Overview of the CNN Fear and Greed Index

The CNN Fear and Greed Index (FGI) operates as a daily, weekly, monthly, and yearly barometer of investor emotions, swaying between the extremes of fear and greed. The undue dominance of fear could potentially drag stock prices to an unjustifiable low, while excessive greed can inflate them to unsustainable levels. The FGI can be a valuable resource for investors seeking to make informed investment decisions.

Key Metrics of the Fear and Greed Index

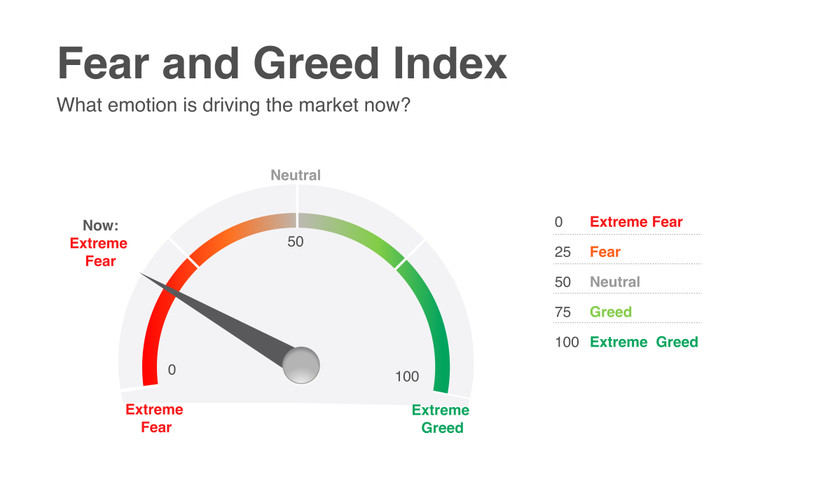

The FGI evaluates investor sentiment using seven diverse indicators and rates it on a scale from 0 to 100, with 0 symbolizing extreme fear and 100 depicting extreme greed:

- Stock Price Breadth: What's the extent of advancement or decline in the share volume on the New York Stock Exchange (NYSE)? For this, the FGI employs the McClellan Volume Summation Index data.

- Market Momentum: How significantly is the S&P 500 deviating from its 125-day average?

- Junk Bond Demand: Is there a trend towards higher-risk investment strategies?

- Safe Haven Demand: Are investors shifting towards stocks from bonds, typically considered safer?

- Stock Price Strength: What's the ratio of stocks reaching 52-week highs to those hitting one-year lows?

- Market Volatility: Here, the FGI uses the Chicago Board Options Exchange’s Volatility Index (VIX), focusing on a 50-day moving average.

- Put and Call Options: What's the degree of divergence between put and call options, with put options exceeding call options indicating fear, and vice versa?

Practical Application of the Fear and Greed Index

When applied judiciously, the Fear and Greed Index can steer investors towards potentially profitable investments. Below are some tips for using the FGI as an investment guide:

Do's

- Use the index to identify optimal market entry points.

- Time your investments to coincide with a swing towards fear on the index.

- Keep an eye out for undervalued companies.

Don't's

- Don’t rely on the index for short-term gains.

- Refrain from investing when the index signals high levels of greed.

- Avoid hastily exiting a stock before it yields a profit.

Navigating the Fear and Greed Index

While some critics downplay the index's efficacy, arguing that it promotes market timing over a long-term buy-and-hold strategy, it can serve as a valuable tool for determining the ideal time to enter the market. Align your investment entry point with the index's inclination towards fear, taking a leaf from Warren Buffett's book who is known for buying stocks at their lowest.

The Fear and Greed Index thus becomes a key indicator of peak fear, often driven by irrational concerns impacting the decisions of otherwise rational investors.

The Role of Behavioral Finance in the Fear and Greed Index

Though the Fear and Greed Index may seem like an interesting investment tool, it has a strong theoretical underpinning. It resonates with the principles of behavioral finance, a discipline that explores the intersection of psychology and financial decision-making. This field has incorporated diverse research, including studies of rats pressing bars for rewards, reflecting human tendencies of fear and greed.

A landmark moment for behavioral finance was the introduction of the "prospect theory" in 1979 by psychologists Daniel Kahneman and Amos Tversky. This theory describes how individuals can display both risk-aversion and risk-taking behaviors, influenced by whether they perceive decisions leading to gains or losses. This inherent loss-aversion often prompts individuals to take higher risks to avoid a loss than to realize a gain, a behavior particularly pronounced when the Fear and Greed Index points towards fear.

Conclusion

The CNN Fear and Greed Index serves as a powerful tool for investors aiming to understand market dynamics and make informed decisions. Though it isn't a magic bullet for investment success, its strategic use can help investors navigate market fluctuations and optimize their investment strategy, backed by the fundamental principles of behavioral finance.