Volatility is a very important aspect of trading that all successful Forex traders are aware of and keep an eye on.

In essence, volatility is the degree to which the price of a financial asset fluctuates (exchange rates when it comes to the Forex market). When price fluctuations are high and fast we say that volatility is high and when price fluctuations are slow, small and often confined to a range we say that volatility is low.

Volatility is something that is always present in markets, but many novice traders are not really aware of or don’t pay enough attention to. Yet, volatility is an absolutely crucial aspect of trading financial markets because when volatility changes the rules of the game usually change with it. Thus, very often new situations are created in the markets where what worked in the past doesn’t work now.

How volatility affects the market and Forex traders

Trading in a low-volatile environment is very different from trading in a highly volatile market. For starters, the size of stop and take profit orders automatically needs to be increased in a more volatile environment. Trading capital (account size) should be larger as well in order for the trader to be able to withstand the large price fluctuations in a volatile and busy market.

However, this is not where the story with volatility ends. Market patterns tend to be different when volatility changes as literally the nature of the market changes. Traders must be aware of these things in order to be able to approach them in an appropriate way and deal with different unexpected situations – which sooner or later inevitably come in trading. This is also one of the primary reasons why being adaptive is a highly valued trading characteristic.

Of course, the risk of loss is generally higher when volatility is high because large moves occur quickly and are erased quickly as well. Thus, it’s common for a lot of margin calls to be issued during such times because of many traders being undercapitalized. However, traders should also realize that profits can be larger in highly volatile times for those who are on the right side of the market.

Measuring Volatility with Technical Indicators

In addition to using technical indicators for generating buy and sell signals, we can also use them to measure the volatility in markets. There are many technical indicators that were created for this purpose and, in this article, we’ll only briefly look at two of the most popular technical volatility indicators – Bollinger Bands and the Average True Range (ATR).

The most important way they are used in terms of volatility is determining the most likely price levels that will be reached within a given trading session. The most important situation where this would be useful is of course stop-placement. For example, if we know that the average daily trading range for the EURUSD pair is 70 pips then we can place a stop loss that is close to this size with which we can have the confidence that the stop will not be taken out in a jerky move.

Bollinger Bands

Bollinger Bands are a technical indicator which primary purpose is measuring the current volatility in the market. This indicator is constructed using 2 standard deviations which means that it successfully predicts trading ranges in about 95% of the cases.

It’s one of the best technical indicators for determining the current volatility in the market and the likely trading range for a given trading session (daily, weekly, monthly or even intra-day). There are even different trading strategies that have been developed specifically for trading with Bollinger Bands that are designed to take advantage of volatility changes in the market.

Bollinger Bands on a daily chart of Gold

ATR (Average True Range)

The Average True Range is a simple yet very useful indicator that measures the average trading range of the instrument or currency pair it is plotted on. The settings of the indicator are customizable and the values can be averaged out according to what the user needs or wants.

The ATR simply shows the average session ranges in pips for the plotted currency pair. The indicator works equivalently well on any timeframe and shows the average trading ranges for that specific timeframe. It is a great way to get a quick view of what is the average volatility in a given asset or currency pair.

Just to illustrate why this is important, consider that there were times when the USDJPY pair traded in an average daily range of about 50 pips and there were other times when the average trading range was close to 200 pips! That’s 4 times higher which means stop loss and account balance sizes need to be 4 times higher as well!

The average True Range plotted below a daily chart of Gold

Now let’s look at one of the most widely used volatility indicators by professional traders. This is not a technical indicator, but an index that is available for trading as a futures contract.

The VIX – A measure of risk-sentiment in markets

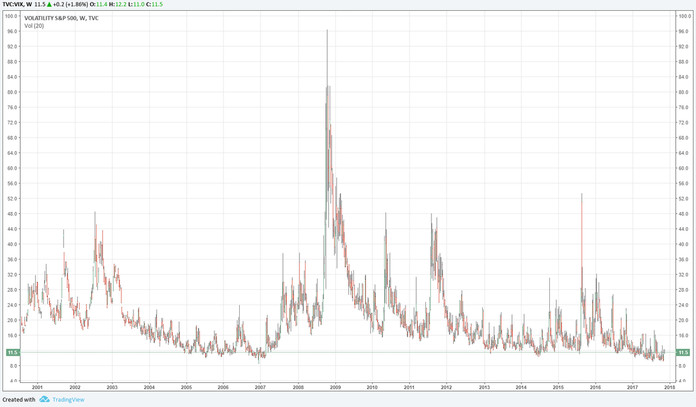

The Chicago Board Options Exchange Volatility Index, or simply known as the VIX is a measure of market expectations for 30-day volatility based on the implied volatility of different S&P 500 options.

Although it’s based on the US S&P 500 Stock index, the CBOE Volatility Index is commonly used as a general and broad measure of risk-sentiment in financial markets and as a result, it’s often popularly referred to as “the fear gauge” or ‘the fear index” in leading financial media.

The existing correlations between the stock market (S&P 500) and some currency pairs allow Forex traders to use this tool to their advantage as well when they are evaluating the current risk mood of the market.

Correlation between the VIX and other risk assets

While it’s hard to say that we can technically analyze the chart of the VIX like a standard price chart (that’s because it is not), still there is a tendency for the VIX to have certain links and correlations to risk-on and risk-off assets.

The basic correlation to remember is that the VIX spikes higher when risk aversion dominates and stock markets plunge while it is stuck down to low numbers when risk appetite overtakes and stock markets are rising.

Some correlations between the VIX and other risk-sensitive assets and currencies include:

- Gold and the VIX tend to be positively correlated – when the VIX rises Gold tends to do so also

- Stock markets and the VIX tend to be negatively correlated as we said above.

- USDJPY and the VIX tend to be negatively correlated.

- USDCHF and the VIX also tend to be negatively correlated.

The Volatility Index spikes higher in times of market turmoil and risk aversion (2009, summer 2015). It stays at low levels during times of stability and risk-appetite (2017)

Summary

Finally, we can conclude that all serious traders should study volatility and how it affects the markets for the simple reason that market conditions change together with volatility. Trading through a 2008-like financial crisis is very different than trading in a stable environment like we had throughout this past year (2017).

A trader who is trading for 2-3 years may assume that he has enough experience and that he can call himself a true pro, but history shows there is no space for overconfidence in markets. These traders could quickly learn how easy is to get a margin call if volatility increases to 2008 levels and they don’t adjust their strategies and positions accordingly.