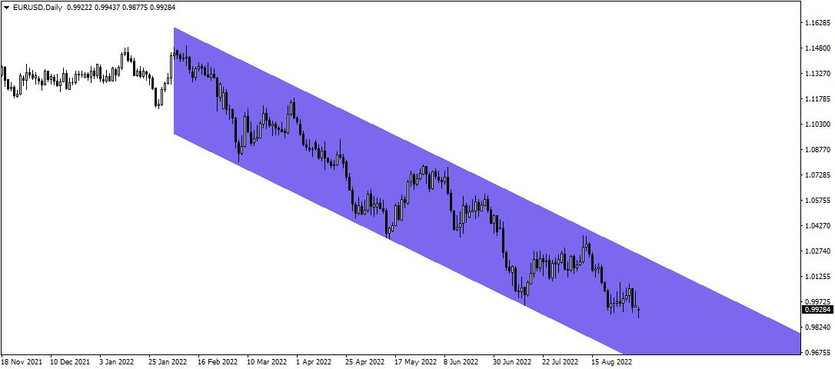

Following Russia's escalation of the continent's energy shortage by cutting off crucial gas supplies, European stocks fell for the sixth time in a week, and the euro plunged to a 20-year low, portending a long, chilly winter for European states. In response to Russia's announcement that supplies through the Nord Stream pipeline would cease, European countries led by Germany announced measures to address a crisis in the cost of living and rising energy costs. The worst since 2002, the common currency fell as much as 0.8% on Monday to 98.78 US cents.

Since Russia's invasion of Ukraine harmed relations between the Kremlin and Europe and drastically increased commodity prices, the energy problem has gotten worse. The euro and the dollar last month reached parity for the first time in twenty years as a result of this important element. The ECB is under pressure to tighten monetary policy as a result of the rising stresses on energy supplies.

The choice is still difficult as ECB president Christine Lagarde and her team deal with the dual issues of high inflation and an oncoming recession. The cost to pay ultimately will be poorer GDP or recession and a worse job market, but persistently high energy prices may limit how far the ECB advances.

Also, the Member states of the EU are taking the steps to mitigate the impact of the approaching energy crisis. Germany revealed a relief package of approximately 65 billion euros ($65 billion) on Sunday, signalling the gravity of the issue, while Finland said it will stabilize the fuel and energy market with a $10 billion initiative. Sweden, which is attempting to prevent a wider financial disaster, announced on Saturday that it would provide a $23 billion crisis backup for its utilities. According to Goldman Sachs Group Inc., during a six-month period, the euro will continue to stay below parity with the dollar. Prior to it, they predicted a return to $1.02.