American economy, which will be released tomorrow (at 12:15 GMT). US private sector workers are expected to grow by 650,000 in May (after rising 742,000 in April, 517,000 in March, 117,000 in February, 174,000 in January, a drop of -123,000 in December). Despite the relative decline, this is a strong indicator that may have a positive effect on the dollar quotes. But the market reaction may be negative, and the dollar will decline if the data turns out to be worse than forecast.

It is worth recalling, however, that the report released last week on applications for unemployment benefits indicated a decline in the indicator to a new record low (406,000 against the forecast of 425,000 and the previous value of 444,000).

And today, market participants will study the Fed's monthly economic review, called the "Beige Book", which may support the positive sentiment of market participants who are betting on the strengthening of the dollar. Its release is scheduled for 18:00 (GMT).

So, as we noted above, the US dollar continues to strengthen, including against commodity currencies, despite the rise in prices for strategic commodities such as oil, gas, copper and iron ore. The pair AUD / USD, for example, is also declining today after rising the day before, despite the publication of positive macro statistics from Australia at the beginning of today's Asian session. According to the Bureau of Statistics of this country, in the 1st quarter, Australia's GDP grew by +1.8% (against the forecast of +1.5% and the previous value of +3.2%). In annual terms, GDP grew by +1.1% in the 1st quarter (against the forecast of +0.6% and a decrease of -1% in the previous quarter).

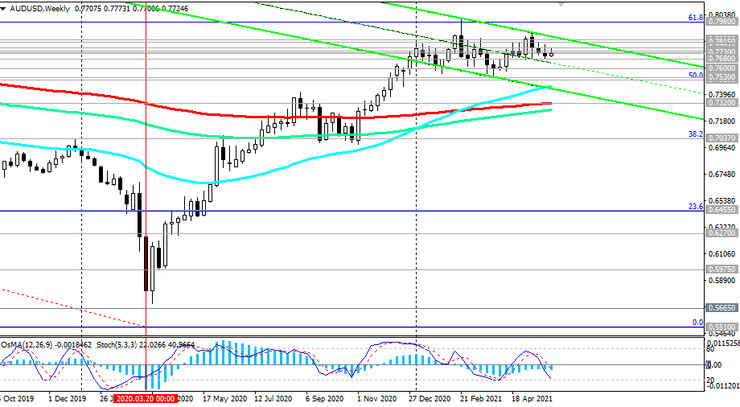

At the same time, since the beginning of the year, the AUD / USD pair continues to trade in a range, mainly between the levels of 0.7600 and 0.7835. In the last 3 weeks, this range has narrowed to 0.7680 and 0.7815 levels.

It is obvious that the pair lacks new strong drivers to move in one direction or another, and much in this matter will depend on the position of the central banks of Australia and the United States.

At a regular meeting on Tuesday, the Central Bank of Australia decided to keep the key interest rate and the target level of yield on 3-year government bonds at a record low of 0.10%. In the accompanying comments, it was said that the Central Bank would not raise the rate until the actual inflation is stable in the range of 2% -3%, which is unlikely to happen before 2024, and in July the bank will consider the issue of further purchases of bonds. Meanwhile, some economists expect the RBA to undertake A $ 50 billion in asset purchases over the next six months (up from the current A $ 100 billion in monthly purchases). In fact, this is the beginning of the curtailment of the stimulating policy. If the RBA really decides at the next meeting to reduce the volume of purchases on the national bond market, then this will mean a reduction in the volume of liquidity and the strengthening of the Australian dollar.

In the meantime, the AUD / USD pair is likely to remain trading in the current range we indicated above.

Of the news this week, which could increase the volatility of the AUD in the short term, market participants will pay attention to the publication (on Thursday at 01:30 GMT) of the Australian Bureau of Statistics reports on the trade balance and the level of retail sales. Previous value (trade balance) is A $ 5.574 billion. The growing trade surplus is a positive factor for the AUD. Forecast for April: A $ 7.900 billion.

The Retail Sales Index measures total retail sales and is considered an indicator of consumer confidence, reflecting the near-term health of the retail sector. Previous index value (for March) +1.1%. If the data turns out to be weaker than the previous value, then the AUD may sharply decline in the short term, above the previous values, then the AUD is likely to strengthen. Forecast: the index will come out with the same value +1.1%.

The AUD is likely to be able to strengthen short-term after the publication of these reports.