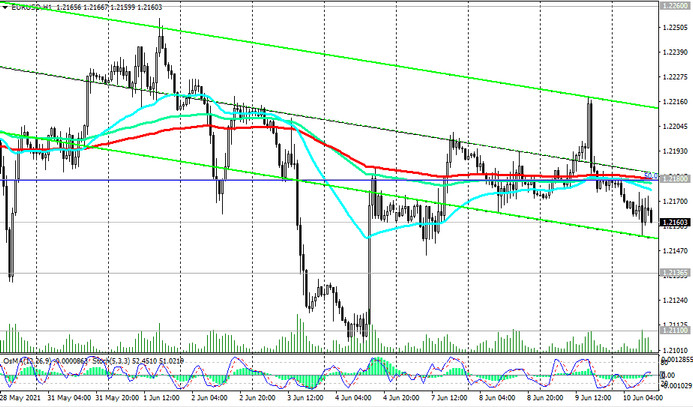

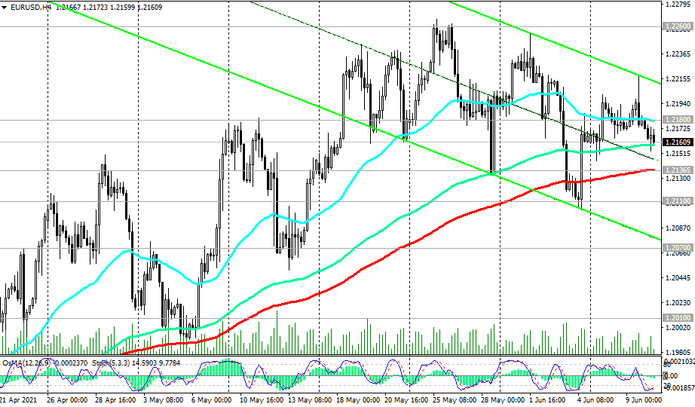

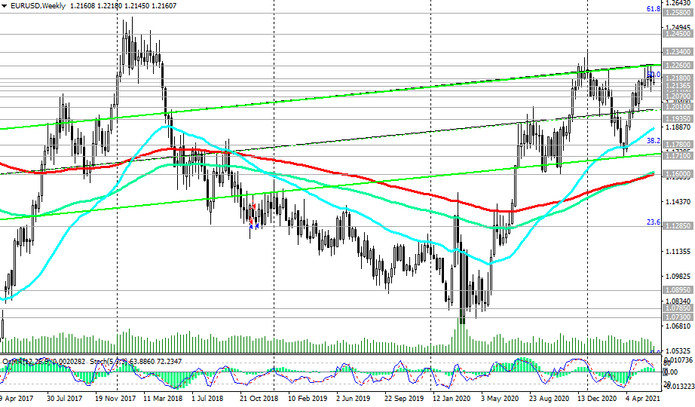

At the end of yesterday's trading day, the price again broke through the important support level 1.2180 (EMA200 on the 1-hour chart and the 50% Fibonacci level of the upward correction in the wave of the pair's decline from 1.3870, which began in May 2014, and the highs of 2018) and today remains in the zone below this level.

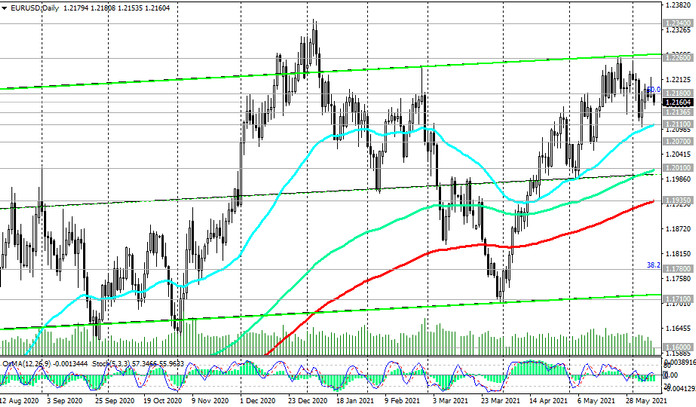

At the time of this article publication, EUR / USD is traded near the 1.2160 mark, while remaining in the bull market zone above the key support levels 1.1935 (ЕМА200 on the daily chart), 1.2010 (ЕМА144 on the daily chart).

Further correctional decline may lead to a fall in EUR / USD to support levels 1.2136 (EMA200 on the 4-hour chart), 1.2110 (EMA50 on the daily chart).

Above these support levels, long positions are still preferred, and a decline to them should be viewed as a good opportunity to build up long positions.

In case of renewed growth and after the breakdown of the resistance level 1.2180, EUR / USD will head towards the upper border of the ascending channel on the weekly chart and the mark of 1.2260.

More distant growth targets are located at resistance levels 1.2340, 1.2450, 1.2500, 1.2580 (Fibonacci level 61.8%), 1.2600.

In the alternative scenario, and after the breakdown of the support level 1.2110, EUR / USD will resume its decline towards the key support levels 1.2000, 1.1930, and the breakdown of the support level 1.1600 (ЕМА200 and ЕМА144 on the weekly chart) will increase the risks of resuming the long-term bearish trend in EUR / USD. The first signal for the implementation of this scenario (the breakdown of the short-term support level of 1.2180) has already been received.

Support levels: 1.2136, 1.2110, 1.2070, 1.2010, 1.1935, 1.1780, 1.1710, 1.1600

Resistance levels: 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.2150. Stop-Loss 1.2190. Take-Profit 1.2136, 1.2110, 1.2070, 1.2010, 1.1935, 1.1780, 1.1710, 1.1600

Buy Stop 1.2190. Stop-Loss 1.2150. Take-Profit 1.2260, 1.2300, 1.2340, 1.2450, 1.2580, 1.2600