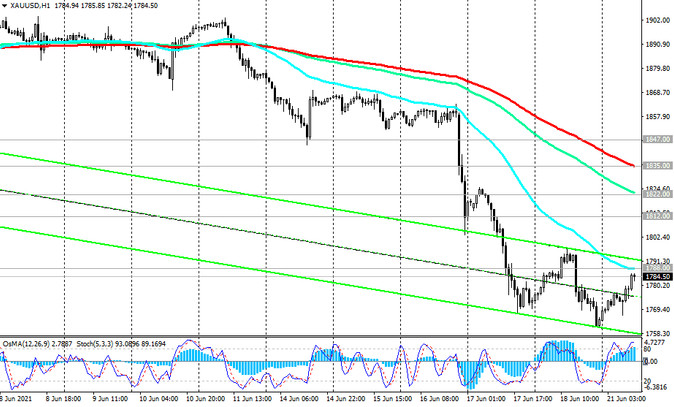

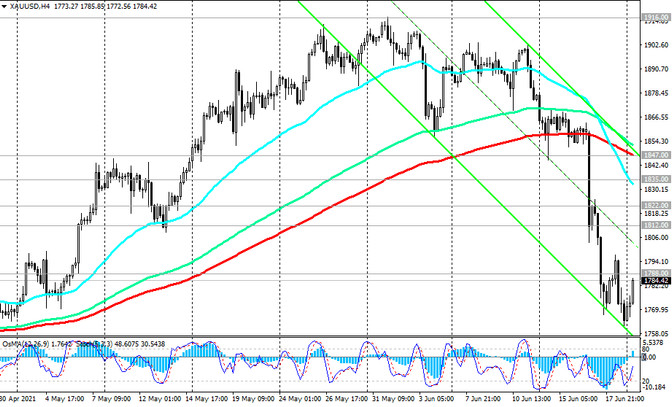

As we noted above, the XAU / USD pair dropped significantly last week amid a strengthening of the dollar after the Fed meeting ended last Wednesday.

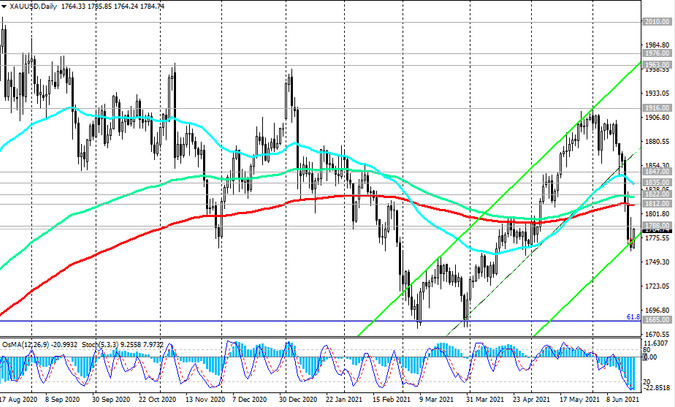

In a continuous decline over the past 3 weeks, XAU / USD declined by 8.6% from the 5-month high reached earlier this month near 1916.00 mark and reached a local 7-week low near 1761.00 mark last Friday.

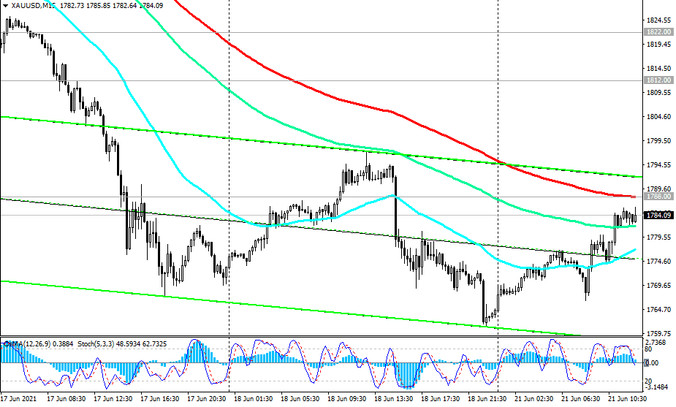

Nevertheless, amid rising inflation and if the Fed continues to remain neutral, the XAU / USD pair has the potential to resume growth. In this case, the targets will be the levels 1916.00, 1963.00, 1976.00 (local highs), 2000.00, and the first signal for the resumption of long positions will be the breakdown of the short-term resistance level 1788.00 (ЕМА200 on the 15-minutes chart) and consolidation in the zone above 1790.00 mark.

Growth into the zone above the key resistance level 1812.00 (ЕМА200 on the daily chart) will confirm the scenario for the resumption of the bullish trend of the XAU / USD.

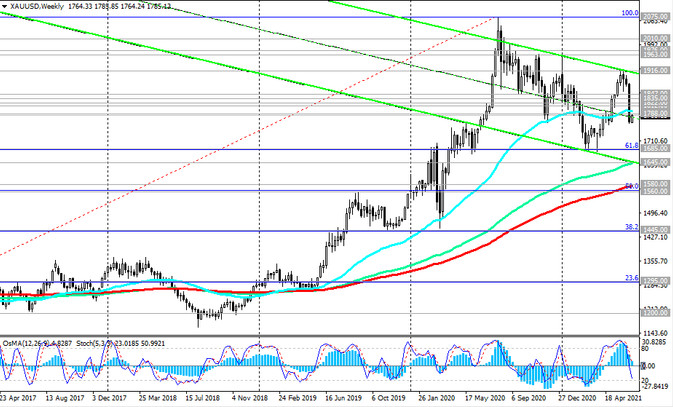

In the alternative scenario, XAU / USD will strengthen the downward trend, and the downward correction may continue inside the downward channel on the weekly chart, the lower border of which passes through the support level 1645.00 (ЕМА144 on the weekly chart).

A signal for the development of a scenario for a decrease in XAU / USD will be a breakdown of the local support level 1761.00, and the closest target is the support level 1685.00 (local minimums and 61.8% Fibonacci level of correction to the growth wave since November 2015 and the level of 1050.00).

Support levels: 1761.00, 1685.00, 1645.00, 1580.00, 1560.00

Resistance levels: 1788.00, 1812.00, 1822.00, 1835.00, 1847.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1760.00. Stop-Loss 1791.00. Take-Profit 1700.00, 1685.00, 1645.00, 1580.00, 1560.00

Buy Stop 1791.00. Stop-Loss 1760.00. Take-Profit 1812.00, 1822.00, 1835.00, 1847.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00