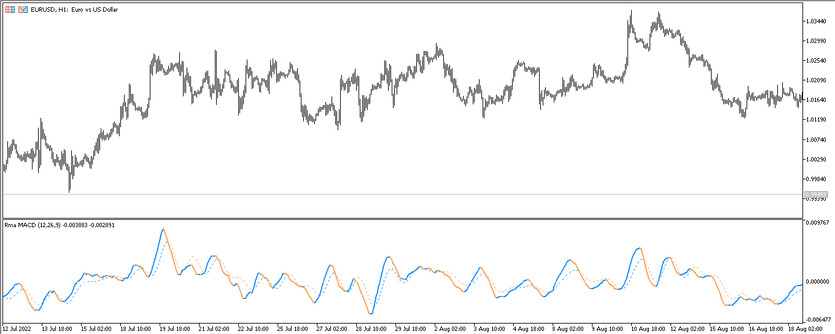

RMA MACD, which can also be known as Rsioma MACD is a trading indicator designed to determine the current market trend and identify the best moments to enter the market. To perform its work, the indicator uses the calculations of the MACD indicator, which is included in the standard forex set, as well as the moving Rsioma, which significantly improves the operation of the MACD itself. Unlike the standard version of the MACD, which is displayed on the chart as a histogram, the RMA MACD is displayed in the lower window of the price chart as two lines: the main and the signal, which change their direction depending on the current market conditions and color.

The RMA MACD indicator can be used on any convenient time frame with any currency pair.

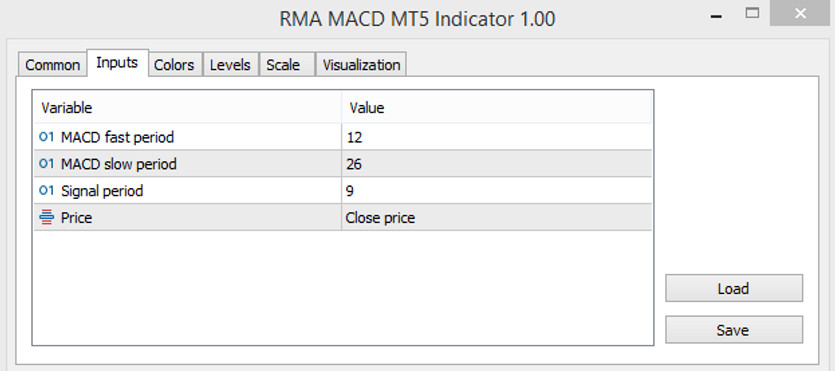

Input parameters

Despite the fact that RMA MACD is an improved version of the standard MACD, that is, its calculations are more accurate due to the added moving average, its input parameters are identical to the standard version. That is, like the MACD itself, the RMA MACD has four input parameters in its settings. And of course, in the Colors sections it can completely changed the color scheme of the indicator, and in the Levels section it can be added additional signal levels.

- MACD fast period - parameter responsible for the value of the period of the fast moving indicator. The default value is 12.

- MACD slow period - period of the slow moving MACD. The default value is 26.

- Signal period - value of the period of the signal line of the indicator. The default value is 9.

- Price - price to which the indicator's calculations will be applied. By default, it is set to Close price.

Indicator signals

The RMA MACD indicator generates signals based on the principle of all moving averages. That is, if the indicator lines, crossing each other, turn into a certain color and at the same time change their direction, this can be considered as an indicator signal for opening positions. That is, any trade made using indicator, should take into account all these values.

Signal for Buy trades:

- The main line of the indicator crossed the signal line from the bottom up.

- In this case, both lines should move up and have a color with a growth value.

Upon receipt of these conditions, a long position can be opened on a certain candle, which, accordingly, should be closed after receiving the opposite conditions, namely, the reverse intersection of the lines or a change in their direction with color.

Signal for Sell trades:

- Both lines of the indicator intersect so that the signal line is higher than the main one.

- In this case, the indicator lines move from top to bottom and are colored in color with the fall value.

After these conditions match on a certain candle, a short position can be opened. It should be closed at the moment when the lines intersect in the reverse order and change their color and direction.

Conclusion

The RMA MACD trading indicator is a very effective indicator, thanks to which it can be quickly determined the current trend and open a certain trade. But in order to properly understand trading with this indicator and study the conditions for its use, preliminary practice on a demo account is recommended.