The arrow indicator Two MA one Stochastic is formed on the basis of the functioning of the trend indicator and the oscillator, that is, the Moving Average and Stochastic indicators. Using the moving averages, the indicator determines the current market trend, and the oscillator, taking into account the value of the moving averages, finds the optimal entry into the trade and sets the arrow of a certain color and directions. Of course, Two MA one Stochastic cannot act as an independent indicator, but in combination with other indicators, it shows excellent results, moreover, on any timeframe and with any currency pairs.

Input parameters

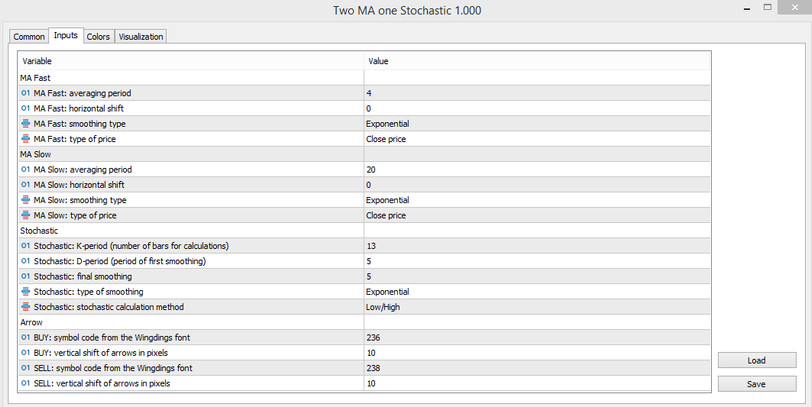

The Two MA one Stochastic indicator has quite extensive settings, which allows to create an indicator for own convenient trading. In the indicator parameters, it can be changed the value of each indicator, which consists of Two MA and one Stochastic.

MA Fast

- -Averaging period - the period for calculating the fast MA. The default value is 4.

- -Horizontal shift-shift horizontally of fast MA. The default value is 0.

- -Smoothing Type - type of fast MA. The default value is Exponential.

- -Type of price - type of price to which the calculation will be applied. The default value is Close price.

MA Slow

- -Averaging period - the period for calculating the slow MA. The default value is 20.

- -Horizontal shift-shift horizontally of slow MA. The default value is 0.

- -Smoothing Type - type of slow MA. The default value is Exponential.

- -Type of price - type of price to which the calculation will be applied. The default value is Close price.

Stochastic

- -K-period (number of bars for calculations)-period of bars to which the calculation will be applied. The default value is 13.

- -D-period (period of first smoothing) - period of the first smoothed moving average. The default value is 5.

- -Final smoothing- period of the last smoothed moving average. The default value is 5.

- -Type of smoothing - type of smoothed moving average. By default, it is set to Exponential.

- -Stochastic calculation method - method for calculating the smoothed moving average to the price. The default value is Low/High.

Arrow

- -Buy: symbol code from the Windings font- character code of the arrow for a long position. The default value is 236.

- -Buy: vertical shift of arrows in pixels - vertical distance of the arrow from the price chart in pixels for a long position. The default value is 10.

- -Sell: symbol code from the Windings font-character code of the arrow for a short position .The default value is 238.

- -Sell: vertical shift of arrows in pixels - vertical distance of the arrow from the price chart in pixels for a short position. The default value is 10.

It can be also changed the width and color of the arrows in the indicator settings at own discretion.

Trading with the indicator

To make trades, it will needed to take into account the direction and color of the arrow. Its direction will indicate the current market trend, and the color will indicate the opening of trades.

Conditions for Buy trades

- - An uptrend is defined on the market. That is, the indicator arrow is directed from the bottom up.

- -The color of the arrow has the meaning of growth.

It took only two simple conditions to complete a buy trade. It is almost the same with closing a trade:

- - The market trend is changing. That is, the indicator arrows change their direction. The arrow is directed from top to bottom.

- -The color of the arrow indicates the fall.

Stop loss in the case of buy trades is set below the recent local minimum. At the same time, take profit can not be set, but the trade can be closed manually, for example, in case of divergence or the above conditions.

Conditions for Sell trades

- -A downtrend is defined on the market. That is, the indicator arrow is directed from top to bottom.

- -The color of the arrow has a fall value.

It took only two simple conditions to complete a sell trade. Closing a trade is almost the same:

- - The market trend is changing. That is, the arrows of the indicator change their direction. The arrow is directed from the bottom up.

- -The color of the arrow indicates growth.

Stop loss in the case of sell trades is set above the recent local maximum. At the same time, take profit can not be set, but the trade can be closed manually, for example, in case of divergence or the above conditions.

Conclusion

The Two MA one Stochastic indicator shows excellent results in practice. But its signals may not be entirely accurate. Before making any trades, it should be borne in mind that the indicator only gives recommendations for entering trades, rather than accurate signals. Therefore, it is worth using additional tools , together with which it can be achieved profitable and fast trades.