The unexpectedly weak ADP report on private sector employment, published at the beginning of yesterday's American trading session, disappointed market participants, betting on the strengthening of the dollar. According to this report, 330 thousand jobs were created in the private sector of the US economy in July, while the forecast assumed an increase of 695 thousand after a similar increase (+680 thousand) in June. The dollar fell sharply following the release of the ADP report, as it diminished the likelihood of an earlier start to phasing out the Fed's stimulus policy. However, volatility has risen sharply again, and the dollar has strengthened after the representative of the Fed and FOMC member Richard Clarida hinted that the US central bank is considering cutting existing stimulus already this year due to the risks of rising inflation.

As a result of yesterday's turbulent American trading session, the DXY dollar index closed yesterday's trading day with a gain of 0.24% to 92.27 mark, adding 23 points to the opening price of the trading day.

Today, the DXY dollar index is close to this mark in anticipation of new drivers for growth or decline. In this regard, investors will be interested in the weekly report of the US Department of Labor with data on the number of jobless claims, which will be published today at 12:30 (GMT).

Yesterday's ADP report on the number of jobs in the US private sector forced market participants to revise expectations for employment growth outside of agriculture to the downside. The ADP report does not directly correlate with the data from the US Department of Labor, but it is a kind of predecessor to the official data. The official US Department of Labor's monthly employment report will be released Friday at 12:30 (GMT) and investors remain cautious while awaiting the release of this report.

Also, market participants will be watching the speech of FOMC member and Fed Board of Governors Waller today (at 14:00 GMT). If he, like Clarida yesterday, speaks out in favor of an earlier start to curtail the stimulus programs of the Fed, then the dollar will receive support again before the important publication of official data from the US labor market on Friday.

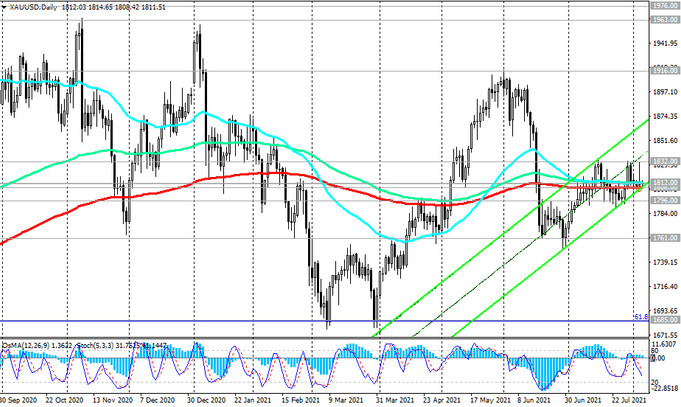

Meanwhile, on the eve of the publication of important macro statistics, gold for the 4th week in a row continues to trade in a range, mainly between the levels passing through the marks of 1832.00 and 1796.00. At the time of publication of this article, the XAU / USD pair is traded near the 1812.00 mark, through which 3 strong support / resistance levels pass at once (see Technical Analysis and Trading Recommendations).

Gold does not generate investment income, but its quotes are extremely sensitive to changes in the interest rates of the Fed and other major central banks in the world.

On the one hand, growing inflation and a more aggressive delta strain of coronavirus spreading around the world create prerequisites for the growth of the XAU / USD pair. On the other hand, investors seem to refrain from building up long positions in gold for the time being in anticipation of new drivers and fresh macro data.

For gold buyers, the alarming moment should be signals from some representatives of the Fed's leadership about the possibility of an earlier start to curtail the stimulating programs. If the rhetoric of the new statements by the Fed leaders regarding the growing inflation increasingly indicates their readiness for an earlier start to roll back the stimulus policy, then this may become a signal for a more aggressive closing of short positions in the dollar and for the sale of the XAU / USD pair.

In this regard, tomorrow's publication of July data from the US labor market is extremely important for investors, since for the Fed leadership, as its head Jerome Powell has repeatedly stated, a more important task than taming rising inflation is the full recovery of the US labor market and its return to levels before the pandemic. It is expected that in July the number of new jobs created outside the US agricultural sector amounted to +870 thousand after an increase of +850 thousand in June, while unemployment fell to 5.7% from 5.9% last month. In general, the indicators can be called encouraging. The data speaks of continued improvement in the US labor market after its landslide in the first half of 2020, and if they are confirmed, the dollar is likely to rise after the publication of these data, and the XAU / USD pair will decline accordingly. If the report of the Ministry of Labor turns out to be as disappointing as yesterday's data from ADP, then market participants will consider it as a signal to sell the dollar.