You may have noticed that we frequently mention the US Dollar Index in our posts and trade ideas in the news section. If you are not sure what exactly it is, you are probably wondering why Forex traders care so much about it.

In this article, we’ll answer that question and also discuss how you can use the Dollar Index to help you in making better trades.

What is the US Dollar Index?

The US Dollar Index (often listed with the abbreviations DXY or USDX) is a broad measure of the value of the currency of the United States against a basket of other currencies. The index works similarly to stock indexes such as the Dow or the S&P 500. It tracks and combines the performance of the Dollar versus the included other currencies and gives a calculated value for the final output.

The USD Index goes up when the US Dollar is rising against the basket of included currencies and it goes down when the Dollar is falling. It was created in 1973 with a starting value of 100.00.

Note: The US Dollar Index should not be confused with the trade-weighted US Dollar Index, the Bloomberg Dollar Index, the Wall Street Journal Dollar Index or other calculations for a broad measure of the US currency. Although they are all moving closely in tandem with each other and are measuring the same thing, their formulas are different, thus they don’t always produce the same results.

In this article, we’ll discuss the classical US Dollar Index (DXY), but keep in mind that any version of the USD Index will do pretty much the same thing and can be used in similar ways.

How is it constructed?

The DXY value is a weighted calculation of the USD value against the following basket of currencies:

- Euro (EUR) 57.6%

- Japanese yen (JPY) 13.6%

- British Pound (GBP), 11.9%

- Canadian dollar (CAD), 9.1%

- Swedish krona (SEK), 4.2%

- Swiss franc (CHF) 3.6%

As you can probably see from the weighted percentages, the Euro accounts for more than half of the Dollar Index. As a result, the EURUSD currency pair and the DXY are closely correlated (inversely).

Why is it important?

It’s an indication of the general performance of the US Dollar. This can be important not only in terms of technical analysis but fundamentally also. Movements in exchange rates of currencies impact the inflation rate and trade relationships of a county. Most policymakers, therefore, like to monitor the performance of their currency and take appropriate measures if/when needed.

The best way to see how strong or weak a particular currency is, is to use an index that shows the broad performance of that currency. The DXY is one such index, and for that matter, all currencies have an index that is monitored by the central bank and Government of that country.

Aside from the above, as the most important currency of the world, the US Dollar and its value can impact many other countries and the global economy. This is why the Dollar Index is the most important currency index and why so many versions of it have been created.

The USDX also has some known relationships with commodities like Gold and Oil. Generally, Dollar weakness is accompanied by rising commodity prices and vice versa.

How to use the Dollar Index?

The US Dollar may be rising against the Euro and the British Pound, but it may be falling versus the Japanese Yen or the Australian Dollar. How do you know if the move is USD driven, or some other factors are at play?

The US Dollar Index comes in handy in such situations as it’s an accurate measure of current USD trends. It shows the combined performance of the Dollar versus its peers. If the Dollar Index is rising then the USD is likely rallying against most of the other currencies.

The reasons for why a currency pair is moving are important and the USD Index is one of the first indicators to look at in order to determine that. USD driven movements in currencies may be due to global factors or US-specific factors and determining that is important for fundamental analysis.

Furthermore, the chart of the US Dollar Index can be used to do an overall technical analysis of the USD currency in isolation of Forex pairs. Since a lot of traders and investors follow the USD Index chart and many are even trading it (via futures or options contracts), support and resistance, as well as patterns on the chart of the USD Index, can often cause subsequent reactions across the Fx market in major pairs such as EURUSD, GBPUSD, USDJPY etc.

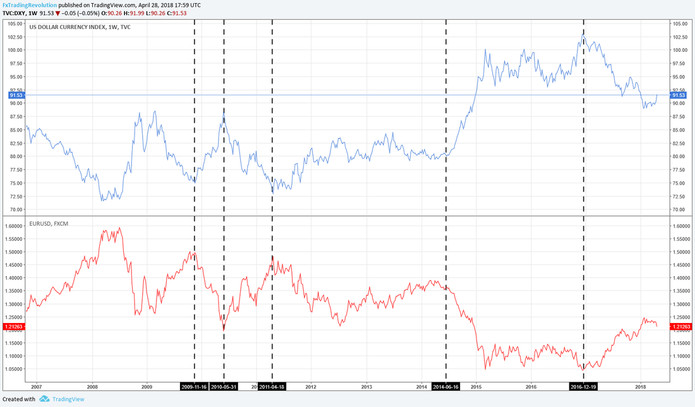

Below is a chart of the Dollar Index and the EURUSD pair showing how tops and bottoms occurred at the same or nearly the same time.

The charts of the USD Index and EURUSD can often show similar patterns and turning points (DXY and EURUSD are inversely correlated)

Conclusion

Any serious Forex trader will watch the Dollar Index chart. It gives a different perspective on the Fx market and it’s very useful in many trading situations, whether it’s spotting something that is not visible on other charts or simply confirming a trading signal on one of the major currency pairs.

Many retail Forex brokers also offer the index for trading, so it can be traded just like any other instrument on the platform. This is particularly useful in times of general USD strength or weakness. Instead of betting on or against the Dollar versus a single currency, you can use the Dollar Index to open a broad USD position that will only be affected by news and developments related to the US while being isolated from movements in other currencies.