Diving into Forex trading can be overwhelming on multiple levels, especially when you are a newbie. Aside from deciding whether to invest or not, there are also the questions of how to invest in, how much to invest, when to do it, and how to do it.

You may think that creating your own trading plan and then trading will be simple and easy like so many ads claim it to be . However, in reality, it is usually a much more involved process.

Sure, simply grabbing the first system that comes along and trading it may work sometimes, and may even work for a while, but it is probably not going to work in the long term. Achieving a good level of consistency in the long run requires more than just having a trading system.

Even having a good trading system is not a guarantee for success.

Trading is a complex game where a multitude of factors are always in play that decide the success or failure of a trader. In order for you to achieve a good level of consistency over the long run, you will need a fair amount of effort and dedication to develop the right trading system and more importantly, master trading it!

Here are some points that are important in order to have a successful trading journey:

1) Know your trading system. Besides understanding how to enter and exit trades with the system, in order to master it and maximize results it is also key to understand:

2) Know your plan first. Being able to execute well is not just about being quick on the game. It is not everything about how well you understand your strategy, but also probably equally important is understanding yourself.

- W hy a certain sequence of price movement triggers an entry signal.

- W hen the strategy is not particularly effective at certain time s .

- W hat to expect from the market after an entry, from both losing and winning trades you are in.

- Are volatile market conditions the most profitable with this strategy or does the trading system work better in quiet markets?

Are you planning to trade every day for 8 hours, or would you prefer to look at the markets once a day every night?

Understanding yourself and your needs will allow you to create a good trading plan for you and align your trading strategies accordingly.

3) Test your plan. There are many considerations that you might need to make and then comes the time when you need to test the plan and the strategy. Keep in mind that if you do not test the strategy that you are going to trade , how will you ever really know whether it has already worked for others? How will you develop the confidence to execute live trades with it ?

Luckily, demo accounts are widely available today and it’s critical that any strategy or plan is tested on a demo account before taking it to a live trading account.

The trading industry has become bigger and better than ever. With the help of a simple but useful tool like the Relative Vigor Index (RVI) and other essential technical indicators , traders can get vital information to make maximum profits from Forex trading.

The Relative Vigor Index or the so-called “RVI” is one of the most popular technical indicators used in the trading world. The RVI is a very useful tool because it compares the closing price to price ranges and provides the trader with a reading of the strength of recent price movements.

The RVI shows higher values when the uptrend’s strength is increasing, while RVI values begin to flatten as the momentum is slowing down.

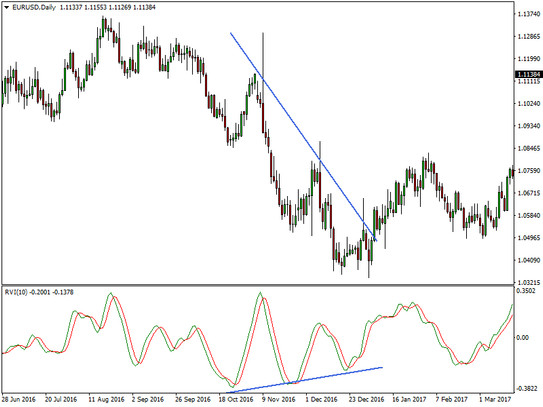

RVI Divergence is a signal for a reversal – EURUSD daily chart

In a downtrend, lower lows in the RVI are an indication of a strengthening downward momentum.

The RVI serves as a momentum indicator where the slope will generally change its direction ahead of the price. Divergence in the RVI indicator is often a leading indication that a reversal is coming.

Finally, whether you are a part-time trader or a full-time trader is not that important. Those who maintain long-term success in trading are those who are thoroughly prepared before they enter the market.