This trade idea was first sent to subscribers of the Free Profitable Forex Newsletter on June 23 2022.

This week, we are looking at a potential longer-tern trade on EURJPY. However, since it is still early as there is no bearish trigger signal to enter a trade, this will be only an analysis of a potential scenario. If and once a bearish signal occurs, we will review this setup and issue a trade idea with entry, stop loss and target levels as usual.

Like other JPY pairs, EURJPY appreciated massively over the past 3-4 months. The move was driven, of course, by the Bank of Japan’s persistent adherence to its dovish YCC and QE policies. The other uber-doves - the ECB and the SNB gave up on dovish policies in the face of high inflation - but not the BOJ. In turn, this has driven even EURJPY and CHFJPY higher.

But, as you may have already heard, what goes up has to come down eventually. This is especially true of the Forex market, where significant fluctuations in exchange rates can create problems for whole economies and countries. Usually, central banks and governments don’t like to see excessively large moves in their currencies over a short time. This is one major factor that pretty much keeps Fx exchange rates generally in ranges over the long-term (of course, speaking about major Fx pairs).

With that said, is it time to go short EURJPY now?

Perhaps. But the fact that EURJPY has already risen a lot is not a reason to go short, of course.

So, let’s first look at the long-term technicals and examine what important signals EURJPY is currently giving and what could be a more convincing signal that we’ve seen the peak.

Then, in the following section, we look at how the fundamentals can shape a top in EURJPY and potentially fuel a full reversal later this year.

Long-term charts at resistance, but no bearish signal yet

The longer-term charts are getting very interesting on EURJPY. In particular, it has reached an important resistance area at 142.00 - 144.00, and we are already seeing it react here. However, a clear bearish reversal signal has not appeared yet on either the weekly or monthly timeframes.

As can be seen from the monthly chart above, EURJPY has only hit a notable resistance area here. But we won’t get any bearish signal at least until the month’s close on June 30. A significant bearish signal would be if EURJPY would drop below the 139.00 level and close the month there. In such a scenario, a bearish candlestick pattern would form on the monthly chart. This would be a solid indication that the bearish scenario may be playing out.

Switching to the weekly chart, we can see the reaction with the resistance here in more detail. Importantly, EURJPY was already rejected once at the 144.00 highs, and this week it is getting rejected for the second time. This could be an early indication that this might be the top.

However, the weekly timeframe also shows that the support at the 139.00 zone is strong, and this is where EURJPY rebounded earlier this month. Thus, it seems this 139.00 zone could be the key for assessing the EURJPY outlook for the coming weeks and months. A break below 139.00 would be a signal that EURJPY can then retrace further lower, with the 132.00 - 133.00 zone likely t be reached next (see chart below).

Also, note that EURJPY topping down from these levels would be consistent with EURUSD moving lower, and also USDJPY moving lower. This could come via an acute risk-off episode (i.e., a sharp stock market sell-off) or a decline in global bond yields. Remember, rising bond yields were what drove JPY pairs sharply higher since March.

So, EURJPY traders should also watch what’s going on in EURUSD and USDJPY, respectively. Support and resistance zones in these pairs can also translate into support/resistance in EURJPY.

At this point, the markets are underestimating the BOJ and overestimating the ECB

First things first, why consider short EURJPY and not short USDJPY. The answer is that the US economy should continue to perform better than the Eurozone this year. This, among other important factors, should keep EURUSD largely in a downtrend this year, or at least keep the bias bearish.

So, with that in mind, if you want to reverse-play the JPY weakness, then shorting the euro is a better choice than shorting the USD.

The question for EURJPY is when it tops? It could happen soon, or there may be another big upswing leg in store before it eventually peaks. A lot will depend on inflation and what the BOJ and ECB do. There is certainly the possibility that the persistently dovish BOJ will trigger further sharp JPY weakness. In this case, EURJPY would probably move above 145.00 and head for the 148.00 highs from 2014 (see monthly chart).

So, all those dynamics like inflation and the economy can be simplified to the markets’ pricing for future BOJ and ECB interest rates. In essence, the markets are currently pricing in too little from the BOJ and a bit too much from the ECB in terms of future policy tightening.

Remember, the ECB already made the hawkish pivot a few months ago as inflation started to rise, but the BOJ hasn’t. Interest rate expectations in futures markets are already pricing in 6 rate hikes (25bp) from the ECB by December, expecting the rate to be at 1.5%. And for the BOJ, the markets are not pricing in any change in monetary policy! This is a big risk and could potentially unleash huge moves on JPY pairs if the BOJ decides to change policy. And the risks for that are growing the more JPY is falling and the longer inflation stays elevated.

Eventually, reality will hit, and the BOJ may have to adjust policy too. Or, in the other scenario, the ECB may need to turn dovish again (as the Eurozone economy is heading down into a recession). When that happens, the markets will reprice those expectations for the BOJ and ECB, and EURJPY would likely take a deep dive down as a result. But how long it would take for that is hard to tell at the moment. It could be weeks or even months.

Currency intervention remains a notable risk to holding short JPY trades

Another way we could see JPY strengthen quickly is through intervention. We discussed this recently in our weekly analysis posts. While intervention would be the least sustainable way for JPY to recover, it is now a clear risk as already Japanese officials have complained about the sharp devaluation of the yen. Still, if it would happen, it would likely lead to a giant move down in JPY pairs. How much will it last is a different question. And if the Bank of Japan doesn’t give up on the dovish policies soon, then intervention is unlikely to help much.

Trade signals from the past weeks

- N/A

TOTAL P/L in the past week: N/A

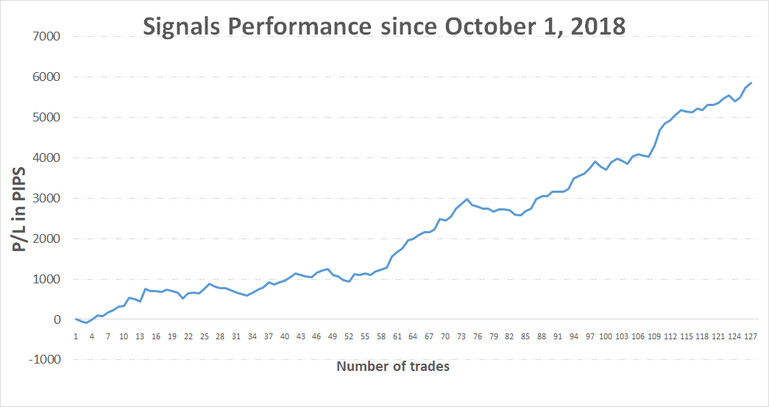

TOTAL: +5855 pips profit since October 1, 2018

![EURJPY Short Trades Could Soon Exist [Fx Newsletter, Jun 23]](https://cdn.investworld.net/insecure/w:835/h:407/rt:fit/g:ce:0:0/el:1/f:jpg/c:0:0/q:90/czM6Ly9zZXJ2aWNlcy0tODM1OS0taW1hZ2VzL2U4NWRiYzg5ODQ5MmFhZGNkNGFkMzRlZTAzMGZjNTIxNTQ1YmQ2YmEucG5n.jpg)