It is not a simple thing to correctly predict the next move in any market and trading the FOREX market can be even trickier than trading other markets.

It goes beyond wild guesses, intuition and rash decisions. Analyzing price charts, forecasting future price movements and choosing the most suitable currency pair to trade is obviously crucial to long-term success.

However, professional traders take one step further and consider every possible factor which has the tendency to affect FOREX rates.

It is important to say that currency exchange rates are often moved by factors like interest rates, politics, supply and demand, economic stability, commodity prices and other related factors.

Even if you lack the technical and in-depth knowledge, you would still have heard news related to oil price movements and change in currency prices as a direct result of it. Commodities like oil and gold have a high correlation with certain currencies that has more or less remained the same throughout the years.

One of the most important and basic things related to understanding the different factors that affect the FOREX market is understanding how different commodities correlate with different currencies.

US Dollar and Gold Correlation

Different commodities tend to have a different relationship with each currency. For example, the relationship between the US Dollar (USD) and Gold is usually inversely proportional, or as it’s usually said gold and the USD are inversely correlated.

The logic here is that investors tend to trust gold for their investments in times of economic trouble and increased risks of high inflation.

Swiss Franc and Gold Correlation

On the other hand, the Swiss Franc (CHF) is positively correlated with gold prices due to the fact that like gold the Swiss currency is regarded as a safe haven by investors, and in addition, a big amount of Swiss currency reserves are backed by gold.

Canadian Dollar and Oil Correlation

The Canadian Dollar (CAD) is among those currencies which have a positive correlation with oil mostly because Canada has the second largest reserves of oil, only after Saudi Arabia.

Canada also exports most of the oil it produces hence an increase in oil prices leads to a stronger demand for the Canadian Dollar because importers have to pay for Canadian oil with the Canadian currency.

Australian Dollar and Gold Correlation

Similarly, Australia is among the top five exporters of gold and any increase in gold prices is likely to have a positive impact on the Australian Dollar (AUD).

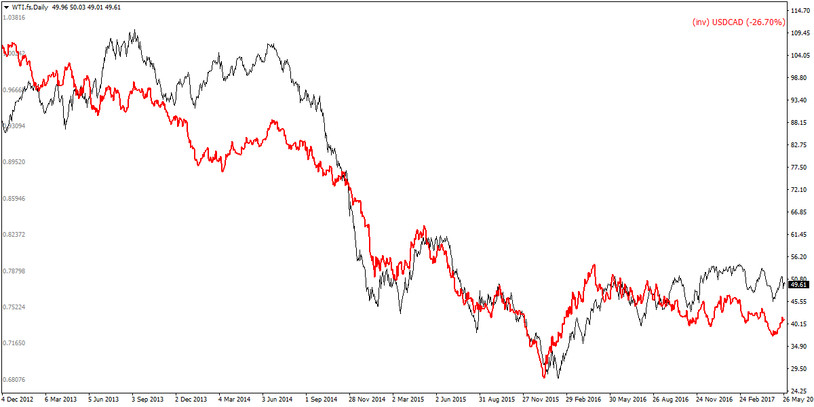

Oil (black) and inverted USDCAD (red) - Correlation has been fairly consistent over the years

Analysis of inter-market assets can be very tricky, so let’s continue with the example of the Canadian Dollar and oil prices to clarify this point. Canada’s economy is hugely dependent on oil exports as we noted earlier.

More importantly, a very big portion of its overall exports, i.e. up to 85%, goes to the United States of America. Thus, there may be no need to analyze global oil demand because even if global oil demand is normal, a massive increase in American oil demand can pull up the oil prices in Canada, resulting in an appreciation of CAD.

Hence, a good understanding of the economy of a particular country and various factors affecting demand and supply of underlying commodities is essential in order to ensure reliable analysis.

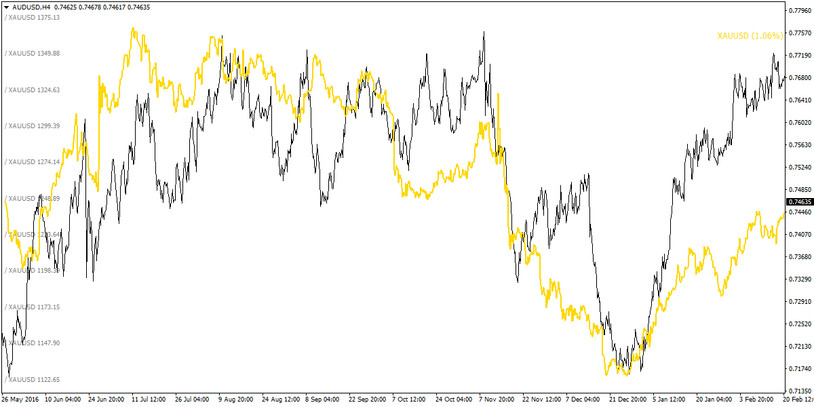

When analyzing the inter-market correlation between currencies and commodities, one of the best strategies may be to focus on the Australian Dollar (AUD) and its movements.

As discussed in an earlier paragraph, AUD has a strong positive correlation with gold prices. Gold prices and the Australian Dollar fluctuate in a similar manner. Hence, AUD can be used to understand gold price trends and vice versa.

The average correlation between gold and AUD is measured to be +0.51. Moreover, the Australian Dollar is also known to move in tandem with the price of crude oil although the correlation is significantly lower than with gold. The average correlation between oil and AUD has been estimated to be +0.23.

Strong correlation between AUDUSD (black) and Gold (Yellow)

Some traders trade both commodities and currencies simultaneously. The exact nature of this trading depends on each individual trader and his ambitions and risk appetite. For example, two opposing instruments can be included in a portfolio to minimize exposure to risk. On the contrary, a trader can also choose to include two positively correlated commodities and currencies with the hope of doubling his profits.

There is nothing wrong in taking either of these paths, however, each decision must be backed by analytical reasoning and strong logics rather than mere intuition or guesses.

The best and perhaps the simplest strategy, when deciding to trade both commodities and currencies simultaneously, is to understand the correlation between them. Analyze past trends and see if they are positive or negatively correlated over a certain period of time. Find out if one commodity seems to be leading the other and vice versa.

To analyze relationships between currency pairs and commodities, you can use our Correlation indicator that you can download for free .

While it is true that unavoidable correlation exists between commodities and currencies, still, it is important to remember that correlations are not equal every time and correlations can change.

Moreover, a positive correlation can even turn into negative correlation for a brief time and vice versa. It is, therefore, strongly recommended to always keep an eye on the current degree of correlation and analyze if prices start to diverge and potentially lead to a breakdown of the correlation between the two asset classes.