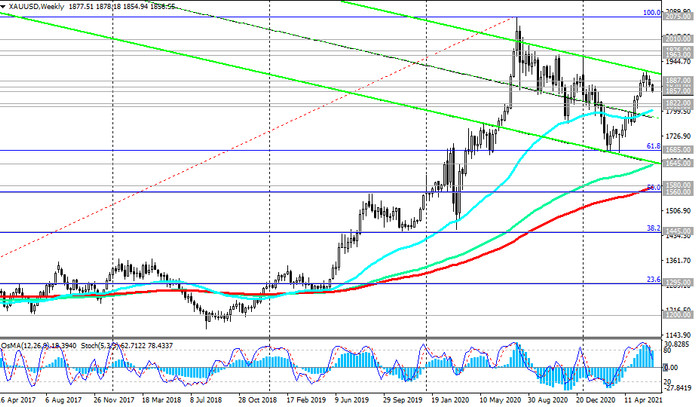

Against the background of the strengthening of the dollar, the XAU/USD pair declined from a 5-month high reached earlier this month near the 1916.00 mark.

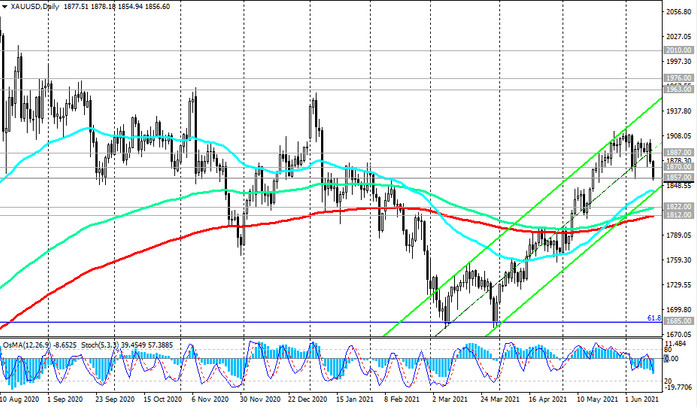

However, against the background of inflation growth, the inaction of the Fed and the prospects for further weakening of the dollar, the XAU / USD pair retains the potential for further growth. In this case, the objectives will be the marks 1963.00, 1976.00 (local maxima), 2000.00.

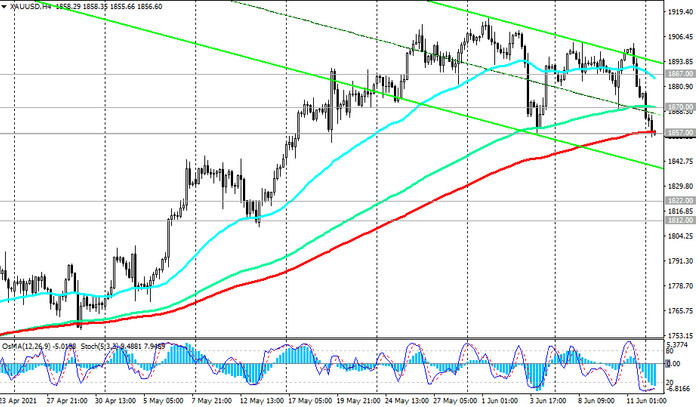

In an alternative scenario, XAU / USD will strengthen the downward dynamics, and the downward correction observed today for the second day in a row may continue inside the ascending channel on the daily chart, the lower border of which passes through the support level (EMA50 on the daily chart) and the mark of 1844.00.

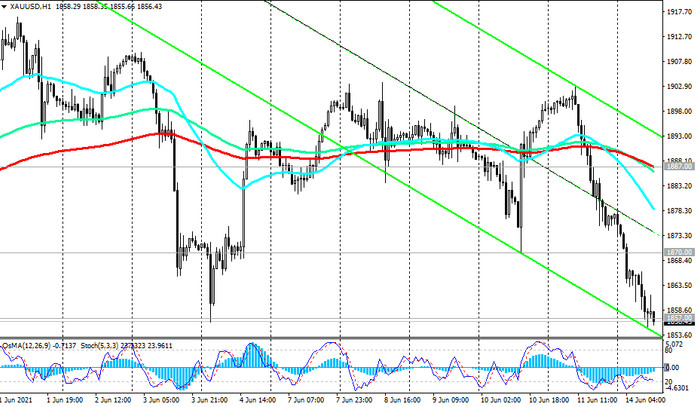

The first signal for the development of the scenario for the decline of XAU/USD has already worked (the price broke down the short-term important support level 1887.00 (EMA200 on the 1-hour chart)). The breakdown of another important support level 1857.00 (EMA200 on the 4-hour chart) will confirm the scenario for a decline with targets at the support levels 1844.00, 1812.00 (EMA200 on the daily chart), 1685.00 (local lows and the Fibonacci level 61.8% of the correction to the growth wave since November 2015 and the mark of 1050.00), 1580.00 (EMA200 on the weekly chart), 1560.00 (the Fibonacci level of 50%).

Support levels: 1857.00, 1844.00, 1822.00, 1812.00, 1700.00, 1685.00, 1645.00, 1580.00, 1560.00

Resistance levels: 1870.00, 1887.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trade recommendations

SELL STOP 1849.00. Stop-Loss 1871.00. Take-Profit 1844.00, 1822.00, 1812.00, 1700.00, 1685.00, 1645.00, 1580.00, 1560.00

BUY STOP 1871.00. Stop-Loss 1849.00. Take-Profit 1887.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00