The Advanced Bollinger Squeeze is a fairly complex calculation system based on the functioning of a large number of effective indicators and oscillators, which, in combination with each other, determine the presence of a trend in the market and its strength. To determine the trend, the indicator uses the ratio of Bollinger Bands and Keltner Channel calculations, and Stochastic, CCI, RSI, MACD, Momentum, Williams % Range, DeMarker and ADX indicators, in turn, determine the strength of the current trend. Thanks to the combination of the best indicators in the Advanced Bollinger Squeeze system, each signal is very accurate, so any trade will be made with the presence of a good profit.

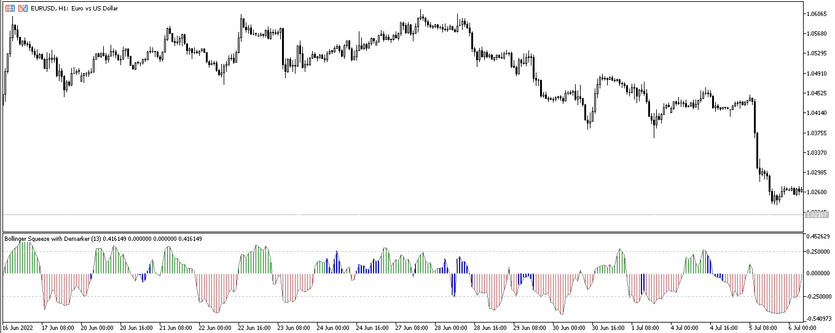

The indicator itself is presented in the lower window of the price chart in the form of a histogram, which, according to the existing calculations, is painted in a certain color and goes up or down, sometimes reaching its levels of 0.25 and -0.25. Advanced Bollinger Squeeze is suitable for trading on any timeframe, using any currency pair, without losing its effectiveness.

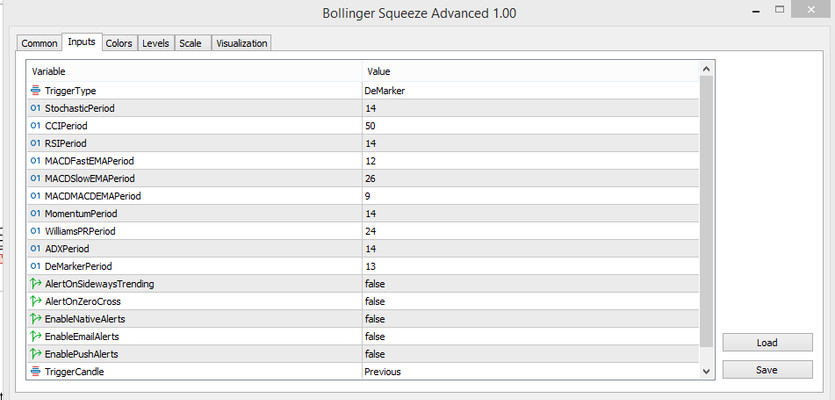

Input parameters

The Advanced Bollinger Squeeze indicator uses calculations of other technical indicators as the basis of its work, which, in turn, are very effective. Therefore, the presence of a large number of input parameters in the indicator settings is due to other technical indicators included in it. In addition, Advanced Bollinger Squeeze is a signal indicator, that is, under certain conditions, the indicator generates a signal and sends it in the most convenient form for the trader. Also in the indicator settings there are parameters responsible for the color range, the width of the histogram and adding additional levels, after crossing which the histogram will generate a signal.

- Trigger type - parameter responsible for selecting the main indicator for the trend histogram. The default value is DeMarker.

- StochasticPeriod - the period of the Stochastic indicator, if it is selected in the Trigger type parameter. The default value is 14.

- CCIPeriod - parameter responsible for the period of the CCI indicator, if it is selected as the main one in the Trigger type parameter. The default value is 50.

- RSIPeriod - value of the indicator period, if it is selected in the Trigger type parameter. The default value is 14.

- MACDFastEMAPeriod - fast exponential moving average period of the MACD indicator, if the indicator is selected in the Trigger type parameter. The default value is 12.

- MACDSlowEMAPeriod - period of the slow effective moving average of the MACD indicator, the parameter can be changed if the MACD indicator is selected in the Trigger type parameter. The default value is 26.

- MACDMACDEMAPeriod - period of the MACD signal moving indicator, if it is selected in the Trigger type parameter. The default value is 9.

- MomentumPeriod - the period of the Momentum indicator, if it is selected as the main one in the Trigger type section. The default is 14.

- WilliamsPRPeriod - the period of the Williams % Range indicator, if it is taken as the main one. The default value is 24.

- ADXPeriod - ADX indicator period value, if it is selected in the Trigger type parameter. The default is 14.

- DeMarkerPeriod - period of the DeMarker indicator, which is set as the main one by default in the Trigger type parameter. The default value is 13.

- AlertOnSidewaysTrending - a signal that, if set to true, is played after the trend changes sideways in the market, and vice versa. The default is false.

- AlertOnZeroCross - a signal that breaks after the histogram crosses the zero level from below and above, if the value is set to true. The default is false.

- EnableNativeAlerts - parameter responsible for breaking through the signal in the main chart window, if true is selected. The default is false.

- EnableEmailAlerts is a parameter that, when set to true, sends the alert to the previously specified email after receiving the alert. The default is false.

- EnablePushAlerts-parameter, if set to true, sends a signal to the previously specified mobile device in the form of a push notification. The default is false.

- Trigger Candle - notification verification candle. The default value is Previous.

Indicator signals

The Advanced Bollinger Squeeze indicator has two main signals, and therefore can be used both to determine the presence or absence of a current trend, and to enter the market. To check for a trend in the market, turn on the AlertOnSidewaysTrending signal, which notifies of a trend or sideways movement, and to enter the market, consider the AlertOnZeroCross parameter, which notifies when the histogram crosses the zero level from below or above. In addition, when entering the market, it should be pay attention to the color and width of the histogram bars.

Signal for Buy trades:

- The histogram crosses the zero level from below, that is, its bars are directed upwards, moving to the level of 0.25.

- At the same time, it is important that an uptrend is determined in the market, which is due to the coloring of at least three columns of the histogram in color with a growth value.

After receiving such conditions on a certain candle, a long position can be opened. Close the trade after the histogram changes its color, which means the end of the uptrend, and it should be considered opening a new trade. However, it is important to remember that if the market is determined to move sideways, then current trades should be closed and new ones should not be opened.

Signal for Sell trades:

- The histogram bars move down, crossing the zero level, heading towards the -0.25 level.

- At this moment, a downtrend is defined in the market, that is, several bars of the histogram are colored with a falling value.

Upon receipt of such conditions, a short position may be opened on a certain candle. It is worth closing it after the histogram columns change their color, this may mean the beginning of an uptrend, in which case it should be considered opening other trades. If the histogram is colored with the value of lateral movement, all current trades should be closed and temporarily not open new ones.

Conclusion

Advanced Bollinger Squeeze is a very accurate indicator that is able to perform all its tasks very accurately, with the practical absence of false signals. Due to the presence of a wide range of indicators in it, the most convenient and accurate one in your opinion can be chosen as the basis for calculations. At the same time, it facilitates trading conditions and the presence of signals that can be sent in the form that is optimal for the trader. Before using it in practice, it should be experimented with the indicator on a demo account, which will allow excluding all difficulties during trading.