The DXY dollar index has risen since the opening of today's trading day, accelerating at the beginning of the European session. As of this writing, the DXY is at 92.06 mark, 20 pips above today's opening price, heading towards last week's highs near 92.40 mark.

It is possible that the strengthening of the dollar may gain momentum on the eve of the publication on Friday of the monthly report on the change in the number of employees in the non-agricultural sector of the United States. An increase in the number of jobs in June is expected by 690 thousand after 559 thousand in May and a drop in the unemployment rate by 0.1%, to 5.7%. The confident improvement in the state of the labor market could provoke a new round of talk about the fact that the Fed may move to a tighter monetary policy faster than so far announced by the leadership of the central bank.

As you know, following the results of the next meeting, which ended on June 16, the Fed leaders kept key interest rates in the range of 0.00% -0.25%, and the volume of the QE asset purchase program at the level of $ 120 billion per month. The accompanying statement said that the Fed will continue to adhere to the current parameters of monetary policy until the target levels for inflation and maximum employment are reached, and the level of interest rates will not change.

Nevertheless, despite this decision, the dollar strengthened significantly after the Fed meeting, which was facilitated by some changes in the sentiment of the FRS leaders regarding the timing of a possible start to curtail the extra soft stimulus policy of the central bank. Now, Fed officials are forecasting two rate hikes in 2023, whereas they previously promised not to raise rates until the end of 2023. 7 representatives of the FOMC against 4 in March expect the start of rate hikes in 2022.

Fed Chairman Jerome Powell, speaking in Congress last week, reassured market participants, saying that the Fed's first priority is to support the US economy and labor market, which are badly affected by the pandemic. Inflation, which shows record growth rates over the past 29 years, in his opinion, is a secondary, albeit no less important problem. The Fed will not rush to tighten monetary policy, relying on inflation alone, and only with the cumulative dynamics of these indicators (inflation growth and maximum recovery of the labor market) the central bank can begin to change the parameters of monetary policy, Powell said.

And yet, macro data coming from the US, which indicate a significant acceleration in the recovery of the American economy, cannot but cause an increase in optimistic sentiments regarding the prospects for the dollar.

As the US Department of Commerce reported last week, the country's economy grew strongly in the first quarter of 2021, driven by consumer activity. Real GDP showed an increase of 6.4%, according to the revised estimate. The US Personal Consumption Expenditure (PCE) Index rose 3.7% in the first quarter, as previously reported, while the PCE excluding food and energy prices rose 2.5%.

The dollar is also receiving support from Joe Biden's new plan to modernize US infrastructure, approved by the US Congress last week, which will require almost $ 600 billion in new spending, and from growing concerns about the worsening epidemiological situation in Asia and Europe due to the increase in the number of new diseases delta strain COVID-19.

Today investors await the publication (at 14:00 GMT) of the Conference Board data on the level of consumer confidence in the US for June and (at 13:00 GMT) the April statistics on the dynamics of prices in the housing market, which is an important part of the American economy. A high result will strengthen the USD, while a low result will weaken it (in the short term).

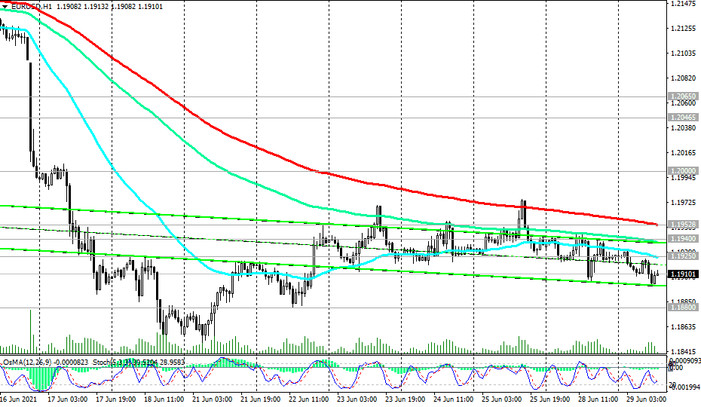

As for the main currency rival of the dollar, the euro, we can say that, with the greatest probability, it will decline against the dollar.

As the European Commission reported on Tuesday, in June, the index of sentiment in the Eurozone economy, reflecting the dynamics of confidence among companies and consumers, rose to 117.9 from 114.5 in May, which corresponds to the maximum in 21 years. For the fourth month in a row, this index is well above the long-term average. The EUR / USD pair reacted to this publication with a short-term growth of 10 points to 1.1911.

Nonetheless, economists believe that the Fed may be quicker than the ECB to begin phasing out stimulus policy. According to them, in addition to supporting the economy, the ECB should simultaneously maintain a "fragile monetary union". There is much less inflationary pressure in the Eurozone than in the US, and the ECB can afford to maintain a soft policy much longer than the Fed, and this will cause the euro to decline against the dollar. Some economists predict that the ECB may tighten policy for the first time no earlier than the second half of 2023, raising the deposit rate by 10 basis points, to -0.40%. Recall also that the ECB's key interest rate is 0%, while the Fed's is 0.25%, and many economists agree that sooner or later the Fed leaders will face stronger and longer-term price pressure, which will force them to start curtailing the stimulus policy. And it will be earlier than in the Eurozone.