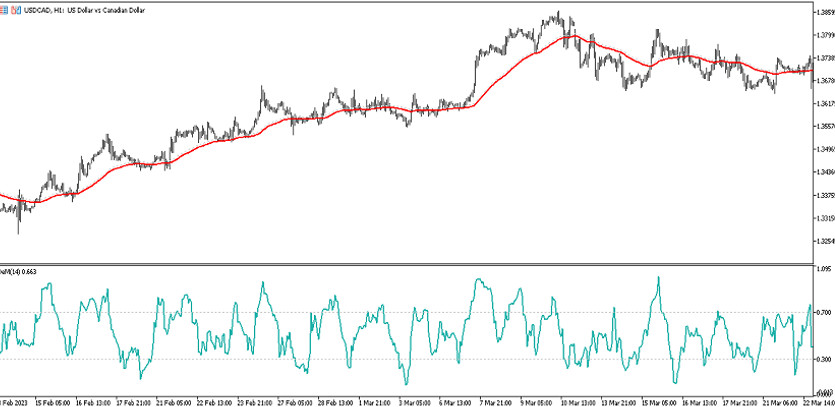

The DeMA strategy is a trading algorithm based on the interaction of two Forex indicators included in its standard set. Indicators are based on trend trading, so before opening a trade, the direction of the current market trend is first determined. Thus, when trading, it is important to take into account the values of both indicators, which in turn determine the current trend. The strategy includes easy-to-use indicators, so the algorithm for applying the strategy itself is also extremely simple.

The DeMA strategy is suitable for use on any timeframe, with the USD/CAD currency pair being the most suitable.

Strategy indicators

The DeMA strategy includes only two indicators, which in turn are included in the standard forex set. The indicators in the strategy are very easy to use, while the trading algorithm itself is very profitable and effective.

-SMA-smoothed moving average with a period of 30 and a signal level of 60, the calculations of which are applied to the Median Price.

-DeMarker - an indicator of the technical analysis of the market. Its period is set to 14 and the signal levels are 0.3 and 0.7.

Trading with the DeMA strategy

The algorithm for applying the DeMA strategy is very simple. To open a certain trade using a trading strategy, using the indicators included in it, the direction of the current trend is determined. At the same time, it is important to take into account the values of both indicators that are part of the strategy. If the indicators signal the presence of an upward trend, buy trades are opened, in a downward trend, sell trades. When the trend direction changes, trades should be closed.

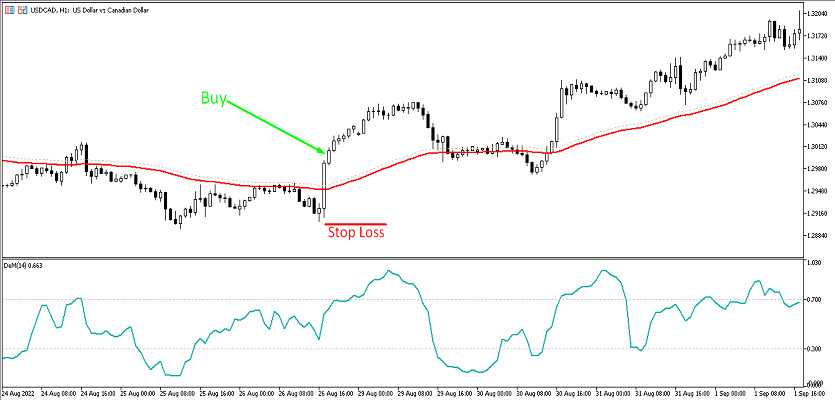

Conditions for Buy trades:

- The moving average is moving up and the current price is above its level of 60.

- The DeMarker line is moving up and remains in the range of signal levels from 0.3 and 0.7.

Upon receipt of such a combination of conditions on a signal candle, a long position can be opened. At this moment, an upward trend is determined in the market. Stop loss is set at the level of a recent local extremum. The trade should be closed upon receiving the opposite conditions from at least one of the indicators. At this moment, a possible change in the current trend is expected, which in turn will allow considering the opening of new trades.

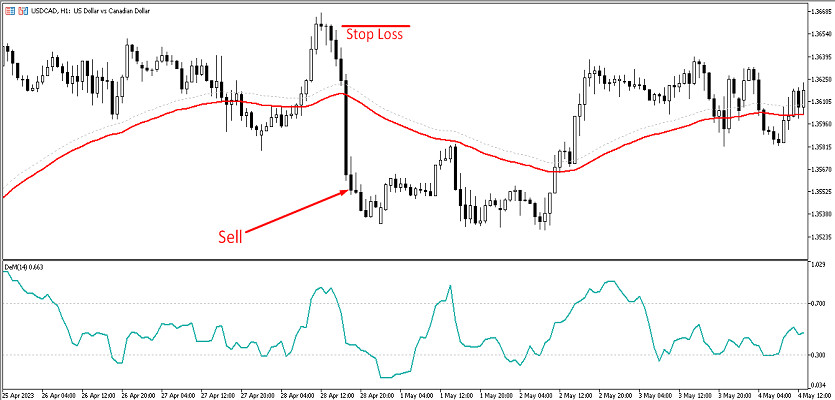

Conditions for Sell trades:

- SMA is moving downwards, while the current price is below the signal level 60.

- The DeMarker indicator moves from top to bottom and remains in the range of signal levels from 0.3 and 0.7.

A short position, determined by the presence of a downward trend, can be opened when a full combination of such conditions is received on a signal candle. A stop loss order is placed at the point of a recent local extremum. When the current trend changes, namely when a reverse signal is received from one of the indicators, the trade should be closed. At this point, it can be considered opening new trades.

Conclusion

Despite the fact that the DeMA strategy is very easy to use, it brings good profits and is considered effective. For the correct application of this strategy, preliminary practice on a demo account is recommended.