This trade idea was first sent to subscribers of the Free Profitable Forex Newsletter on September 9, 2022.

USDJPY broke above 140.00 this week and then quickly reached new multi-decade highs around 145.00. These moves are extraordinary and significant; the last time USDJPY traded above 140 was in 1998.

The main fundamental drivers of yen weakness are the same since the trend began in February when Russia started the war in Ukraine. The first one is the now wide and further increasing yield differential between Japan and other countries (as the BOJ keeps interest rates at 0%), while the second one is Japan's weakening trade position and worsening trade balance due to rising energy costs.

The BOJ is still in uber-dovish mode, while nearly every other central bank has shifted hawkish this year. Staying dovish in an inflationary environment means only one thing - your currency will depreciate, and it will depreciate rapidly!

The other factor - energy prices - perhaps has a less direct impact on JPY weakness but still should not be neglected. Japan imports virtually all its energy, and with the high prices for oil and gas this year, the country's trade balance deteriorated significantly, from previously a surplus (Japan was a net exporter) to now a trade deficit.

This week's breakout is more about momentum than fundamentals

Putting the fundamental factors aside, this week's breakout above 140.00 seems to have much more to do with technicals and momentum. For instance, bond yields are only gradually rising, and oil prices have fallen further, yet USDJPY galloped higher once it broke 140.00. This is obviously a momentum break above a very significant technical zone, and the fast continuation higher is a natural reaction in such situations as very few, or no sellers are left in the market.

That means that we are now in uncharted waters on USDJPY (other JPY pairs too). Japanese officials are getting increasingly uncomfortable with the yen weakness as it has already lost around 25% of its value this year, and there are still four months before the year is out. Indeed, we already got some verbal intervention overnight, with BOJ Governor Kuroda saying that rapid yen weakness is undesirable for the economy. The comments triggered a reversal, and USDJPY is now trading some 300 pips off the week's highs.

Still, it's unlikely that just verbal intervention by the BOJ will reverse or stop this uptrend in USDJPY. The momentum is powerful, with the fundamental drivers strong and set to pull USDJPY further higher. Japanese officials will need to do more if they want to stop yen weakness. They will need to put money behind their words and actually enter the market by bidding the JPY higher).

USDJPY testing 24-year highs

As the long-term, monthly chart of USDJPY below shows, the next important technical area higher is 147.00. These are the highs from October 1998. Furthermore, a projection of the big bullish leg from 2011 - 2015 points to the 151.00 zone as the 100% projection target. Based on this, we can say that the whole 147.00 - 151.00 area on USDJPY will be important resistance.

Given the high volatility, it's easily possible that USDJPY could quickly reach this 147.00 - 151.00 area relatively soon. But that will highly depend on the above factors discussed, such as the fundamentals and whether the BOJ will intervene or not. If this area is reached, some reaction is very likely. Perhaps USDJPY first will go to 150.00, and such a move itself could inspire intervention from the BOJ.

To the downside, the zones at the round numbers, such as 140.00, 135.00, and 130.00, are in focus as support. If USDJPY reverses down hard, then those zones will be where USDJPY could react and bounce on the way down.

Conclusion: Be extra careful trading USDJPY these days

The main question for Fx traders who look at JPY pairs is, will the BOJ intervene? That is what we should be very careful about with USDJPY trading at such extreme levels. If the BOJ or Japan's Government decide to intervene, USDJPY can drop like a stone, easily 500 - 1000 pips in a matter of minutes or hours. This remains the main and biggest risk to holding long USDJPY positions right now.

While even such "real" intervention in the market is unlikely to sustainably reverse JPY losses by itself, the volatility it can bring about in the market can be tremendous. Hence, Fx traders must be extra cautious trading JPY here, both from the long side and from the short side.

Obviously, the main risk to holding long USDJPY positions is intervention from the BOJ, as discussed above. On the other hand, the main risk to trying to pick a reversal here by shorting USDJPY is a potential runaway break higher, like we saw this week after the break above 140.00. With the market being rather liquid at these unusually high levels, extreme volatility and rapid moves can become a "normality".

All in all, the high volatility indeed makes USDJPY potentially a more profitable trading opportunity, but at the same time, it makes it that much riskier.

Trade signals from the past weeks

- September 9, 2022 - Short EURUSD from 1.050 (trade idea sent Sep 2)

TOTAL P/L in the past three weeks: N/A

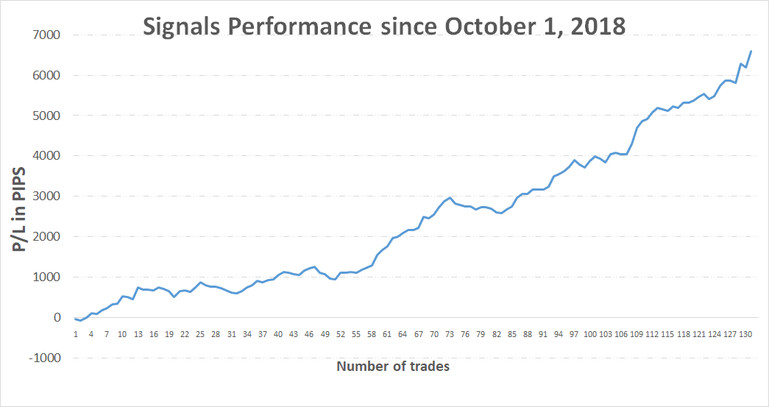

TOTAL: +6595 pips profit since October 1, 2018

![USDJPY: Breakout but Beware Intervention [Newsletter Sep 9]](https://cdn.investworld.net/insecure/w:835/h:407/rt:fit/g:ce:0:0/el:1/f:jpg/c:0:0/q:90/czM6Ly9zZXJ2aWNlcy0tODM1OS0taW1hZ2VzLzg0YjFhMTY4OGE3NjkwNzc5ZjM3ZmNmOGJhZTVhZDE3MGFiYjkzYmQucG5n.jpg)