A prospective Forex trader would do well by researching what currency pairs tend to give the most profitable opportunities before beginning to trade in the Forex market.

For example, some currency pairs present trading challenges which may not be suitable for new traders. Some pairs may be far more volatile than others or might trade in a thin market with wider spreads and sharp exchange rate movements.

Nevertheless, many trading opportunities exist among both the major and the minor currency pairs.

Each major currency pair tends to have its own characteristic trading style. For example, EUR/USD is highly liquid and tends to move in long sweeping trends which can be readily identified. On the other hand, GBP/USD or sometimes also called Cable tends to be much more volatile, and so many times it can be harder to read the chart and trade.

Technical and Fundamental Market Research

Once the trader has identified the optimum currency pairs to trade, they are then ready to research the currency pairs which they will be trading. Many successful traders use a combination of technical and fundamental analysis in their research.

Often, traders will use technicals for timing entries and exits, while the fundamentals can be used to forecast longer term exchange rate movements.

Both of these market research techniques are popular and each has its advantages and drawbacks.

As a result, many traders prefer to use both types of analysis to a degree and will usually look for agreement between them as a basis for initiating a trading position.

The Trend is your Friend

An often repeated phrase among forex market professionals is “the trend is your friend”. This trading maxim summarizes a trend trader’s trading technique very well. Indeed, trading with the trend is still the most profitable way to trade the Forex market and the best advice that can be given to a trader, no matter how cliché it may sound.

Accordingly, identifying the direction of the underlying trend represents the first hurdle for the trader to clear.

Discerning the Trend

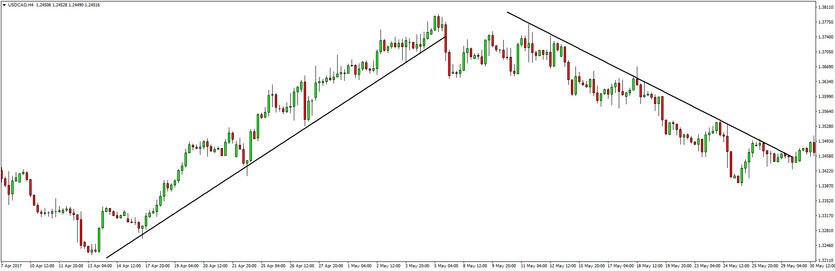

Perhaps the most efficient way to identify a forex trend consists in examining graphs or charts of the exchange rate for a currency pair as it evolves over time. Technical analysis of exchange rate behavior makes up the first line of approach that many forex traders use when determining the market’s trend.

By examining price charts and perhaps drawing lines between successively higher highs and higher lows for an uptrend or lower highs and lower lows for a downtrend, the technical trader can assess whether the prevailing trend in the market is higher, lower or sideways overall.

Trends can also occur on different time frames, such as long term, medium term, and short term.

Traders will draw lines between successively higher highs and higher lows to identify an uptrend and lower highs and lower lows to discern a downtrend

Trading the Trend

Once the trader has correctly identified the current trend’s direction, they will generally seek to establish a position that will profit from the trend’s continuation, while placing Stop-Losses at points that would indicate the trend is reversing.

Several different possibilities on how to trade the newly identified trend exist for the trader.

The first consideration involves what kind of strategy the trader will be using to take advantage of the trend.

While most traders will seek to buy to profit from up trends and sell to profit from declining trends, the exact type of trading strategy used by the trader may also depend on whether the time frame of the identified trend is short, medium or long-term in nature.

Finally, trading trends successfully is likely to require a combination of technical and fundamental research. The large trends in the Forex market are driven by fundamentals and in order to capture them it’s best to keep the fundamentals in check rather than focusing solely on technicals.