Candlestick pattern (or formation) is the term of technical analysis used in the forex, stock, commodity, and other markets in order to portray the price patterns of a security or an asset.

Candlestick charts are easy to understand and provide ahead indications regarding the turning points of the market. Candlestick charts not only illustrate the market trends but also give you an idea about the underneath forces that encourage the trend.

The candlestick charts assist in respect of the entry and exit points in the market. The trader can potentially decrease the risk exposure by using the candlestick technical analysis as well as be in the right time at the right place.

The candlestick charts are also called Japanese candlestick charts. Candlestick charts can be used at all time frames and for all trading styles - including day trading and swing trading as well as long-term position trading.

Candlesticks explained

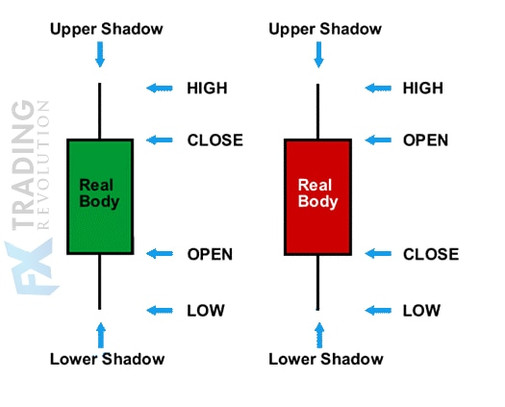

Before explaining the candlestick patterns, it is necessary to define how every candle looks like, and what price information do they tell us. You can see the bullish and the bearish candlestick well explained in the picture below. Note that the green candles stand for a bullish period, while the red candles stand for a bearish period. You can also change the color of the candlesticks in your trading platform.

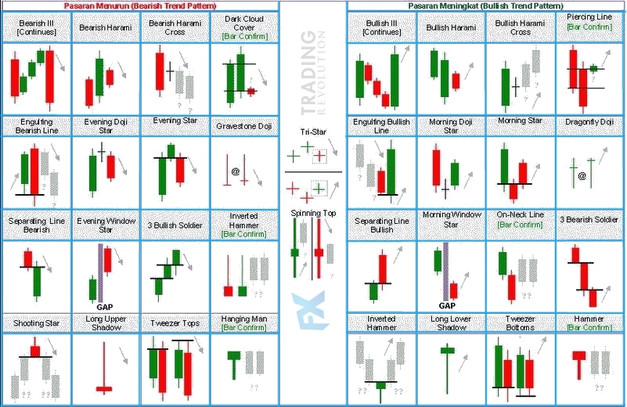

The candlestick patterns are broadly divided into two portions, i.e. bullish patterns and bearish patterns. The candlestick patterns give the indication of trend reversal or continuation of a long-term trend, and the candlestick patterns are created with the help of one or more candles.

Following are the most common candlestick patterns used by forex traders for analyzing the market conditions;

Engulfing Candlestick Pattern

Direction: bullish and bearish

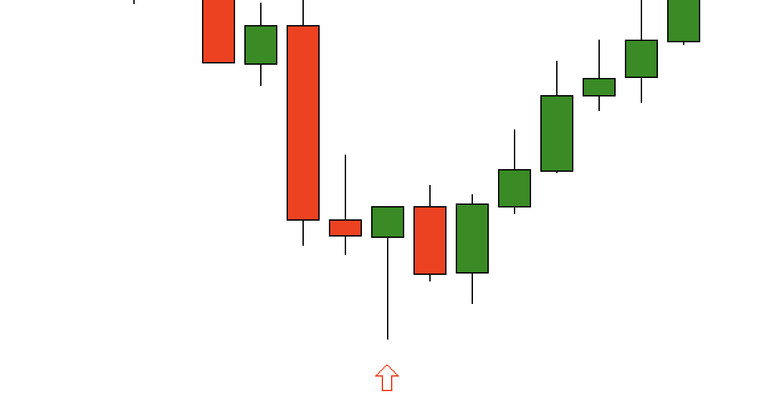

The engulfing candlestick patterns are either bullish or bearish reversal patterns. The engulfing candlestick patterns are consisting of two candlesticks. The bullish engulfing candlestick patterns are normally taking place at the underneath of a downtrend. The large green candlestick is engulfing the small candlestick. This pattern indicates the end of bearish move / downtrend and signaling the beginning of a bullish trend in respect of an asset. Practically, the engulfing pattern can also be considered to be the outside bar pattern.

The bearish engulfing pattern shows the opposite signal of bullish engulfing pattern where the white/green candle is engulfed by the big red/black candle. It normally appears during the uptrend. The pattern shows that the trend is continuing and make higher high than the previous day close, but finally close lower than the previous day’s opening or low.

Hammer Candlestick Pattern

Direction: bullish

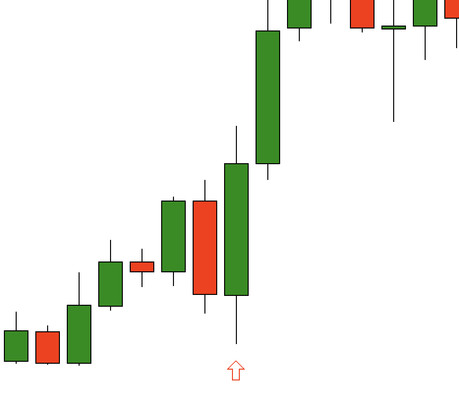

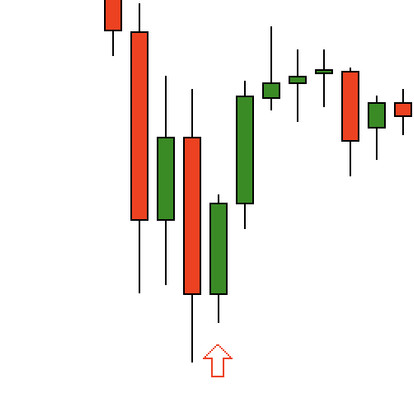

Hammer is the bullish candlestick reversal pattern. As shown in the picture, the candle looks like a hammer containing a long lower shadow with a short body and having no upper shadow or a very short one. The hammered pattern consists on a single candle.

The hammer usually occurs during the downtrend when the price of the asset is falling, signaling a possible end of the bearish move. The hammer candlestick pattern appears when the price of the asset fall from its opening price during the trading session and the closing price ends nearby the opening price after recovery. Here it does not matter that much whether the body of the Hammer is bullish or bearish. Practically, the hammer pattern can also be considered to be the bullish Pin Bar pattern .

Harami Candlestick Pattern

Direction: bullish and bearish

The bullish harami pattern consists of a long black/red body candle followed by small white/green body candle. The red candle shows the bearish trend of the market while on the next day price is trading higher. These patterns point out maybe the end of the long-term bearish trend or the reversal of the trend.

In the case of bearish harami patterns, a big white/green candle is followed by a small black/red candle. The pattern indicates the reversal of the bullish trend.

Usually, the harami candlestick pattern can also be considered to be the inside bar pattern.

Piercing Candlestick Pattern

Direction: bullish or bearish

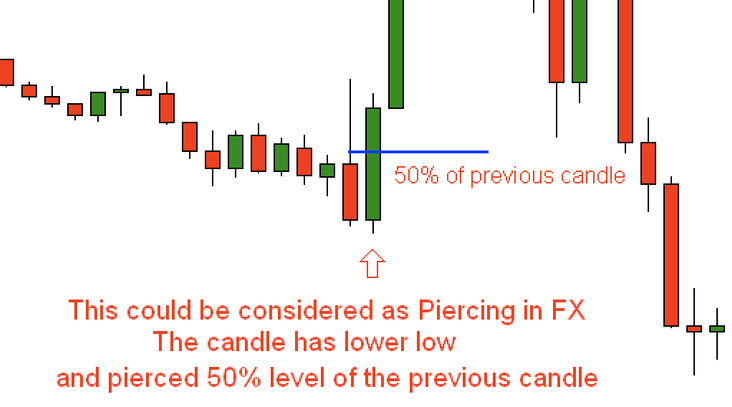

This pattern consists of two candlesticks. In the bullish piercing, reversal pattern consists of black or red candle followed by the white or green candle starting lower with a down gap (that is not so usual in case of currencies) and close out more than half of the previous candle's range.

The piercing pattern signals the reversal of the bearish trend as the asset price downtrends and starts moving toward upward.

The bearish piercing candlestick patterns look exactly opposite.

Doji Candlestick Pattern

Direction: bullish or bearish

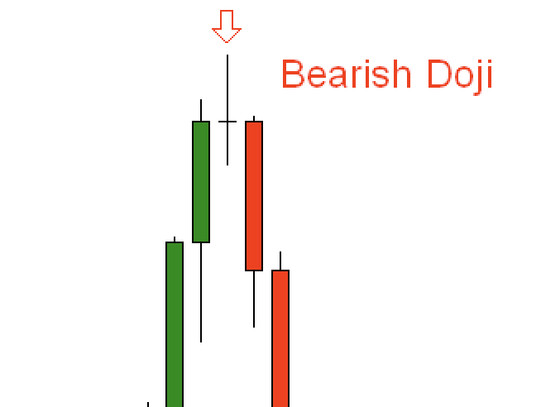

Doji gives the indication that the market is taking a rest. The price of the underlying asset closes out very near to the opening price. The lack of real body indicates that the market players, i.e. sellers and buyers are not able to overcome each other so the price is stagnant during the trading period. It may be considered as the sign of a reversal pattern of current market move and may be taken as the continuation pattern of the long-term trend.

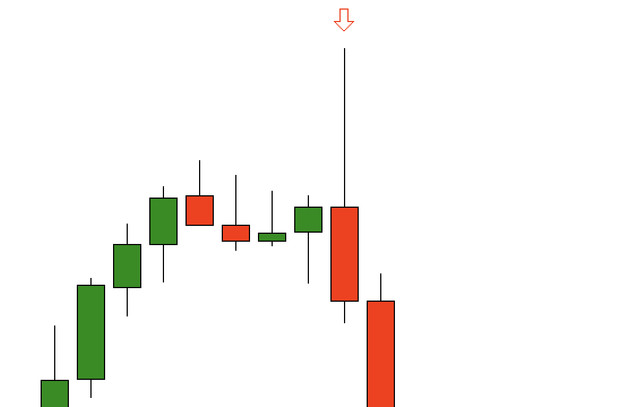

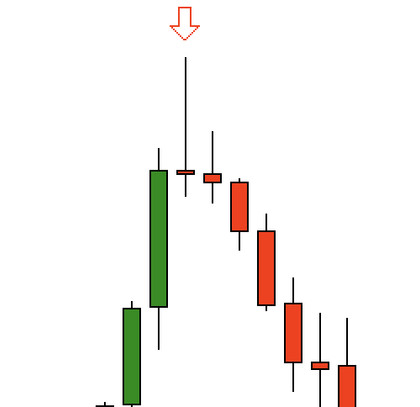

Shooting Star Candlestick Pattern

Direction: bearish

The shooting star pattern looks like an inverted hammer. A shooting star is a bearish reversal candlestick pattern that occurs during the uptrend. The price is going higher, so it seems like a bullish trend continues, but the candle closes near the opening price - signaling a possible reversal.

Practically, the shooting star pattern can also be considered to be the bearish Pin Bar pattern .

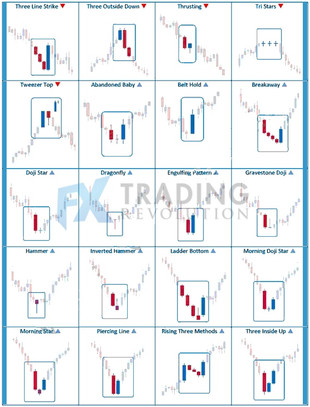

Below you can also take a look at the summary of already mentioned candlestick patterns, as well as some more candlestick patterns that can be effectively used in forex trading.

And one more summary of the candlestick patterns that you can use in your forex trading below: