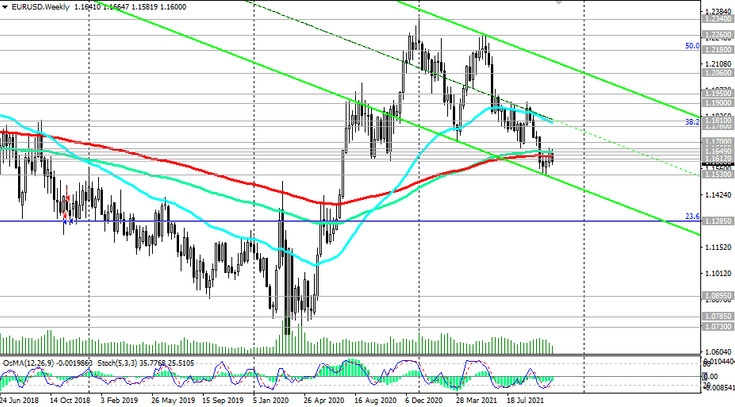

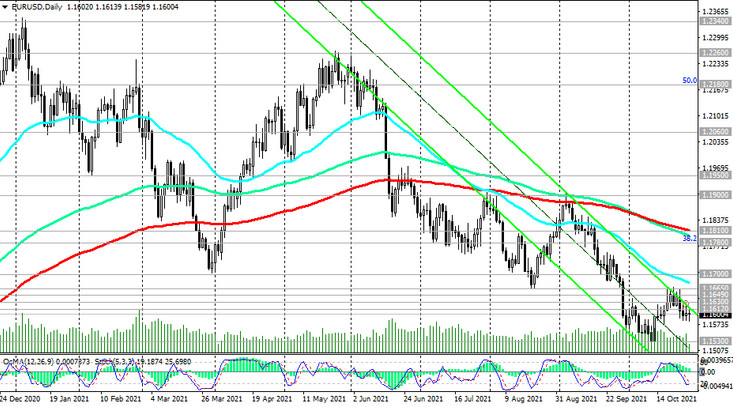

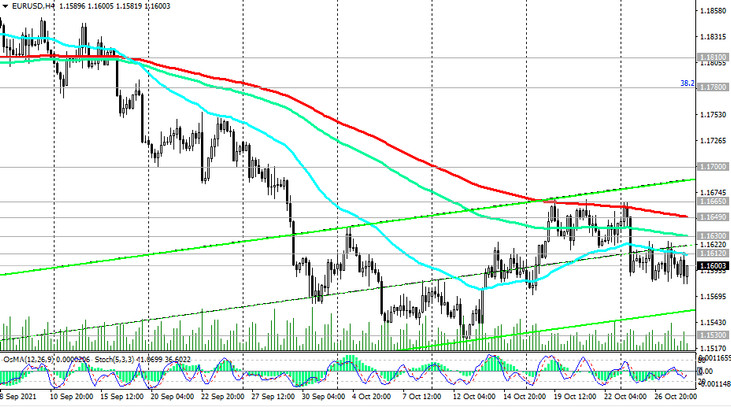

EUR / USD remains in the bear market zone, trading below the key resistance levels 1.1630 (EMA200 on the weekly chart), 1.1810 (EMA200 on the daily chart), 1.1890 (EMA200 on the monthly chart).

At the moment, the euro remains one of the weakest major world currencies due to a number of fundamental factors.

Further decline in EUR / USD is most likely. In view of this, short positions for this currency pair remain preferable. After the breakdown of the local support level 1.1530, the next target of decline will be the support level 1.1285 (Fibonacci level 23.6%).

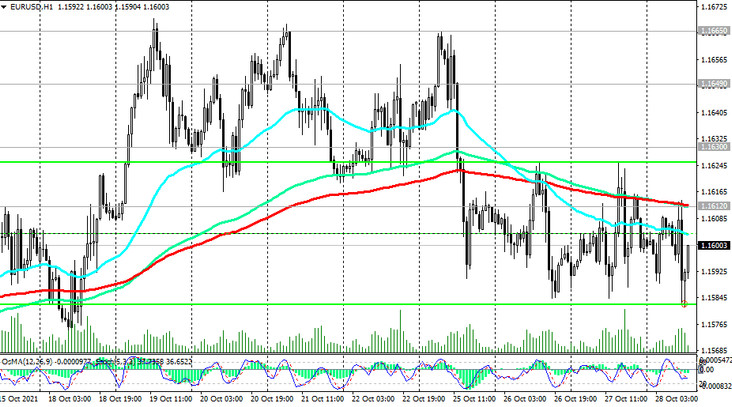

In an alternative scenario, the breakdown of the short-term resistance level 1.1612 (ЕМА200 on the 1-hour chart) will be a signal for the start of an upward correction towards the local resistance level 1.1665.

However, only the breakdown of the key resistance levels 1.1780 (Fibonacci level 38.2% of the upward correction in the wave of the pair's decline from the level of 1.3870, which began in May 2014, to the level of 1.0500), 1.1810 will indicate a return of EUR / USD to the bull market.

Below the resistance levels 1.1665, 1.1700, short positions remain preferable.

Support levels: 1.1580, 1.1530, 1.1400, 1.1285

Resistance levels: 1.1612, 1.1630, 1.1649, 1.1665, 1.1700, 1.1780, 1.1810, 1.1900, 1.1950, 1.2060, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.1580. Stop-Loss 1.1635. Take-Profit 1.1530, 1.1400, 1.1285

Buy Stop 1.1635. Stop-Loss 1.1580. Take-Profit 1.1649, 1.1665, 1.1700, 1.1780, 1.1810, 1.1900, 1.1950, 1.2060, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600