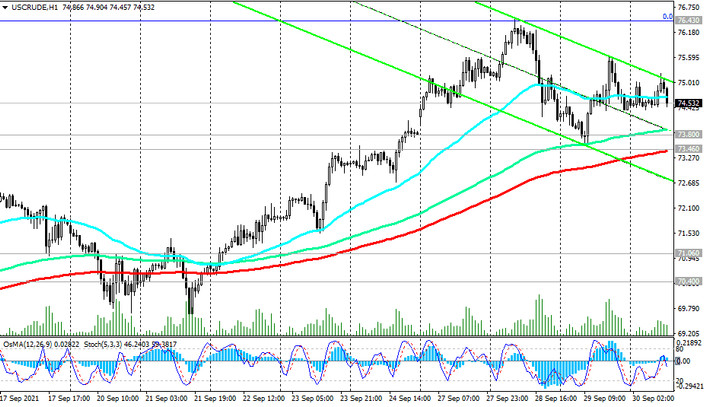

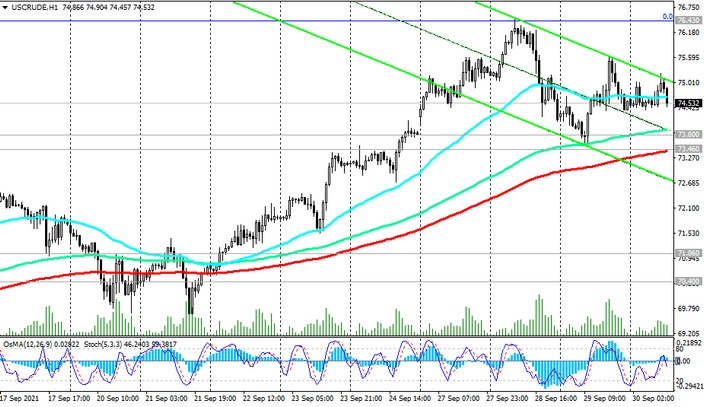

Against the backdrop of strong fundamental factors, the price of oil on Tuesday renewed its 35-month high by several points, reaching mark of $ 76.50 per barrel.

Then the price bounced back from the reached levels, however, its strong upward momentum remains.

Growth is most likely to continue, and in case of a breakdown of the local resistance level 76.50, the price will move towards new multi-year highs above 77.00.

In an alternative scenario, the breakdown of the short-term important support level 73.46 (ЕМА200 on the 1-hour chart) will be a signal to open short positions with targets near the support levels 71.06 (ЕМА200 on the 4-hour chart), 70.40 (ЕМА50 on the daily chart). Above these support levels, preference should be given to long positions.

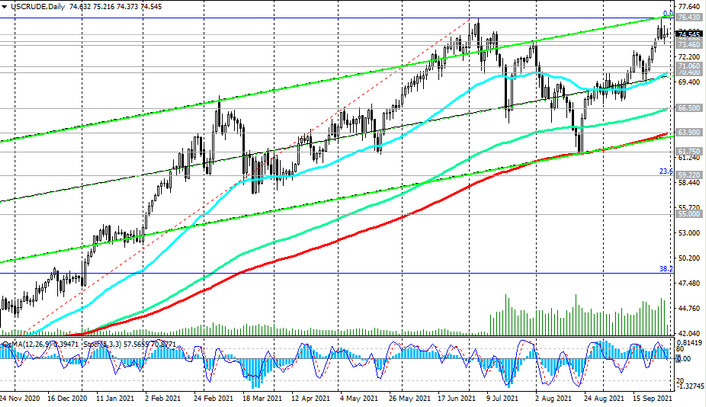

However, their breakdown will provoke a deeper decline towards the key support level 64.00 (ЕМА200 on the daily chart).

A breakdown of the support level 55.00 (ЕМА200 on the weekly chart) will bring WTI oil back to the bear market.

Support levels: 73.46, 71.06, 70.40, 66.50, 64.00, 61.75, 60.00, 59.22, 56.40, 54.30

Resistance levels: 76.50

Trading recommendations

Sell Stop 73.35. Stop-Loss 75.35. Take-Profit 73.00, 72.00, 71.06, 70.40, 66.50, 64.00, 61.75, 60.00, 59.22, 56.40, 54.30

Buy Stop 75.35. Stop-Loss 73.35. Take-Profit 76.50, 78.00, 79.00, 80.00