The world of forex trading has enormously evolved for the past years and continues to flourish up to the present where anyone can trade. But it does not mean that everyone is suitable of doing so.

If you want to become a professional trader, you should start by choosing a market you’ll concentrate on. You can select from various forex currency pairs as well as other markets like stocks, stock indices, commodities and others.

As you select the market you’ll engage with, the next thing you need to do is to familiarize yourself with Average True Range (ATR) Forex Indicator . This is essential, for the reasons that this simple tool is very handy when it comes to measuring market “volatility”.

Forex Volatility Definition

Let's start with a simple and practical definition of the term "volatility". The term volatility means, in its simplicity, a strength or fierceness of market moves. The easiest way to measure volatility is to just take a look at any chart. If you will see huge wicks and bodies of candles, huge market moves, then there is a high volatility. In opposite, if you will spot a very calm and mostly sideway traded market, then there is a low volatility.

Founder of the Average True Range (ATR) Forex Indicator

Developed by J. Welles Wilder, one of the most innovative minds when it comes to the field of technical analysis, this indicator can help traders to enter and exit trades easily. The best part is, traders can use this indicator on any market they desire successfully which provides them a huge chance of increasing their trade’s profitability.

Why do you have to use ATR on all your trades?

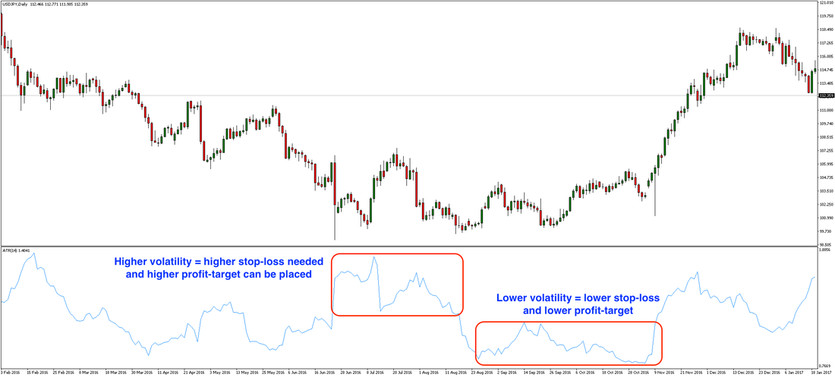

Although Average True Range (ATR) does not send out buy or sell signals, it plays a major role of measuring market volatility which is a huge factor to execute profitable trades. The price volatility is very useful when it comes to deciding on where a trader will set a stop loss or profit target (or if he even should open a trade or rather not).

This is very handy on your part as a beginning trader for the reason that when a price volatility is high, it is a sign that you should not use the tight stop-loss because there is a huge chance that it can be breached and your order will be closed. As a result, you will lose money. In opposite - when considering profit-targets, it would be a pity to set too small profit-target if there would be a potential to take higher profits from the market.

And if the volatility is low and you are deciding where to put your stop-loss order, you can set a tight stop-loss for you to survive. Because a breakout of the low volatility period would mean a strength of bulls or bears, and the right time to close the order. And when setting profit-targets, it is always better to take what the market offers rather then trying to shake the market for a higher profits.

Remember : adapting to the current market structure and volatility is the key to a long-term profitable forex trading!

How can you use the Average True Range (ATR) Forex Indicator?

- You can use Average True Range (ATR) as a strategy when trading based on volatility. Like it was stated before, you can use ATR as a trading signal. If you are watching a specific market for a while now and you notice a fluctuation from its historical average volatility, this can be the right time to keep your charts open. This is a clear sign that you should wait for the ATR to increase so that you can place a trade in the direction of the breakout move.

- Use Average True Range (ATR) for setting Stop-Losses and Profit-Targets. If you are trading forex for a while, you know how important it is to set the stop-losses and profit-targets correctly. The Average True Range (ATR) allows you to measure current market volatility and set the value of a stop-loss that will not get your order out of the market too soon. Also you will estimate the potential amount of profit in the market that the market could potentially offer you. You can always see the current value of the indicator in its upper left corner. In the chart below, you can see that we are analyzing the EURUSD currency pair, H1 time-frame and ATR is set to 14 periods. Current ATR's value is 15 pips. When setting stop-losses and profit-targets based on the ATR indicator, you can use some multiple of the current ATR value. The best way is to go through a certain amount of sample trades that would be executed based on your strategy in history, and see which multiple value will work the best in a conjunction with your trading strategy.

- Use Average True Range (ATR) to Filter out Possible Bad Trades. The majority of traders like you and me are counting on volatility to make some nice profits. You know - without a volatility, we would not be able to execute any trades. However, the question is: whether your trading strategy needs huge market moves, or you rather prefer calm market traded in some nice range. Both situations offer profitable opportunities, but both situations require different trading approaches as well. Thanks to the ATR indicator, it will be easier for you to filter out those situations that you would like to avoid, and the indicator will also show you when the best time for you to trade is. As you concentrate on the market situation that suits you and your trading strategy, therefore, you have a huge chance of attaining bigger profit.

What are you waiting for? Don’t just rely on luck and plain instinct, familiarize yourself with the Average True Range (ATR) Indicator and consider how it can be useful for you.