2018 was a year that bewildered traders and investors, in many ways defying the widespread expectations regarding where markets will move and, in the end leaving them without profits.

2019 starts with a sour taste as risk aversion dominates rather than risk appetite, as was the case at this time last year. Risk-off assets have risen in the past several weeks while risk-on assets have sold off across the board. The fallout in the stock market has subsequently affected currencies with the safe haven JPY outperforming risky currencies.

Below, we look at the top 3 major currencies and currency pairs and the fundamental and technical factors that could affect them in 2019.

US Dollar 2019 outlook

Despite consensus expectations for a broad decline of the Dollar in 2018, the US currency has managed to end the year stronger versus all of the major currencies except for the Yen as the Federal Reserve went on, against market expectations, to raise interest rates 4 times while at the same time pressing on with Quantitative Tightening. This occurred at a time when other major economies (particularly the EU) experienced an economic slowdown in 2018, but Trump’s tax cuts in the US helped to keep the growth momentum going in the United States.

The rate hikes from the Fed have already led to an inversion of the US Treasury yield curve with 1-year yields now higher than 5 or 7-year yields. Although the acclaimed 2Y-10Y spread has still not inverted, it is only several points apart from accomplishing that. Yield curve inversions are known as one of the best predictors of economic recessions which usually occur roughly a year after the curve inverts. With that said, a US recession looks probable at the latter part of this year.

The response of the Fed to economic conditions is what will matter for the greenback. So, if the Fed reverses course on rate hikes and starts cutting instead then the USD is in for a hard beating. And is certainly the most probable scenario if the US indeed enters a recession in the following months.

Nonetheless, given the tightening of economic conditions in the US due to a rising USD and Fed rate hikes, and additionally, dissipating effects of tax cuts, further acceleration in the economy will be more difficult compared to last year. Hence, the USD is likely to be an underperformer in this scenario, but for that, other major economies will need to start growing at a faster pace.

Finally, the US twin deficits is another thing to watch for the Dollar in 2019, and if investors’ worries over the deficits return it can cause a very sharp USD sell-off. Given the increased Government spending of the Trump administration, any bigger slowdown in economic growth will likely exacerbate the problems over the US deficits and likely cause serious damage to the US Dollar.

Overall, odds seem to be tilted against the Dollar for 2019, as the Fed is likely to slow down rate hikes and maybe even Quantitative Tightening unless the US economy can surprise and accelerate markedly from the current state and again outperform the other major economies. However, that looks highly unlikely from the current perspective.

Euro 2019 outlook

The state of the Eurozone economy has declined sharply over the second half of 2018 after starting the year on a very positive note. This rather surprising deceleration in the economy has resulted in EURUSD starting a downtrend in Q2 2018. The election of a populist Government in Italy didn’t help the prospects for ECB tightening or for a stronger Euro as conflicts between the populists and the EU Commission over the Italian budget added additional downside pressures on the single currency. The popularity of French pro-EU President, Emanuel Macron has also plummeted throughout the year and he now has to deal with protests of the yellow vests movement as citizens are requiring lower taxes and a higher standard of living.

The situation in the Eurozone starts to seriously resemble the problems of 2014 and 2015 when EURUSD was in a steep downtrend and close to 1.0500 rather than the optimism from 2017. However, that is the current situation and that could change. Markets are driven by expectations for future events, so for the Euro currency, it will be all about how things overall develop from here (both on the political and economic front).

So, all in all, the performance of the Euro will again depend on the performance of the EU economy and the subsequent monetary policy response from the ECB. When looking at the EURUSD currency pair, it’s also important to compare the performance of the EU economy against the US economy. Usually, the pair is highly correlated to the convergence/divergence of the two largest economies in the world. So, depending on which economy outperforms the other, EURUSD will likely rise or fall. Furthermore, trends in EURUSD often set trends in the cross pairs and across the whole Forex market also (either broad Euro strength or broad USD strength).

EURUSD Technicals

The technical situation on the monthly EURUSD chart is interesting as the pair is trading inside of a downward bearish channel but has met strong confluence support around the 1.1500 area. This support zone stretches all the way to 1.1200 where the 61.8% Fibonacci retracement from the 2017 rally sits.

A smaller bearish channel pressures the pair to the downside and if this 1.1200 area is broken then the next big support is at the major 1.0500 lows. A bullish breakout of the smaller (weekly) channel will be among the first technical signals that the 1.1500 support area has held and the next likely destination would be 1.2000 where there is major resistance due to the large bearish channel (as shown on the chart below).

British Pound 2019 outlook

For the Pound, it will be all about Brexit again until it is resolved in some way, most probably in one of the 3 main scenarios: an exit with a Brexit deal; a “no deal” exit; or no Brexit at all and the UK remains in the EU.

The latest developments on the UK political scene have brought the option for a second referendum back on the table and no Brexit altogether. Agreeing on the exit conditions seems difficult for UK politicians as they are trying to keep the benefits of a close relationship with the EU while also trying to avoid the obligations that come with the benefits. Of course, that is not easy to achieve.

How Sterling trades this year will to a large extent depend on which of the above 3 scenarios unfolds in reality.

- No deal Brexit – Most negative GBP scenario (GBPUSD easily seen at 1.2000 and below in this case)

- Brexit deal passes Parliament (Theresa May deal accepted) – Positive GBP scenario (GBPUSD toward 1.40)

- A second referendum, no Brexit – Most positive GBP scenario (GBPUSD could head toward pre-Brexit levels 1.50)

Another vote on the Brexit deal is scheduled in the UK Parliament in mid-January 2019 and the outcome of this event could be very market moving for the Pound. Once Brexit is resolved in some way, the focus of traders and investors should shift back to the Bank of England and the performance of the economy.

The state of the economy will depend to a large degree on what happens with Brexit and, accordingly, the Bank of England actions will be a response to that.

The economy has done OK so far, hence in a positive Brexit development, further rate hikes from the Bank of England will be likely. This would add to the bullish pressures for the Pound. The political front will also be watched by traders and investors as Theresa May’s leadership is seriously challenged and she will probably be out of office after the Brexit process is completed.

Overall, binary risks to the GBP outlook are still very high and there are possibilities for both bullish and bearish scenarios depending on which direction things develop from here. So trading the GBP will remain volatile and challenging in 2019 as well.

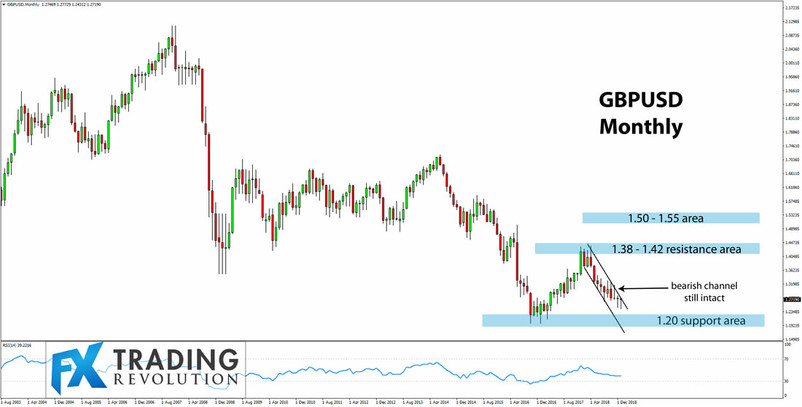

GBPUSD Technicals

In our yearly GBPUSD outlook last year, we noted the 1.3800 – 1.4200 area as very important technical resistance area, and indeed that’s where GBPUSD topped in 2018. That area continues to be important resistance for GBPUSD.

The pair now is trading closer to the major support at the 1.2000 area and there are already some bullish signs. However, GBPUSD is still trading within a downward channel (better visible on the weekly chart) and for as long as it holds the medium term trend will remain bearish.

In essence, the most probable trading range for GBPUSD is again likely to be between 1.2000 and 1.4000, while levels beyond those two would represent extreme scenarios for GBPUSD such as “no deal” Brexit or severe USD weakness.

Japanese Yen 2019 outlook

The Japanese Yen spend most of 2018 trading on low volatility except in the two instances of stock market sell-offs in February and then at the end of the year in the final weeks of December. The Japanese Yen remains the preferred choice of currency safe haven for Forex traders and investors in times of doom and gloom, as we have seen many times in history and just recently at the end of the last year and the start of this year. Hence, a lot of how the Yen trades in 2019 will continue to depend on the risk appetite - risk-aversion mood shifts in the markets.

Monetary policy remains stimulative and the Bank of Japan keeps interest rates firmly in negative territory in an effort to battle the long-standing problems of low inflation and deflation. That is unlikely to change, though the central bank has pretty much reached the limits in terms of how much they can ease monetary policy further. Thus, from this perspective, the odds continue to be tilted in favor of the Yen.

Global growth and the performance of global stock markets will also be a huge factor for the Yen and for risk sentiment. The more the risk-on mood can be sustained the weaker the JPY will trade. However, the current conditions in the US and globally suggest otherwise, so for the first part of 2019, the Yen will likely remain firm due to general risk aversion amid the sell-off in stock markets.

How things develop further on this front, as well as on the BOJ monetary policy front, will shape the trends on JPY pairs.

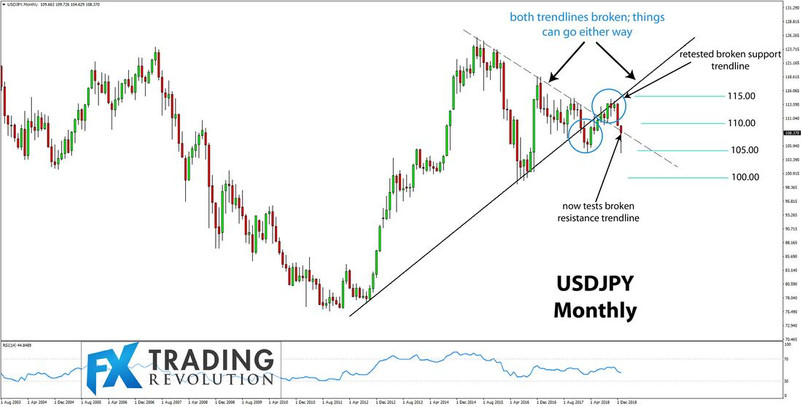

USDJPY Technicals

2018 was just another year spent in ranges for the USDJPY currency pair, most of the time close to the 110.00 level which generally does not look much different on the charts from 2017.

The 105.00, 110.00 and 115.00 technical areas are still key to watch for traders and will act as support and resistance. There are some other developments on the monthly chart, however, particularly the breakout above a major resistance trendline which is now being tested from the other side.

If the bullish re-test is successful then the outlook for USDJPY will be bullish and new gains toward 115.00 will probably be on the cards. If the re-test is unsuccessful and USDJPY breaks back below the trendline (108.00), then further losses will be the likely scenario and the 100.00 area will be within reach.