Tomorrow (at 14:30 GMT) the Energy Information Administration of the US Department of Energy will publish a weekly report on the dynamics of stocks of oil and petroleum products. Economists expect a reduction in oil reserves in the country's storage facilities by -0.400 million barrels after an increase in the previous week by +4.467 million barrels. It must be said that this figure has been showing very uneven dynamics lately, from an increase in inventories by +8.235 million barrels in early July, to a reduction of -4.523 million barrels two weeks earlier.

However, the situation on the oil market and the volatility of black gold quotes reflect the overall picture and the situation in the global economy and the financial market.

In a relatively normal economic situation and a relatively calm geopolitical situation, with the growth of dollar, oil quotes are declining.

At the moment, investors are in no hurry to invest in the assets of the oil market, given the turbulent geopolitical situation in the world and the slowdown in the global economy.

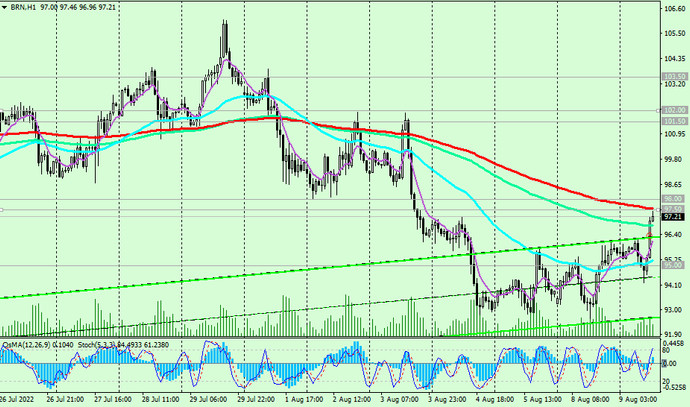

As can be seen from the charts showing the dynamics of futures for Brent crude, the price has been trying to break below $93.00 per barrel three times over the past 5 weeks, the lowest level since mid-February.

Also 2 most important long-term support levels 98.00 (EMA200 on the daily) and 95.00 (EMA200 on the weekly chart) have been broken.

In case of a breakdown of the local support at 92.00, the price will deepen inside the downward channel on the weekly chart, heading to its lower border and to the key support levels 77.50, 73.00 (EMA200 on the weekly chart), separating the long-term bullish trend from the bearish one.

In our main scenario, price growth will resume from current levels. It is possible that now is the right moment to enter long positions and resume buying.

Support levels: 95.00, 94.00, 93.00, 92.00, 90.00, 85.75, 77.50, 73.00

Resistance levels: 97.50, 98.00, 101.50, 102.00, 103.50, 104.00

Trading recommendations

Sell Stop 91.80. Stop Loss 98.20. Take-Profit 91.00, 90.00, 85.75, 77.50, 73.00

Buy Stop 98.20. Stop Loss 91.80. Take-Profit 100.00, 101.50, 102.00, 103.50, 104.00, 105.00, 106.00, 109.00, 114.00, 120.00, 130.00, 131.00