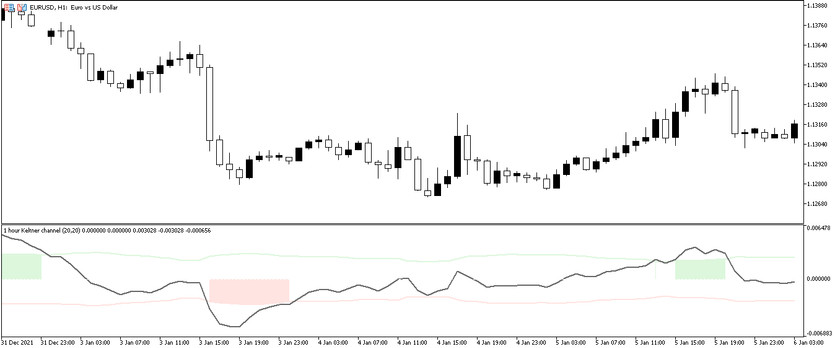

The Keltner Channel Oscillator is an updated version of the Keltner Channel indicator, designed to make it easier to identify channel breakouts. With using this oscillator, it can be easily detect features and patterns in price dynamics that are difficult to determine with the naked eye. Technically, both versions of the indicator are very similar.

The Keltner Channel Oscillator also consists of two parallel bands, above and below the moving averages, but unlike the Keltner Channel, the indicator is formed in the lower chart window and is an oscillator. This greatly simplifies the work during trading. The indicator is used on the MT5 platform. The indicator has an additional function, when using which you can see the indicator reading on all time frames. All currency pair is used.

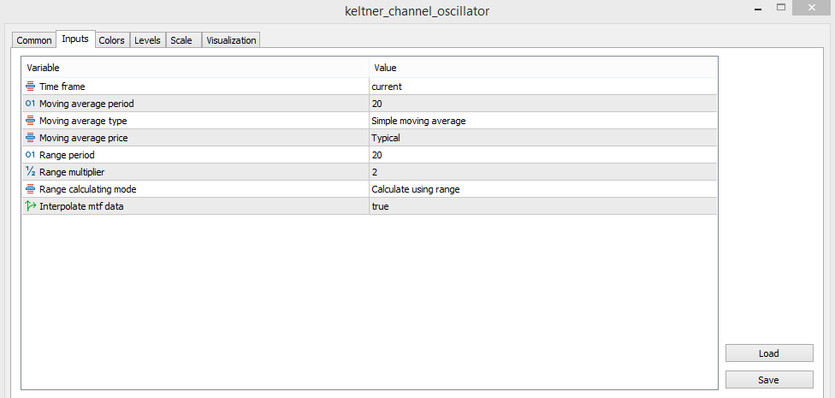

Input parameters

Unlike the Keltner Channel indicator, the Keltner Channel Oscillator has more advanced settings, which helps to create more convenient trading conditions at own discretion.

- Time frame-parameter with which you can use an extended time interval: from 1 minute to 1 month. The default value is current.

- Moving Average Period - the period on which the calculation will be made. The default value is 20.

- Moving Average Type - moving average type. There are two types in the parameters: Exponential Moving Average (EMA) and Simple Moving Average (SMA). Default is SMA.

- Moving Average Price-price type for a moving average. Using this parameter, it can be set the optimal maximum, minimum, the level of opening and closing trades and other price options. The default value is Typical.

- Range Period-range of the indicator calculation period. The default value is 20.

- Range multiplier - moving average range multiplier. Default value is 2.

- Range calculating mode - calculation execution mode. The default value is Calculate using range.

- Interpolate mtf data- is a data definition parameter. The default value is True.

Indicator signals

Making trades using the Keltner Channel Oscillator indicator is very simple, even for beginners. To make trades in order to get more accurate signals, you should use additional indicators that determine the trend. If an uptrend is defined on the market, you need to make buy trades, if it is downtrend, sell trades. And it is worth closing a trade when the trend changes in the market. In order to make a buy trade, it should be waited for the moving upper boundary of the channel to be broken upwards. And a sell trade, if the lower boundary of the channel is broken by the moving downwards. If the moving line returns to the channel, the trade should be closed before the next signals to make trades.

Conclusion

The Keltner Channel Oscillator indicator, being a modified version of the Keltner Channel, is more accurate and convenient to use. Thanks to the advanced settings, it can be changed for your own comfort. However, for making trades with a high probability of profit, it is worth using additional indicators.