You’ve probably heard of the phrase “let your winners run and cut your losers quickly” as one of the top recommendations thrown out there for succeeding in Forex trading.

Everybody knows this phrase, everybody is saying it, but… How does it actually work? Those of us who have traded the Forex market for longer know that this is by far easier said than done.

In practice, letting a winner run can many times translate a winner turning into a loser and cutting losers early can, in the end, turn out to be cutting a winner prematurely.

And certainly, those are situations we most utterly wish to avoid.

While it’s nice to say the phrase out loud for entertainment and to boost your mood, for actual real-world trading success, concentration, focus, independent thinking and complete objectivity in your opinions regarding what is happening in the market will be of far greater help to you and your trading account in the end.

Although the general idea is correct, you absolutely should let the winners run and cut the losers early, the phrase by itself doesn’t show us how to do it.

In this article, we are going to discuss a similar, but more advanced concept and look at charts and situations that occurred in the past. Specifically, we ‘ll discuss adding to winning trades and cutting from losing trades as a way to more efficiently let winners run and cut losers early.

This money management strategy can be particularly good for trend trading the Forex market. During trending markets, we get multiple opportunities to join the trend and hence we can load up on a given currency pair more and more gradually as it continues to move in our favor.

However, the risk is in that we never know when the trend can end. Just because a trade is a winner now does not mean at all that it will stay there or move further into profit tomorrow.

In fact, trending markets experience sharp and deep retracements quite often thus leading to many Stop-Losses being taken out of those who got in late.

Here are some guidelines about adding more positions to an existing one.

1. Treat every new lot you add to the position as a separate trade

For this strategy to work well, it’s important for each position you add to the trade to have a slightly different reasoning behind it. For example, taking each position based on different charts is one way this can be done and which can work very well.

So, if you take the first position based on the weekly chart, chances are on the daily and intraday charts you are going to experience many ups and downs in the trade potentially leading you to close the position, which is absolutely the wrong thing to do since you took the position based on a higher timeframe but you are closing it based on a lower timeframe.

By splitting the risk into several positions, you can hold the long-term trade while looking for opportunities to add to it on intraday charts.

For example, if you are confidently long based on the weekly chart, you can only look for buying opportunities on the 4h and daily charts and disregard selling signals.

2. Have clearly defined conditions for the trade and technical levels on the chart

You must always have a clearly defined set of reasons for the trade. Based on those reasons and new incoming information you can decide whether to add to a position or trim down a position.

3. All technical and fundamental strategies can be used with this money management strategy

The basic purpose of adding to winners and cutting losers gradually instead of doing it in one shot is to diversify the risk and to have more opportunities to make your judgment about a trade. Just because leverage allows you to open large positions doesn’t mean you should do it and especially not all at once!

4. Keep in check the fundamentals

If you are going to trade a longer-lasting trend, like on the 4-hour chart and up, it is going to be driven by fundamentals. So, understanding the fundamental drivers behind a trade can help you stay confident in the trade in times of deeper retracements and even add new positions at excellent prices.

5. Keep leverage under control

To really trade this money management strategy, you will need to use smaller lot sizes than you normally would if you take positions in one shot. In essence, you need to divide the lot size you are comfortable with trading into 2 – 3 or maybe even 4 parts.

Finally, let’s look at some examples.

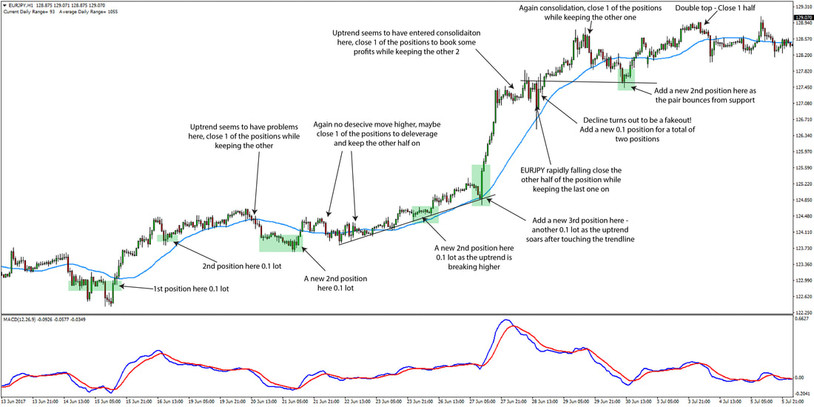

This uptrend in the EURJPY pair is a nice example where the strategy worked nearly perfectly. From left to right entry and exit points are shown and described. With the first part of the position, the trader could have captured this whole uptrend from beginning to end while booking profits many times on the way.

An uptrend in the EURJPY pair that gave many opportunities to join the move

Booking profits and tightening the stop loss as the trade deepens into profit is important because losing pips you’ve already won can have the same negative psychological impact as a losing trade.

The psychological impact is important for all of us because at the end of the day we are all humans and we are impacted by it. And the main advantage of this money management strategy is that it significantly decreases the psychological pressure.

Now, in contrast to the near-perfect first example, let’s look at an example where the trend turned against us and how it would have been managed with this strategy.

This downtrend in the EURAUD pair seems attractive but in the end, the price completely reverses. The chart below shows how profits can be protected by entering trades in several parts rather than all at once. At each of the decision points the trader makes a choice, do I want to get more exposed to this trade or am I losing confidence and I want to head for the exit?

Eventually, by using this kind of a “barometer” approach to managing trades, the trader can avoid many fake-outs that are quite frequent in the Forex market and very often purposely fabricated to trap traders on the wrong side of the market.

This trade didn't work out perfectly but profits were still protected with this strategy – EURAUD 1-hour chart

Like with any other trading strategy, time and practice breed confidence. And this strategy is of course not perfect, but odds are that if the trader has 3 chances to guess he is more likely to get it right in the end than if he has only 1 chance to pick a direction for a currency pair.