The dollar strengthened significantly after the publication of a block of important macro statistics on the US. The DXY dollar index jumped 0.66% yesterday, gaining 60 points and returning to mid-last month levels. As of this writing, the dollar is trying to hold onto yesterday's gains, while DXY futures are traded near the 90.52 mark, which corresponds to yesterday's highs and yesterday's closing price.

Buyers of the dollar and market participants, betting on its further strengthening, received strong support yesterday from the exceeding expectations of the US labor market data and from the agency IHS Markit and the ISM institute, which reported the growth of business activity in the service sector of the US economy. The purchasing managers' index (PMI) for the US services sector, calculated by IHS Markit, was revised to 70.4 (in May) against the preliminary value of 70.1 and after 64.7 in April, and a similar index from the Institute for Supply Management (ISM) rose to 64.0 in May (against 62.7 in April and the forecast of 62.5).

Meanwhile, the US Department of Labor reported that the number of initial claims for unemployment benefits last week fell by 20,000, reaching 385,000 against the forecast of 393,000, and data from the ADP recorded a significant increase in employment in May (+978 thousand against the forecast of +650 thousand).

Millions of Americans are returning to work in service companies, and despite new signals of a labor shortage, the pace of hiring in the private sector of the US economy accelerated in May. "The data on the number of jobs in the private sector improved markedly from previous months, indicating the strongest employment growth since the beginning of the economic recovery", - said in the ADP.

The service sector accounted for most of the new jobs - 850,000, with most of them created in the leisure and hospitality sector - 440,000. "Employment in the manufacturing sector grew at a steady pace, however, the service sector provided most of the new jobs, demonstrating employment growth significantly higher monthly average over the past six months", - also reported in the ADP.

Market participants are now awaiting the publication of the US Department of Labor report today (at 12:30 GMT). The May employment report is expected to indicate a 650,000 rise in non-farm jobs in the US and a decline in unemployment to 5.9% from 6.1% in April.

However, despite the strong employment report from the ADP, there is considerable uncertainty around the release of the official employment report from the US Department of Labor. Although the ADP report is often viewed as a harbinger of an official report from the Ministry of Labor, it does not have a direct correlation with it.

It is worth recalling that the previous April employment data fell short of expectations, being significantly weaker than the forecast. The dollar fell sharply after the April employment report was published in early May. It is possible that history may repeat itself. If the official May employment report also turns out to be weaker than the forecast, then the dollar, which strengthened significantly yesterday, may lose most of its yesterday's gains and decline today.

However, the data still show that the labor market continues to recover. Earlier, Fed officials said that rising inflation was not a sufficient reason for tightening monetary policy, as employment and unemployment remained weak. At the same time, high rates of vaccinations, fiscal stimulus and relaxation of quarantine measures are helping to improve the situation in the labor market, while also supporting the growth of the American economy. Now, the latest data on the labor market may lead them to an earlier cut in bond buybacks, which could strengthen the position of the USD. At the same time, some of the more cautious investors may choose to stay out of the market during this time frame. With the publication of data from the US labor market, a surge in volatility is expected not only in USD quotes, but throughout the entire financial market. It is often difficult to predict the market reaction to the publication of indicators, because many indicators for previous periods are subject to revision.

Simultaneously with the release of the US employment report today (at 12:30 GMT), a similar employment report from Statistics Canada will be released.

Unemployment in Canada last month rose according to forecasts by 0.1%, to 8.2%, and the number of employees fell by 20,000 (after a decline of 207,100 in April), due to massive closures in previous months due to coronavirus and layoffs. If unemployment continues to rise, the Canadian dollar will decline. If the data is better than the previous values, the Canadian dollar will strengthen. A decrease in the unemployment rate is a positive factor for CAD, an increase in unemployment is a negative factor.

Thus, an extremely volatile start of the American trading session is expected.

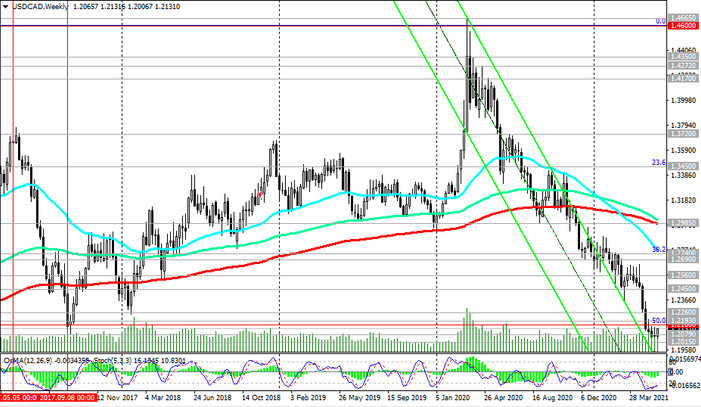

Since the beginning of April last year, USD / CAD has been trading in a downtrend. Over the past 14 months, the overall decline in the pair was more than 21%, as a result of which it fell by 2000 points, breaking through all key support levels and reaching 1.2015 at the end of last month. The Canadian dollar is also supported by the continuing rise in the price of oil, Canada's main export commodity. Despite yesterday's correction, so far, everything is in favor of short positions and a further decline in USD / CAD.

And today, with the publication of data from the US and Canadian labor markets, new drivers will appear either for a further decline or for the continuation of the correction and growth of USD / CAD.