Position trading is a long-term trading strategy, but unlike scalping, it is not important to enter positions at the most convenient time.

Long-term trading has really big advantages over short-term trading, mainly for example in the sense that it is relatively easier to maintain high quality money-management. Also this trading style is less time-consuming and finally from a psychological point of view, it is not as burdensome for traders as other more nimble approaches and strategies.

Position trading

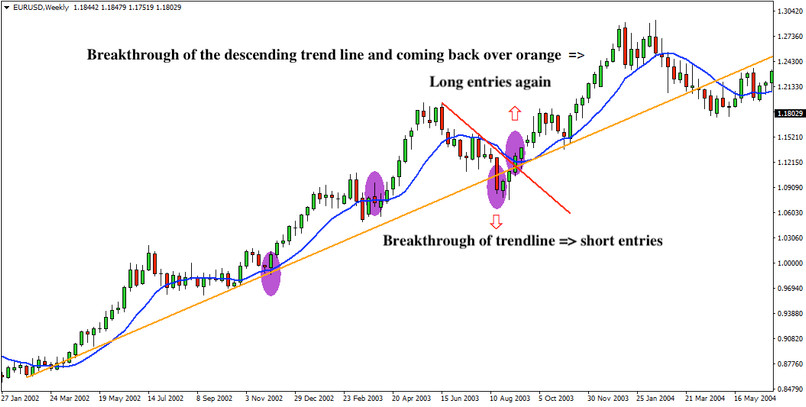

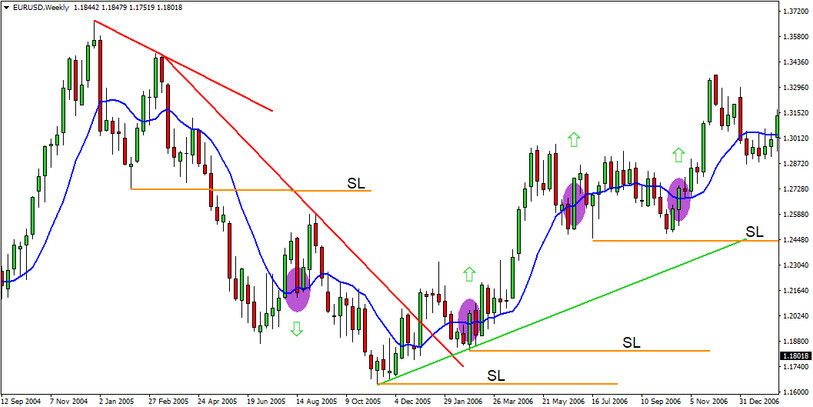

Position trading can take many forms, an important factor is that it is usually traded on daily and weekly charts (see charts below), which makes it just possible to start trading even the longest trends that the markets have to offer. In our example here today, we have chosen a strategy for position trading based on trend lines, moving averages and partly "Price action".

For today's strategy, it is only necessary to understand exactly what functions the above-mentioned elements perform. Trend lines are an important indicator here, which decides whether it is possible to enter a position or not. In simple terms, if there is, for example, a buy signal in the market and the trend line is rising, then nothing will trigger a possible entry; in the opposite case (falling trend line), entries never occur. Another important factor is the moving averages, which are the so-called trading signal maker in the strategy, where it is up to the traders themselves which price actions (for example, it may be a breakout of the trend line and MA, a bounce from the MA, or it may also be a breakout through the moving average, etc.) will eventually be taken as a signal and which ones will not.

Trading Strategy - Process

Today's strategy performs best in markets where long and strong trends regularly alternate. Assuming that the markets are experiencing such conditions, then this strategy can not only exceed a success rate of 80%, but at the same time the average size of the gains from a single position here usually exceeds the average loss by several times.