Trading chart patterns is about profiting from repeated occurrences in the markets that are known to yield a certain kind of results over and over again.

As with anything in technical analysis, it’s always good to combine chart patterns with other tools like support and resistance to filter out the best setups. The flag and the wedge are two very popular chart patterns among traders, and they both have their bullish and bearish versions.

Continuation Pattern: The Flag

The flag is a trend continuation pattern and takes place during the consolidation phases of the trend, and therefore it gives traders a wonderful opportunity to join the trend in a high probability manner.

The flag is a formation on the charts with two horizontal or rising parallel trendlines in a bearish flag, and two falling or horizontal parallel trendlines in a bullish flag.

A falling flag (bullish) occurs during an uptrend and a rising flag (bearish) will occur during a downtrend.

Flags will usually form after a sharp move in the market and most often because of overbought or oversold levels. With the flag formation the market sort of digests the previous sharp move and is ready to continue the trend for another swing.

The breakout of the flag is our signal to join the trend and enter a trade.

Entry rules:

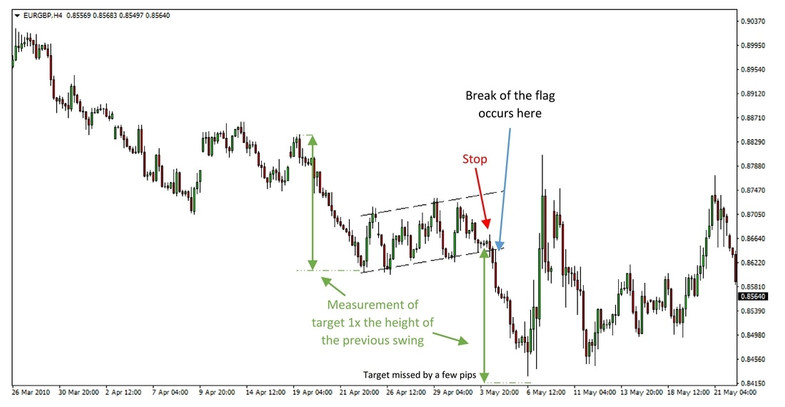

Initial stop placement:

- behind the last swing high (in a bearish flag) or

- behind the last swing low (in a bullish flag).

Bullish flag on EURUSD 4h chart

Managing the trade:

- If price returns inside of the flag after breaking out then the whole trade idea would become invalid and the trade should be closed.

- After price moves in your favor by the amount of the stop loss, move the stop to breakeven.

Bearish flag on EURGBP 4h chart

Profit targets:

To calculate profit targets measure the height of the most recent previous swing in the direction of the trend Note : If present, important support or resistance levels (especially from higher timeframes) on the way of the trade should be viewed as targets themselves.

- First target is 1x the height of the swing

- Second target is 2x the height of the swing

- Third extended target is 3x the height of the swing

Reversal pattern: The Wedge

When you spot a wedge on the charts pay attention because it almost certainly is a signal of the trend ending and a violent reversal coming.

The wedge is a formation on the charts with two rising trendlines in a rising wedge and two falling trendlines in a falling wedge.

A rising wedge forms in uptrends and is a signal of a bearish reversal, while a falling wedge forms during downtrends and signals that a rebound in prices is likely to occur soon.

So, the trend still continues in a wedge formation however at a slower rate. The trendlines that limit the price swings in a wedge are sloped in the same direction (up or down) and contract into one another hence leading to choppy price action inside of the wedge.

Most often the reason for a wedge forming is an exhaustion of the trend, an oversold or overbought market and change in underlying market sentiment. Volatility will also tend to drop in wedge before expanding again when the price breaks out of the wedge.

How to trade it?

Entry rules:

- Keep in mind though, the second tactic is riskier!

- Note: It’s also a good idea to keep check of the fundamentals when the breakout occurs. Try to find out why the breakout happened and if a major shift in fundamentals caused it. This can help you avoid fakeouts which happen quite often in the Forex market.

An example of a rising wedge on AUDUSD 1h chart

In the AUDUSD case on this example, the price violently broke through the lower trendline of the wedge. There were fundamental reasons for this breakout (a Fed rate hike) and that gives us greater confidence that the downtrend will last for a longer time, as was the case here.

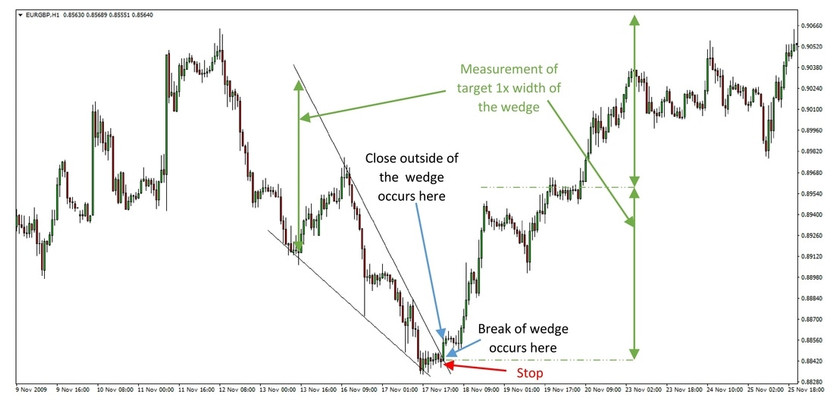

Initial stop placement:

- behind the last swing high (in a bearish rising wedge) or

- behind the last swing low (in a bullish falling wedge).

Falling wedge on the EURGBP 1h chart

Managing the trade:

Profit targets:

- If price returns inside of the wedge after breaking out then the trade scenario of a wedge would become invalid and the trade should be closed.

- After price moves in your favor by the amount of the stop loss, move the stop to breakeven.

To calculate profit targets measure the width of the wedge at its starting point

- The first target is 1x the width of the wedge

- The second target is 2x the width of the wedge

- The third extended target is 3x the width of the wedge

Note : If present, important support or resistance levels (especially from higher timeframes) on the way of the trade should be viewed as targets themselves.