The Forex market is widely known as the world’s largest financial market, in the past only available to professionals from the banking sector, but now with the technological advancements in recent decades, the largest financial market is accessible for many retail traders as well.

However, trading doesn’t go as smoothly for the retail crowd as it does for the professional traders. To name but a few, the size of capital and access to information are some of the disadvantages that retail traders have to cope with. Unfortunately, most retail traders do not succeed in Forex trading with estimates putting the numbers of successful retail traders in the range of 2 – 5 percent. That means that the other 95% – 98% of traders ultimately lose in the wilderness of exchange rate fluctuations.

There is a famous 90/90/90 rule usually passed among traders which states that 90% of traders lose 90% of their account in 90 days. As shocking as it may sound this rule is not far from the actual truth regarding the longevity of retail Forex traders.

Most often the reason for losses is lack of education early on at the start of their Forex trading journey. A lot of times traders also get scammed by unethical brokers which is a shame but it’s real, so everyone must be able to deal with it. One of the reasons for which the FxTradingRevolution project was started was exactly for this – to filter out the bad from the good Forex brokers. For that, be sure to check our reviews of Forex brokers and see what other clients are saying about a broker you may be considering to trade with.

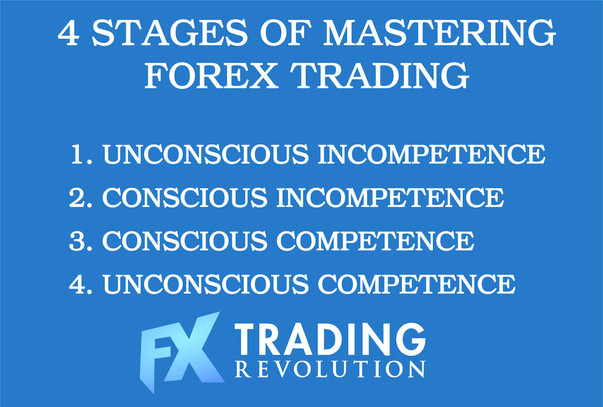

Not everything is so dark in retail Forex trading, though, and there is a way to succeed. There are generally 4 stages to mastering the art of trading. As a matter of fact, they also apply for mastering any skill or profession in life as the path to success is generally similar in whatever you do. Understanding these 4 stages can help you find out at which stage you are presently at and also to better deal with any challenges you may be facing during your learning voyage.

1. Unconscious incompetence

This is the stage at which traders are most prone to losing money. Failing to move from this to the next stage quickly can make trading much more dangerous and risky for a beginner trader.

Most traders start by finding one simple system which gets them hooked on trading. They are then quick to think they’ve got what it takes to extract cash from the market, but they soon realize that trading isn’t a simple or easy thing to do.

The first stage to mastering Forex trading, the so-called “unconscious incompetence” is the most illusionary stage of all and that’s why it’s the most dangerous to trade with real money.

In fact, when you are at this stage you shouldn’t be trading a live account at all, however, that can be tricky to understand at the “unconscious incompetence” stage because most traders are not aware that they are incompetent to trade real money.

Basically, at this stage, a trader is what you would consider a newbie. Some will pass quicker to the next stage than others. Generally, the more you read/learn about trading the quicker you will transition to the stage of conscious incompetence and the better off you are.

2. Conscious incompetence

Once the trader realizes how much more there is to Forex trading, he has reached the “conscious incompetence” stage.

At this stage, the trader begins to understand how dangerous Forex trading can be and starts to tone down on risk – which is good. The biggest danger while being in this stage is thinking that you’ve mastered trading too early. This leads to the trader being too confident in what he has learned (which is not a lot), but then sure enough reality kicks in and the trader painfully learns where he is at.

This stage can be frustrating in many cases as most traders go from one system to the next trying to find something that works. And, that is certainly not easy, and a lot of traders give up at exactly this stage when they realize how far they are from consistent success in Forex trading.

A trader can spend a lot of time at this stage, especially if he takes a wrong path in his learning/trading journey. Persistence and an abiding hunger to learn is what can get one through this stage and into the next - faster.

From the next stage on (conscious competence) results start to improve more sustainably as the trader has at this point gained more knowledge and experience in trading the markets.

3. Conscious competence

This stage usually begins with the Eureka moment. It’s that “Aha” feeling that finally hits the trader after a long time spent on searching the right strategy/approach to trade Forex successfully. After this, the trader has a new sense of confidence about how this works and usually experiences a steep improvement in his/her results.

However, nothing comes easy in trading, and certainly, the journey is not over here. Although most traders will get some nice and consistent results at this stage, they are still prone to making mistakes. A lot of times traders can fall back in stage 2 if they are distracted which leads to them forgetting/abandoning the principles that brought them here in the first place. Fortunately, though, the trader is able to quickly get back on his/her feet when he had already reached the 3rd stage.

Going forward from here, it’s generally easier for the trader because he/she already knows how success looks like and he knows that he took it and that he can grab it again. Mastering the most rewarding trading techniques is usually how a trader moves from this to the next and final stage.

4. Unconscious competence

When the trader reaches the stage of “unconscious competence” he already had a string of consistent results in his trading accounts – usually at least a few years. This stage takes time to be reached, but most importantly it takes time spent learning, practicing and mastering the most effective trading techniques that the trader found.

This is the mastery level. All great masters in any field are unconsciously competent at what they do. Competency, therefore, automatically translates into confidence and this “success” cycle continues as the two feed on each other.

Reaching unconscious competence is essentially what we all strive when we want to achieve something professionally. Traders that have reached this level probably find themselves in a very nice position in their life due to their ability to consistently earn money from the market and grow their capital.