Correlation in FOREX trading is essentially the practice of trading based on the existing relationships between relevant currency pairs.

There are some currency pairs that tend to move in the same direction, with similar momentum, while there are other forex pairs that tend to move in opposite directions.

The pairs that move in the same direction, are said to be positively correlated while those that move in opposite directions are negatively correlated.

Correlation in the Forex market exists because economies are often related, and affected by each other. Forex traders can capitalize on correlated pairs in order to increase their profitability ratios. The key is to find the pairs that are correlated and to trade accordingly. Regardless of whether a pair is positively or negatively correlated, a keen forex trader should be able to use that knowledge to his advantage.

The first logical step to take when trading correlated pairs is to identify that a correlation exists. For example, the EUR/USD and the GBP/USD forex currency pairs tend to move in the same direction or are said to be positively correlated while the EUR/USD and the EUR/CHF tend to move in opposite directions and are said to be negatively correlated.

Whenever the EUR/USD is rising, the GBP/USD is usually rising as well and whenever the EUR/USD is rising, the EUR/CHF is usually falling. This correlation is easily identified by taking a look at these forex pair charts and recognizing that there is a relationship between the two pairs.

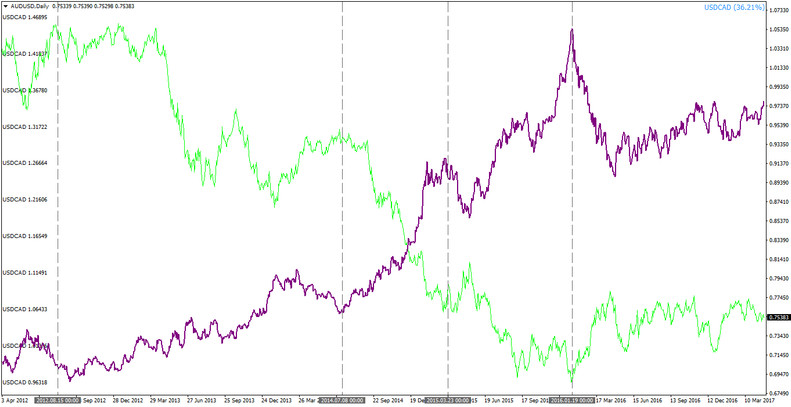

An example of negative correlation between AUDUSD (green) and USDCAD (purple) – Notice how tops in one currency pair tend to happen almost simultaneously with bottoms in the other currency pair (dotted vertical lines)

Some relationships between the currency pairs are stronger than others, and even some are completely uncorrelated, nor positively nor negatively. Also, correlations can and do change over time as market conditions evolve so it’s important to make sure that a correlation exists in the recent past rather than several decades ago.

How Traders Can Benefit from Trading Correlations?

Once a correlation between currency pairs has been identified, traders can establish solid trading strategies that will allow them to improve their profitability.

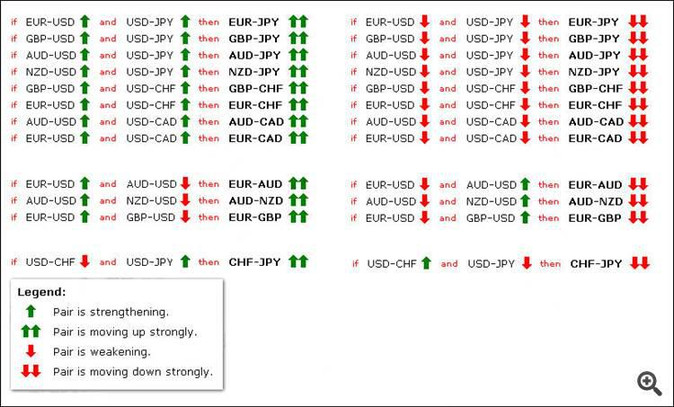

For example, if a trader realizes that both the EUR/USD and the USD/JPY currency pairs are strengthening, he can trade the cross currency pair EUR/JPY. As you can see in the picture above, if both EUR/USD and USD/JPY are strengthening - then EUR/JPY currency pair is moving up strongly.

Also if a trader realizes that there is a positive correlation between the EUR/USD and the EUR/GBP, he can trade both pairs and make profits by trading the same way in both markets. That means that if he decides that the EUR/USD market is bullish and so he needs to place a buy order, he can do the same thing in the EUR/GBP pair and profit on both trades.

It’s like killing two birds with one stone. If the trader makes a winning trade in one market, if the pairs are positively correlated, he is highly likely to make winning trades in the correlated currency pair as well.

On the other hand, if he was wrong about one market, he may be wrong about the other market as well and may end up making two times the losses. So it is important to take this in mind in your risk management when placing the orders. Nevertheless, once correlation is identified, it can give the trader another point of view on any particular trade he is considering.

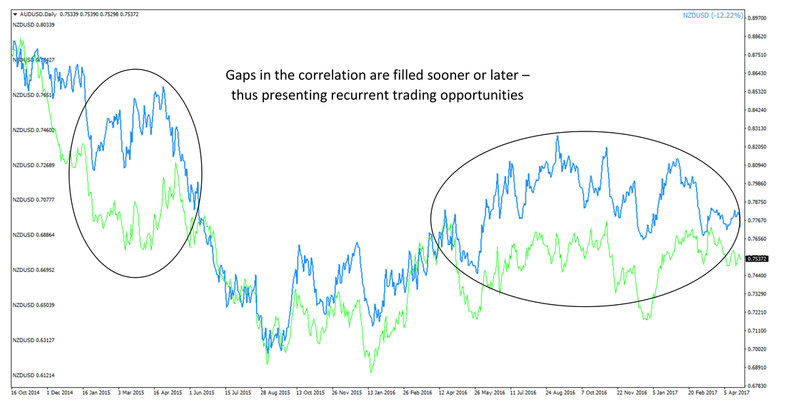

Another way that traders can benefit from correlation trading is identifying times when there are changes in the correlation of any forex pair. For example, a trader may notice that in a pair that is usually strongly positively correlated, that one pair is rising, but that the other pair is falling.

This is a clear indication that something is happening in the market that is not normal. This is an opportunity for the trader to make winning trades since he knows that sooner or later, the pair is likely to resume its original correlation pattern. So even though the market may seem to be out of whack, often times this can present a great trading opportunity for the forex trader.

An example of positive correlation - Notice how closely correlated are AUDUSD (green) and NZDUSD (blue)

Correlation trading presents a few key advantages to forex traders. These include improved trading efficiency, the ability to leverage profits, the ability to diversify risks, hedge against risks, the ability to confirm breakouts and also to avoid fakeouts. When conducting correlation trading, it is best to use the higher timeframes since those tend to be more reliable. In other words, only use timeframes of 15 minutes or longer since anything less than 15 minutes is less likely to give reliable signals.

Conclusion

Since the various world economies tend to be related in some way or another, there tends to also be correlations in the forex markets between currency pairs. Pairs may be either positively correlated or negatively correlated. Based on this knowledge, traders can gain an advantage by establishing trading strategies that should increase the trader’s profitability potential.