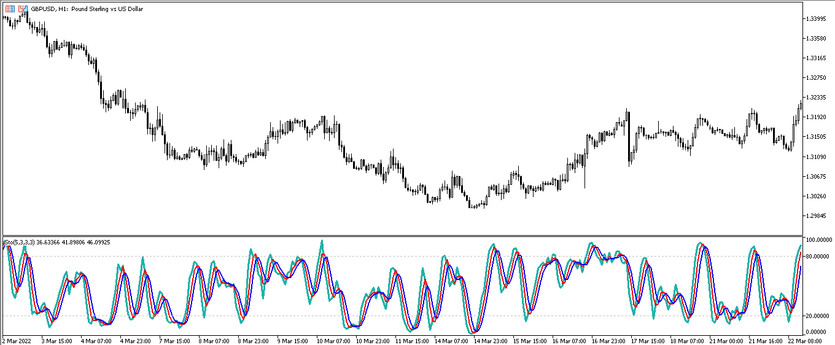

The Special Slow Stochastic indicator, also known as SSS, is a modification version of the Stochastic indicator, which is included in the standard forex set. SSS and its standard version are almost the same in terms of the scheme of work and general visualization, however, an additional line was added to the new one, called Special Slow. Thanks to the presence of this line, the indicator becomes more accurate and correct in its calculations. The trading conditions of the indicator are almost the same, but now the values of the Special Slow line will also be taken into account.

This indicator is mainly used to find optimal market entry points, however it can also be used in various strategies to determine whether the market is overbought or oversold. Like the previous version, Special Slow Stochastic can be used on any timeframe, with any currency pairs.

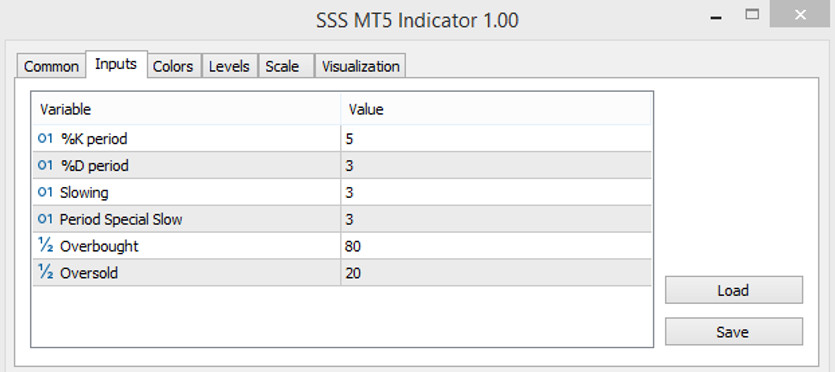

Input parameters

The Special Slow Stochastic settings are almost the same as the Stochastic itself, however, since this is a modification version, the SSS settings have acquired additional parameters. The indicator parameters also include sections responsible for the colors and width of the indicator lines, as well as for adding additional levels, the intersection of which can be considered as a signal.

- %K period - parameter responsible for the period of the main line of the indicator. The default value is 5.

- %D period - period of the signal moving average. The default value is 3.

- Slowing - the period of slowing down the values of the indicator lines. The default value is 3.

- Period Special Slow - the period of the special slow moving average added to the indicator. The default value is 3.

- Overbought - the value of the overbought level, which is available in the indicator window. The default value is 80.

- Oversold - parameter responsible for the value of the oversold level presented in the indicator window. The default value is 20.

Indicator signals

The signals of the Special Slow Stochastic indicator are identical to the signals of its standard version. That is, taking into account the position of the main and signal moving averages relative to each other, as well as their location between the oversold and overbought levels, a certain trade can be considered. However, the location of the Special line should also be taken into account in the new version Slow, which under certain conditions also crosses the indicator lines and levels 20 and 80.

Signal for Buy trades:

- The indicator lines should be positioned so that the main line should be above all, followed by the signal line, and below them is the Special Slow line.

- At the same time, after crossing the oversold zone, all of them should start moving up, but do not cross the overbought level.

After such a crossing of the moving averages, taking into account the remaining conditions, a buy trade can be opened. It should be closed after the reverse intersection of the lines occurs or one of them crosses the overbought zone.

Signal for Sell trade:

- The moving averages of the indicator should intersect with each other so that Special Slow is on top, followed by the signal% D, and then the main one -%K.

- It is important that, after crossing level 80, the lines should go down, but do not cross level 20.

Upon receipt of such conditions, a short position can be opened on a certain candle. It should be closed after crossing the lines in reverse order or when at least one of them enters the oversold zone.

Conclusion

The Special Slow Stochastic indicator is very simple and logical to use, especially when using a demo account in advance, as well as a little study of its standard version, since their scheme of work practically does not differ from each other. With practice, money management control, as well as strict adherence to trading conditions any trade will be made efficiently, that is, with a good profit and minimal loss.