As a rule, the highest profit on Forex is brought by trades in which it is possible to predict a trend reversal even before its actual reversal. In the traders' environment, the attitude towards predictors of indicators is ambiguous. Most of these algorithms build their prediction models by mirroring historical markup.

The Fourier Extrapolator indicator does not follow the same path but uses mathematical principles when building a forecast. From the name of the instrument, it becomes obvious that its developer used some of the provisions of Fourier's theory, which has found application in many areas of human activity, from theoretical physics to the creation of musical instruments.

Indicator calculations

Within the Forex market, this theory is used as follows - the Fourier Extrapolator indicator automatically examines the amplitudes of price fluctuations over several periods at once and then selects from them the models, the parameters of which most closely correspond to the third harmonic. Of course, this interpretation is not entirely clear for those who are unfamiliar with the complex Fourier theory. Nevertheless, it does not hurt to use this algorithm in trading, knowing the stages of its calculations, which can be divided into four steps:

These stages implement the Fourier theory in this indicator.

Indicator settings

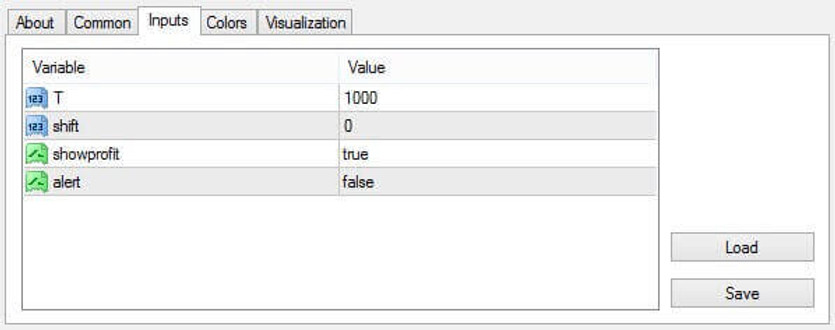

The following editable parameters are available in the indicator settings:

- T is the base period, through which the duration of the longest interval for searching for harmonics is set;

- Shift - a shift of the starting point of the projection along the time axis, which is used to assess the quality of modeling in the past;

- The show_profit parameter - enable/disable the virtual equity line;

- alert - if the value is true, the predictor indicator will display a special window that lists the segments whose harmonics were involved in the construction of the averaged forecast.

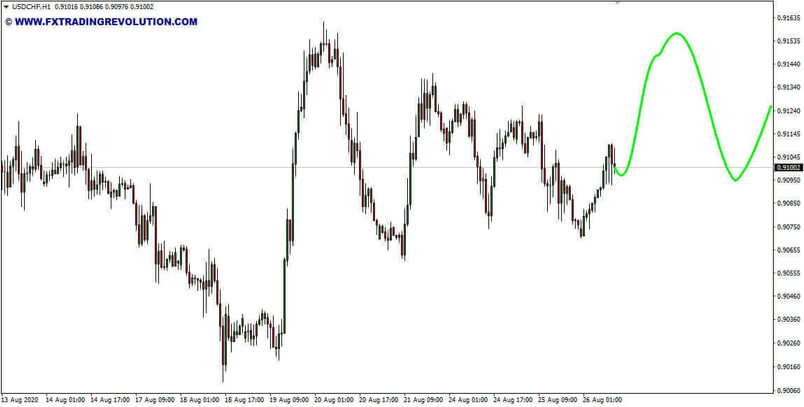

Indicator signals

As with all predictor indicators, this tool displays a light green forecast line designed to inform the trader about further price movement.

Conclusion

The peculiarity of this tool, as mentioned above, lies in the fact that it does not use historical models of behavior, but builds its own predictions based on Fourier theory. Experiments with Fourier Extrapolator show pretty good results for his predictions. But in order to fully trust its methodology, the trader should independently study the forecasts of this indicator and adjust its parameters to the traded asset through careful experiments.

Tip: Can’t open the downloaded archive file (ZIP or RAR)?

Try WinRAR for Windows or The Unarchiver for Mac .

Do you need help with installing this indicator into MT4 for Windows or Mac OS? Our guide HERE will help you.