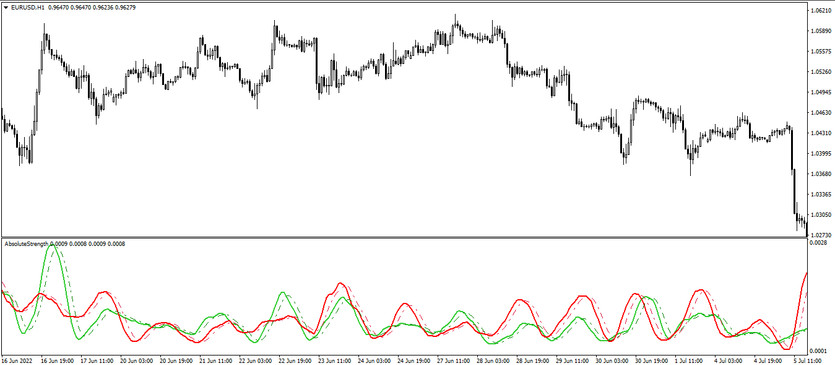

The Absolute strength is a special algorithm created to determine the prevailing trend in the current market. Absolute strength calculations can be reproduced based on the RSI or Stochastic indicator, at the user's choice one of these indicators, combining work with a moving average, the type of which can also be selected in the settings, reproduces the calculations. The indicator, presented in the lower window of the price chart in the form of two main and two signal lines of different colors, depending on their direction, color and intersection with each other, allow determining the current trend, and based on this, open a position in a certain direction.

The Absolute strength indicator is suitable for use with any convenient currency pairs, on any suitable timeframe.

Input parameters

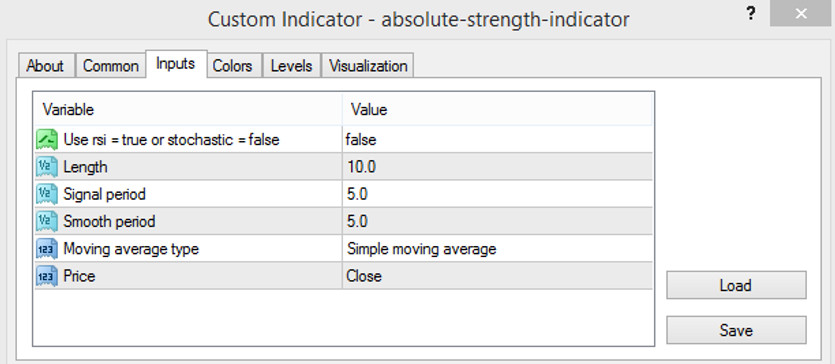

The Absolute strength indicator settings consist of six input parameters, which in turn affect the indicator's calculations. Also, its settings have sections responsible for the color gamut, line width and adding signal levels to the indicator window.

Use RSI=true or Stochastic=false - parameter responsible for choosing the main indicator for calculations. The default value is false, that is, Stochastic.

Length - parameter responsible for the length of the indicator values. The default value is 10.0.

Signal period - period of indicator signal lines. Default value is 5.0.

Smooth period - period for smoothing indicator values. The default value is 5.0.

Moving Average type - the type of moving average used for indicator calculations. The default value is Simple moving average.

Price - price to which the indicator's calculations will be applied. The default value is Close.

Indicator signals

The main purpose of the Absolute strength indicator is to quickly determine the current trend. With the help of the intersection of lines and their color, it can be understood which trend prevails at the moment and determined the direction of the trade that can be opened during a certain trend. To do this, it is needed to follow the direction of the lines, the intersection of the main lines with each other and signal ones, as well as their color. Thus, taking into account these conditions, a position can be opened on a certain candle in the direction with the current trend.

Signal for Buy trades:

- The line with the value of the growth crosses the line with the value of the fall from the bottom up. At the same time, in turn, being above its signal.

After the indicator lines intersect in this order, a long position can be opened. It should be closed after the reverse intersection of the main indicator lines, as this will indicate a change in the current trend, which will allow opening new trades.

Signal for Sell trades:

- The main lines of the indicator crossed so that the line with the fall value is higher than the line with the growth value. In this case, the signal line with the fall value should be higher than the main one.

After receiving such an intersection of the indicator lines, a short position can be opened. It should be closed after the indicator lines cross in the opposite direction, which will indicate the end of the downtrend, and at this moment it can be considered opening new positions.

Conclusion

The Absolute strength indicator is very powerful, but at the same time a fairly easy-to-use trading algorithm. Thanks to the use of effective indicators in its calculations, Absolute strength brings good profits. But despite its ease of use, it should be not neglected its preliminary use on a demo account.