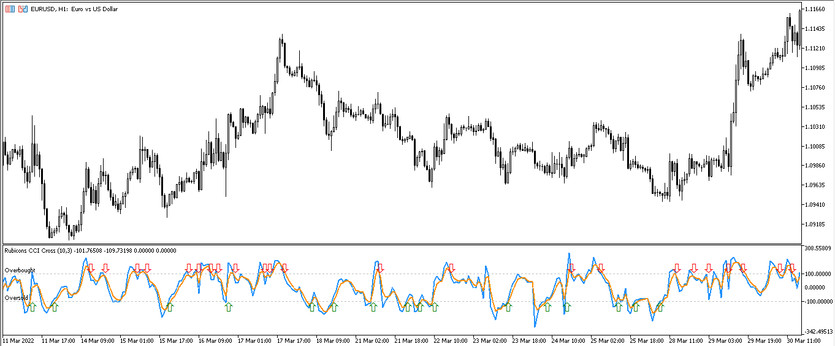

The Rubicons CCI Cross indicator is designed as a small system that consists of classic indicators, namely CCI and EMA. Under certain conditions of their interaction, the Rubicons CCI Cross indicator generates a signal to open positions. The indicator window also contains levels of 100 and -100, which characterize overbought and oversold. The indicator is universal, so trading with it can be made with any currency pairs, on any timeframe.

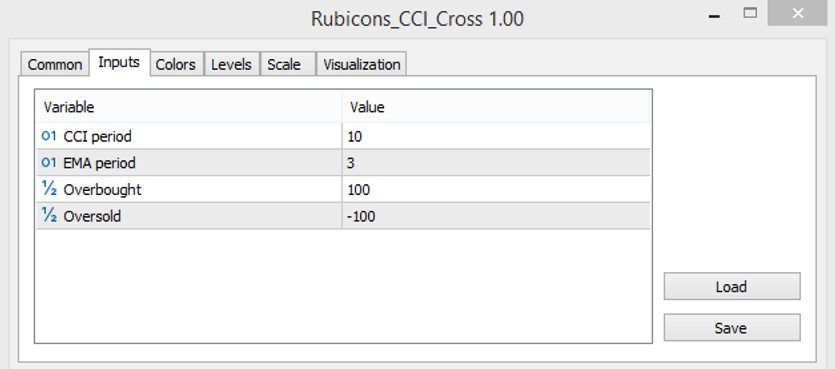

Input parameters

The Rubicons CCI Cross indicator, due to the fact that it is based on the functioning of two indicators, has parameters related to each of them. At the same time, the values of overbought and oversold zones can be changed in the settings. But at the same time, the indicator settings cannot be called very advanced, since it has only four input parameters.

- -CCI Period - the value of the period of the CCI indicator, which performs basic calculations. The default value is 10.

- -EMA Period - exponential moving average period, default value is 3.

- -Overbought - the value of the overbought level set in the indicator window. The default value is 100.

- -Oversold - the indicator's oversold level, with a value of -100.

Indicator signals

Due to the functioning of CCI and EMA, the signals of the Rubicons CCI Cross indicator are generated very quickly, while it should be borne in mind that they may not always be accurate. The signal to open positions is formed taking into account the values of both indicators.

Signal for Buy trades:

- - An arrow is formed on a certain candle, indicating the beginning of an uptrend.

- - The lines of the CCI and EMA indicator crosses the level of 100, that is, the overbought zone from the bottom up.

- -At the same time, the CCI indicator line should be above the exponential moving average.

After the formation of these conditions, a signal is generated to open a long position. After the exit of the lines from the overbought zone or the formation of an arrow with the opposite direction, the trade should be closed.

Signal for Sell trades:

- -Under certain conditions, an arrow is formed with a downward direction. This signals the beginning of an uptrend.

- - Both lines of the indicator cross the oversold zone, that is, the level -100.

- - EMA indicator, that is, the signal line is above the CCI indicator line, that is, the main one.

After the formation of these conditions, a short position can be opened. After the appearance of an arrow with an upward direction, or after the lines exit the oversold zone, the position should be closed.

Conclusion

Despite the ease of use and fast generation of signals, the Rubicons CCI Cross indicator is not entirely accurate. Therefore, it is recommended to use additional tools and filters to create a more effective strategy. A demo account will also help to instill the skills of using the indicator.