It’s more than a month the stock markets were overwhelmed by real panic. For example, when taking a look at the S&P500 index development, it could look that the best actual solution is the protection of capital so the sale of asset. However, in case of S&P500 history tells us that selling the asset does not have to be the best idea, in particular for the long-term investors.

From the chart below, it’s evident that those hot-headed traders (in the even of economic crisis in 2007), who were selling under the pressure of panic that time, often suffered significant losses. On the other hand, those who remained confident about “more optimistic days” got out of their losses by 2013.

Some decisions shall be really well considered, in particular the fact if certain factors (e.g.: the strength of fundaments, behaviour of the economy, interest rates, profit statements etc.) are sufficiently persuasive so the strategies have to be changes or certain measures must be undertaken.

When taking decisions, it’s also good to evaluate if the portfolio corresponds to the used strategy and if the capital is not in danger without any reason, e.g. by the fact that certain assets in portfolio correlate markedly.

Explanation: high correlation of assets results in the fact that despite the relative significant diversification of portfolio it may happen that the assets in such portfolio behave in similar way over time. That results in the fact that the diversification ends with certain set-off.

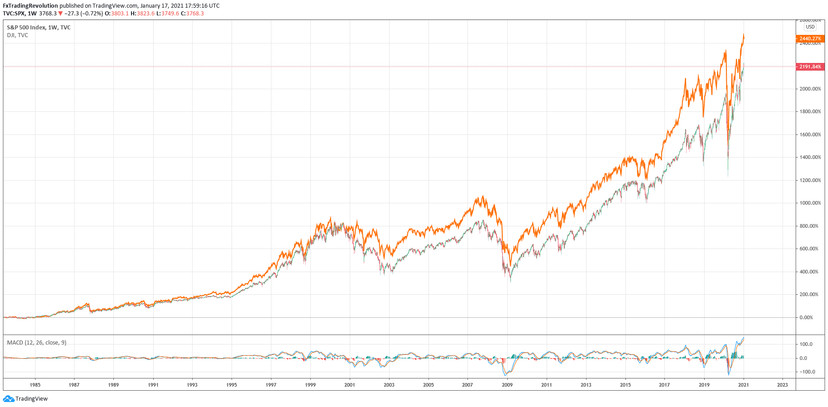

Typical example is the correlation between S&P500 (blue) and DOW (orange).

At the chart above we can see that there is a high correlation between the S&P500 and Dow Jones index, and so it’s maybe not worthy to invest into both of these indices within such diversification.

Evaluation

Trading, as well as the life, is about decision where the trader does not know in advance who consequences it’ll have for him. However, in general it applies that the decisions based on a careful and high-quality analysis have higher chance of success in comparison to the decisions made on the basis of emotions. That also proves the above-mentioned example (development after 2007), how the market developed in certain times and what consequence it had when the decisions were made on the basis of emotions or without them.

If you are long-time traders, corrections are a natural thing in markets. And exactly these are the moments testing the resistance of long-term investors.

So if you would rather avoid long-term equity investments due to significant corrections, there a short-term trading could be more appropriate for you, where you can enter the market on the basis of proven technical analyses’ strategies and to set a clear stop-loss for each trade primarily as well as the potential take profit. Thanks to this, you will have a limited risk per trade set as well as potential profit in advance.

This is a huge advantage in comparison to a long-term investment as no open position stay on your trading account for a very long time (in case of correction from 2007 even 6 years), when you would have to wait for the market to return back. At the same time, you can make a potential profit thanks to market drops within short-term trading.

We wish a lot of profitable trades!

About the Author

Team Purple Trading

Purple Trading is a true and 100% fair ECN / STP forex broker providing direct access to the real market. High speed orders execution, no trade-offs, no limits for any type of trading, the most advanced trading technologies. Explore more about Purple Trading at www.purple-trading.com .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64.4% of retail investors lose their capital when trading CFDs with this provider. This value was determined within the period from October 1, 2017 to September 30, 2018. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading forex exchange with margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. You could lose part or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Seek independent advice if you have any doubts.

Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. L.F. Investment Limited will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

P.M. Purple Trading is a trade name owned and operated by L.F. Investment Limited., 11, Louki Akrita, CY-4044 Limassol, Cyprus, a licensed Cyprus Investment Firm regulated by the CySEC lic. no. 271/15.