Triangles are chart patterns that most of the time form in sideways markets as part of the consolidative process. Although triangles tend to be broken in the direction of the previous trend (if there is a strong prior trend), it’s not a definitive rule and triangle breakouts can occur in either direction.

In technical analysis there are 3 types of triangle patterns and trading each of the triangle patterns is similar, although there are some subtle differences between them.

We will treat the symmetrical triangle as a slightly different kind, while the ascending and descending triangles are the exact same thing only in the reversed direction.

Symmetrical triangle

The symmetrical triangle most of the time forms following a sharp move during a trend and is an indication of a correction taking place. The direction of breakout is most often in the direction of the preceding trend and usually, it’s just a matter of when this breakout will occur. In this regard, the symmetrical triangle can be thought of as similar to the flag pattern, only with a different formation on the chart.

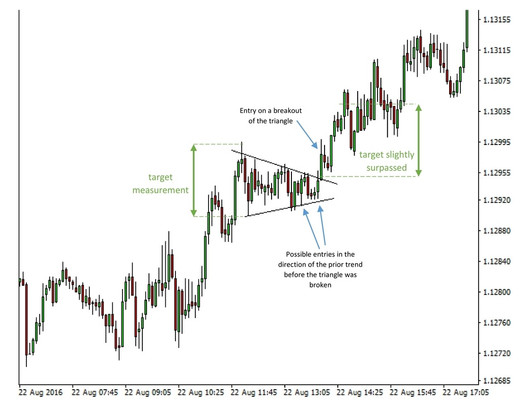

It forms when a rising support trendline and a falling resistance trendline converge into one another, hence price action gets squeezed into a tighter and tighter space awaiting a breakout.

As with most corrective patterns, price action inside of the symmetrical triangle tends to be choppy and highly unpredictable.

Entry rules:

- Because it is a continuation pattern it can be a valid strategy to take a trade in the direction of the prior trend before the breakout of a symmetrical triangle occurs. But remember that this is a riskier strategy and appropriate protective measures should be taken such as a stop loss behind a key nearby technical level.

- Waiting for the triangle to break in the direction of the trend is the classic way to trade this formation and it does have a higher rate of success. However, the downside of this approach is of course that you get to enter much later (at a worse price) and potentially give away a large portion of the profit.

- If for some reason the symmetrical triangle is broken in the counter-trend direction then no trade should be taken.

An example of a symmetrical triangle on EURUSD 5m chart

Initial stop placement: Managing the trade: Profit targets:

- If the trade has been initiated using the first approach (before the breakout occurs) then the stop loss should be placed a few pips behind the appropriate trendline (the upper falling trendline in a short trade and the bottom rising trendline in case of a long trade).

- When trading the breakout stop-loss should be placed behind most recent swing high (in a downtrend) or swing low (in an uptrend).

Ascending triangle

A chart formation where the resistance trendline is horizontally flat and the support trendline is ascending and converging into the flat resistance trendline, thus the name “ascending triangle”.

It can be a sign of continuation in an uptrend, but it’s very unlikely to form as a consolidation during a downtrend. In fact, in a downtrend, it will more likely signal the onset of a reversal and the start of a new bull trend.

Statistically, most of the time price breaks out of ascending triangles to the upside, though as anything in trading it’s not a definite rule and protective measures like stop loss orders should always be taken.

Entry rules: In our example of the ascending triangle on the EURGBP 4 hour chart, the pattern appeared at the beginning of an uptrend. After the breakout, the price reached the first target (the width of the triangle) then paused before resuming the trend to reach the second target (2x the width of the triangle).

EURGBP 4h chart - Ascending triangle

Initial stop-loss placement: Managing the trade:

- behind the most recent swing high (in a bearish breakout) or

- behind the most recent swing low (in a bullish breakout)

Profit targets: As with any trading strategy, it’s crucial to be aware of key support and resistance levels on higher timeframes and make sure that no such obstacles lie ahead of the targets.

- 1st target - Measure the height of triangle and project it to the right on the chart (from the breakout point).

- 2nd target – 2x the height of the triangle.

Descending triangle

This chart pattern is formed by a resistance trendline which is descending (falling) and a support trendline which is horizontally flat. The name descending triangle comes from the descending price action that creates the triangle.

The price will most of the times break a descending triangle to the downside. This is mainly due to the selling pressure that tries to penetrate the horizontal support several times until it’s finally stronger and cracks it.

However, as we’ve said other times that is not always the case and descending triangles can be just as easily broken to the upside.

Entry rules: In the following example on the USDCAD daily chart, price broke the descending triangle to the downside as is the case most of the time with descending triangles. However, instead of plunging down immediately price returned to the broken support trendline and “retested” it from below. This is not an uncommon scenario and it’s a great opportunity to enter the trade at a much more attractive price.

USDCAD Daily chart - Descending triangle

Initial stop placement: Managing the trade: Profit targets: If there is a strong support or resistance level on the way to the target, the price might reverse even before reaching it. This is why it’s very important to make sure that there are no such obstacles in the way.

- behind the most recent swing high (in a bearish breakout) or

- behind the most recent swing low (in a bullish breakout)