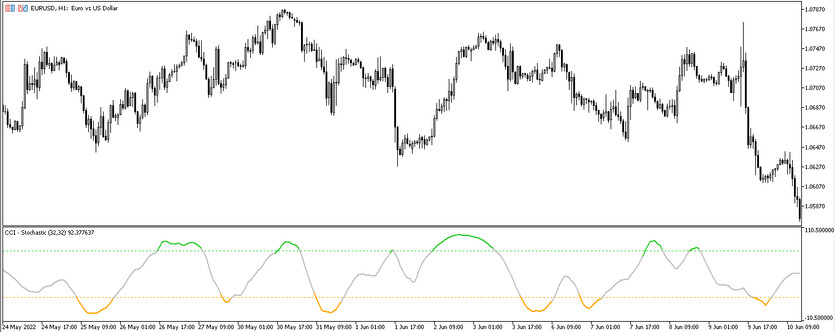

The CCI Stochastic indicator was developed as a small strategy to facilitate trading conditions. The indicator was compiled on the basis of the work of two others, namely CCI and Stochastic. Thanks to the interaction with each other, they create the most accurate signals, which allow making effective trades with good profit. In addition, the indicator has a convenient color scheme, thanks to which it can be easily distinguished which zone the market is in: neutral, overbought or oversold. The indicator can be used with any currency pairs, on any timeframe.

Input parameters

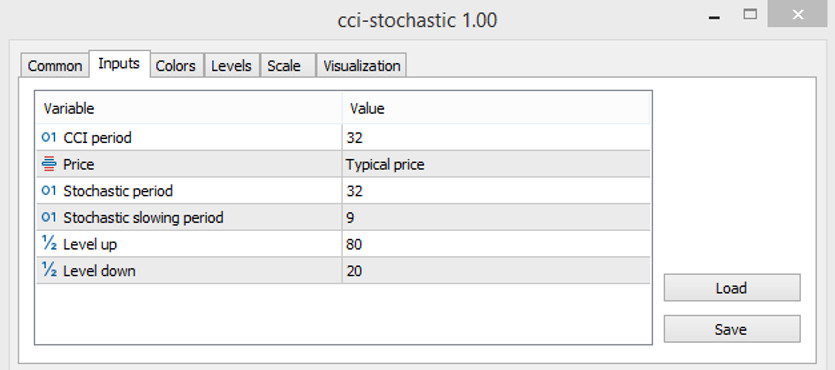

Due to the fact that CCI Stochastic uses two indicators at once in its calculations, its settings contain parameters related to both CCI and Stochastic.

- -CCI Period - CCI indicator period. The default value is 32.

- -Price-price to which the indicator's general calculations will be applied. Default value is Typical price.

- -Stochastic Period - the value of the period of the Stochastic indicator. The default value is 32.

- -Stochastic slowing period - the period of slowing down the Stochastic indicator. The default value is 9.

- -Level up - the upper level of the indicator, which indicates the transition of the market to the overbought zone. The default value is 80.

- -Level down-lower oversold level of the indicator. The default value is 20.

Also, in the indicator settings, the color scheme and the width of the indicator line can be changed. In addition to the overbought and oversold levels, a neutral level can be added to the chart, when it passes, a position is opened in a certain direction.

Indicator signals

The CCI Stochastic indicator is shown on the chart as a solid line, which, under certain conditions, crosses levels 20 and 80, moving into the oversold and overbought zones, or is located between them, at this moment trades are opened. Before trading, it is recommended to add a neutral level 50 to the indicator window.

Signal for Buy trades:

- -After crossing level 20, the indicator line moves up, crossing level 50 and is located above it.

- -At the same time, it is important that the line does not cross the level of 80, that is, the overbought zone.

After receiving such a signal, namely after crossing the level 50 upwards, a long position can be opened. The trade should be closed after the line passes the level 80 or changes its direction.

Signal for Sell trades:

- -After staying in the overbought zone, the indicator line moves down, below the level of 50.

- -The line should not be below the oversold level, that is, level 20.

When level 50 is crossed downward, a short position may be opened. The position should be closed when the direction of the line changes or it crosses level 20.

Conclusion

Thanks to the interaction of CCI and Stochastic, a new indicator was created, the calculations of which are extremely accurate. Despite its effectiveness, the indicator is very easy to use, so it can serve as an assistant for traders of different levels of preparedness. However, a little practice in the form of using a demo account never hurts.