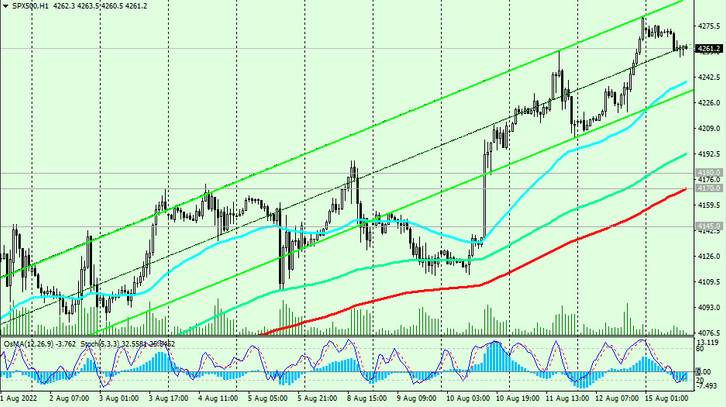

The US broad market index S&P 500 broke last week the key resistance level of 4180.00 (EMA200 on the daily chart), rising to a 14-week high and a mark of 4281.00.

In general, the positive dynamics of the S&P 500 remains above the level 4180.00. Probably, the breakdown of the local high of 4281.00 will be a signal to open new long positions.

In an alternative scenario, and after the breakdown of support levels 4180.00, 4170.0 (EMA200 on the 1-hour chart), 4145.00 (EMA144 on the daily chart), the S&P 500 will again head to the key long-term support level 3670.00 (EMA200 on the weekly chart), separating the multi-year bullish trend from the bearish one. Its breakdown could finally break the long-term global bullish trend of the S&P 500.

Support levels: 4200.00, 4180.00, 4170.0, 4145.00, 4100.00, 4038.00

Resistance levels: 4281.00, 4300.00, 4400.00, 4540.00, 4630.00, 4800.00

Trading recommendations

Sell Stop 4210.00.00. Stop Loss 4285.00. Targets 4200.00, 4180.00, 4170.0, 4145.00, 4100.00, 4038.00, 3670.00, 3600.00

Buy Stop 4285.00. Stop Loss 4210.00. Targets 4300.00, 4400.00, 4540.00, 4630.00, 4800.00