Oil prices have gone up again, recovering from a strong drop earlier this week.

On Monday, WTI oil quotes fell by more than 7%, Brent fell more than 6% amid investor concerns about the spread of the delta strain of coronavirus in the world and the OPEC+ coalition decided to increase oil production. Last week, OPEC+ members agreed on a phased increase in oil supplies by 400 thousand barrels per day from August to December. In addition to meeting the growing demand, the cartel also appears to be aiming to lower world oil prices somewhat. The growth of commercial stocks in the US also negatively affected oil prices.

However, the rise in oil prices did not help the Canadian dollar very much in its confrontation with the US dollar.

The US dollar lost some ground yesterday after the data released that showed an increase in the number of initial jobless claims in the US last week by 51,000 to 419,000 (according to the forecast, the number of applications was expected to decrease to 350,000).

However, many economists believe that any short-term weakness in the US dollar will be limited as concerns about the spread of the coronavirus globally will support demand for it as a safe haven asset. At the same time, consumer and business confidence in the US remains high.

The DXY dollar index maintains positive dynamics, and at the time of publication of this article, DXY futures were traded near the level of 92.93, which corresponds to the levels of the beginning of April.

Meanwhile, market participants turn their attention to the Fed meeting, which will end on Wednesday with the publication (at 18:00 GMT) of the decision on the interest rate.

The Fed now buys $ 80 billion in Treasury bonds and $ 40 billion in mortgage-backed bonds every month, and keeps interest rates in the 0.00% -0.25% range.

Earlier, Fed officials have repeatedly stated that they will not slow down the rate of bond purchases until they see "significant further progress" in achieving the inflation target of 2% and the labor market reaching pre-crisis (before the pandemic) levels. Inflation is now well above the target, but Fed officials still expect inflation to slow after closing the deficit amid the opening of the economy after the lockdowns.

Since the Fed leaders have signaled their intention to warn the markets in advance of the cuts in stimulus, it is likely that they are unlikely to start such cuts at the July meeting.

Nevertheless, the intrigue around the intentions and actions of the FRS remains, since after the meeting in June, 13 out of 18 Fed leaders predicted a rate hike until the end of 2023, and 7 - until the end of 2022.

Still, the further spread of the coronavirus remains a serious risk to the global economy, supporting the dollar, offsetting the impact of US labor market data indicating that the Fed will be less likely to tighten its policies.

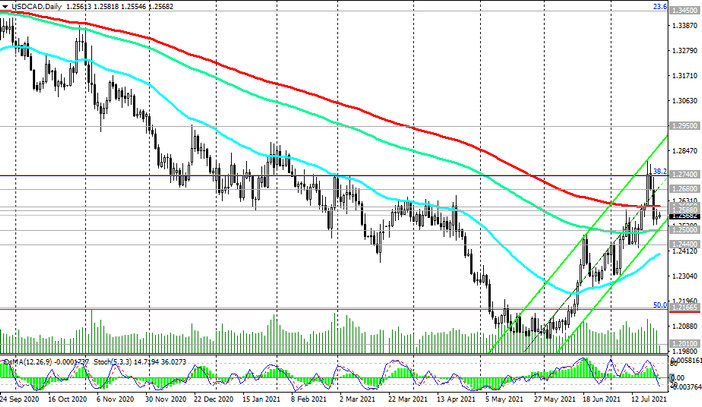

Returning to the Canadian dollar and the USD / CAD pair, which at the time of publication of this article is traded in the zone below the important resistance levels 1.2580, 1.2605 (see Technical analysis and trading recommendations), market participants will pay attention to the publication today at 12:30 (GMT) data on retail sales in Canada (expected to fall by -3.0% in May after a decrease in retail sales by -5.7% in April, which is negative for CAD) and on the publication at 13:45 (GMT) of PMI indices from Markit of business activity in the US (PMI values are above the level of 60.0 and their next growth is expected, which is generally positive for the USD).

Thus, from a fundamental point of view, we should expect further growth of the USD / CAD pair, or at least the preservation of its positive dynamics, which resumed in early June.

Today, oil market participants are also awaiting the publication (at 17:00 GMT) of the report on active oil platforms from Baker Hughes. Previous data reflected an increase in the number of drilling rigs from 378 to 380 units, which was the third consecutive increase, and which is a negative factor for oil prices and, accordingly, the Canadian dollar, which in many respects still retains the signs of a commodity currency.