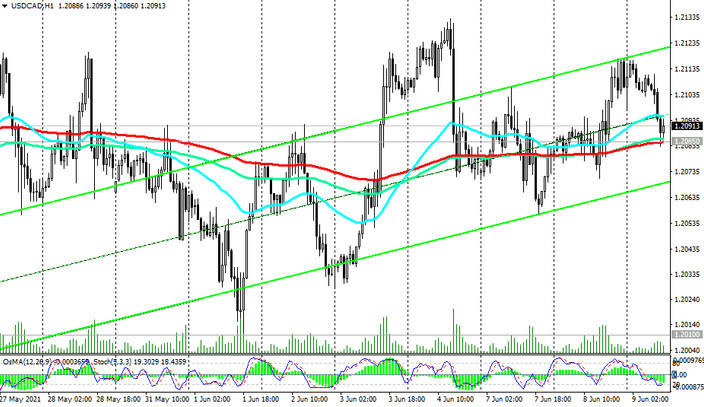

At the beginning of today's American session, the USD / CAD pair is traded slightly below 1.2100 mark, at a short-term support level 1.2085 (ЕМА200 on the 1-hour chart), still maintaining a tendency to further decline, including against the backdrop of strong fundamental factors.

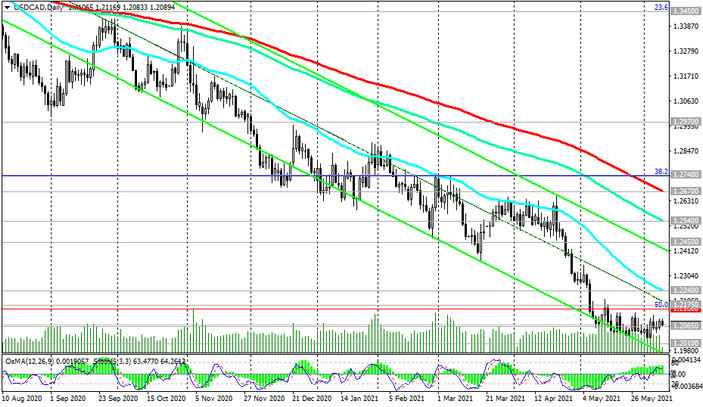

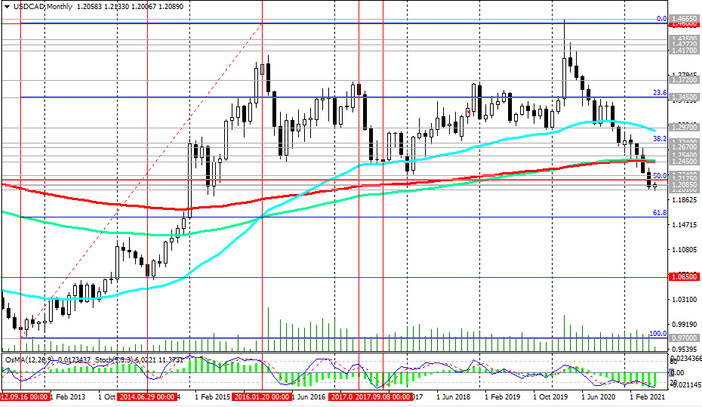

The pair is traded below the important long-term resistance levels 1.2450 (ЕМА200 on the monthly chart), 1.2970 (ЕМА200 on the weekly chart), 1.2670 (ЕМА200 on the daily chart).

Remaining below the key resistance levels 1.2450, 1.2670, in fact, USD / CAD is in the bear market zone.

A breakdown of the short-term support level 1.2085 will be a signal for the resumption of short positions in USD / CAD.

In an alternative scenario, a signal for a possible start of a reversal and breaking of a bearish trend will be a breakdown of important resistance levels 1.2160 (Fibonacci level 50% of the downward correction in the wave of USD / CAD growth from 0.9700 to 1.4600), 1.2175 (ЕМА200 on a 4-hour chart) with the prospect growth to resistance levels 1.2450, 1.2670.

Support levels: 1.2085, 1.2010

Resistance levels: 1.2118, 1.2160, 1.2175, 1.2240, 1.2450, 1.2540, 1.2670, 1.2740

Trading scenarios

Sell by market, Sell Stop 1.2080. Stop-Loss 1.2120. Take-Profit 1.2010, 1.1900

Buy Stop 1.2120. Stop-Loss 1.2080. Take-Profit 1.2160, 1.2175, 1.2240, 1.2450, 1.2540, 1.2670, 1.2740