The MACD Flat Trend indicator is used to determine the presence of any trend or flat in the market using the MACD indicator calculations. The indicator is represented as a solid line, which, when determining a trend, is painted in one of three colors, with the help of which the current market movement is revealed.

Despite the fact that the MACD Flat Trend indicator is not entirely suitable for independent trading, it can be used in various strategies, in as an assistant that determines the current trend. If it is used the indicator in a strategy, it should be taken into account the nuances of other indicators when choosing a timeframe and currency pair, but the MACD Flat Trend itself is suitable for trading on any timeframe using any currency pair.

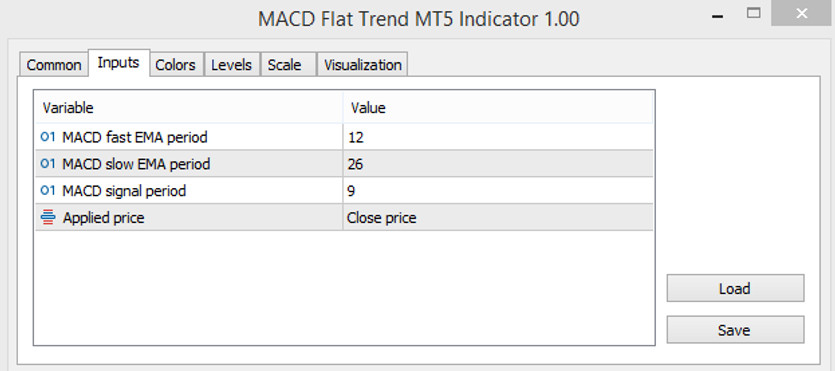

Input parameters

The MACD Flat Trend indicator has absolutely identical settings with the MACD, which consist of only four parameters. Therefore, if it is first studied the MACD indicator, then using its new versions will not be difficult.

- MACD Fast EMA period-period of fast exponential moving average. The default value is 12.

- MACD Slow EMA period-value of the period of the slow moving average. The default value is 26.

- MACD signal period-period of the signal line of the indicator. The default value is 9.

- Applied price - the price to which the general calculations of the indicator will be applied. The default value is Close price.

Indicator signals

Unlike the standard version, the MACD Flat Trend indicator makes it much easier to determine the current trend, thanks to the presence of a line that is painted in three selected colors. One of them indicates an uptrend, the second is a downtrend, and the third color indicates the presence of a flat in the market. It should be traded when a trend is detected, as trades made during a trend are more profitable.

Signal for Buy trades:

- After coloring in the color indicating an upward trend, the line changes color, characterizing the upward movement.

Thus, after the appearance of a color indicating an uptrend, a long position may be opened. However, for own certainty, the entry point should be checked using other indicators or advisers. It should also be borne in mind that the trade should be closed and not opened at all if the indicator determined flat. The closing of the trade also occurs if the end of the uptrend is determined on the market.

Signal for Sell trades:

- After the end of an uptrend, the line is colored with a falling value, indicating that there is a downtrend in the market.

After receiving such a signal, a short position can be opened on a certain candle, which should be closed after changing the color of the line. It should also be borne in mind that trading cannot be made if a flat has been determined on the market.

Conclusion

The MACD Flat Trend trading indicator easily and accurately determines the presence of a trend or flat in the market, thanks to the calculations of the effective MACD trend indicator. However, unlike the standard version, the indicator is not always accurate in identifying the entry point to the market. Therefore, it is better to use the MACD Flat Trend indicator in in combination with other technical indicators or advisors.