Volumes indicator is the easiest technical indicator for a trader to understand. It reflects the real tick volume of trading by the number of bought/sold shares, futures, currencies, or options for the selected period of time.

Since the Forex market is decentralized, Volumes counts the number of ticks - triggered orders of traders without taking into account the volume of purchases or sales. They are most correctly reflected only on ECN accounts, on which direct transactions with liquidity providers and clients of other brokers take place on the united interbank platform.

Volume is an important adjunct to a price change for understanding the strength of the trend and the level of liquidity at the current time of the session. This explains why the indicator is included in the standard technical analysis tools of almost all trading platforms.

Indicator calculations

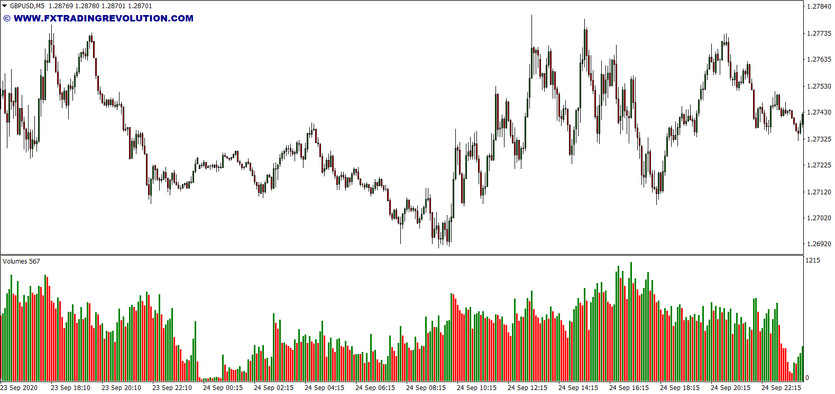

The Volumes indicator does not contain complex formulas - it is a tick counter for a specific period of time equal to the selected timeframe. Ticks are displayed in real-time as a cumulative histogram that changes as new deals appear on the market.

As soon as the candlestick closes, a new bar appears on the chart, colored in one of two colors, which has nothing to do with the price change:

The histogram below the previous value turns red;

The histogram above the previous value turns green.

Indicator signals

Market theory and practice make the growth of volumes a prerequisite for the trend. Below average trading volumes will help predict a flat or the end of a trend for a trader. In the first case, low volume indicators will save the trader from erroneous trades, allowing him to enter at the moment the trend continues. In the second case, they will work as a filter, stopping buying at the top of the trend.

Consecutive red bars of the histogram on an uptrend or downtrend reveal exchange rate manipulation by market makers who continue to artificially support the directional movement. The indicator gives a signal to refrain from new trades, ignoring entry points in the trading system until the moment of correction.

On the daily chart, three consecutive declining columns of volumes may indicate a high probability of a candlestick correction of the three-bar pattern. It is determined by connecting the first candlestick's opening price, which led to the formation of a red histogram bar, with the third candlestick's closing price.

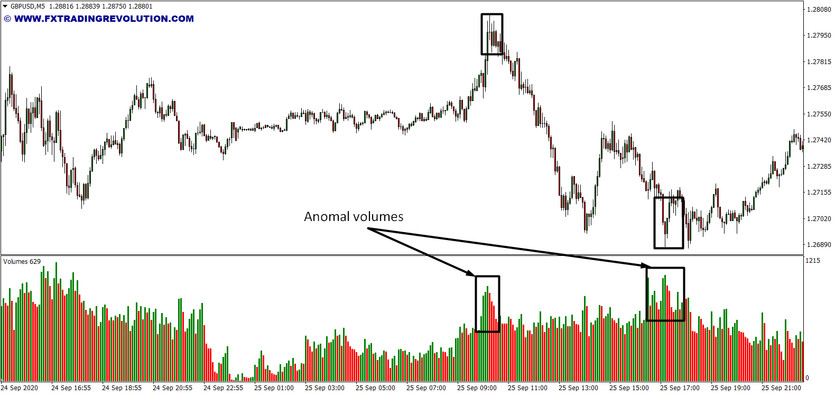

Abnormally high volumes of the Volumes indicator are another sign of a possible trend completion. They arise at the end of a global movement when big players are investing very heavily in reversing long-term trends.

A sharp rise in the Volumes histogram often occurs with local trends but does not necessarily lead to a reversal. After a short correction and flat, the movement may continue in the same direction, but the trader will receive a signal to protect the current profit or open a countertrend trade.

Conclusion

Volume is the main engine of the market, on which other parameters depend: volatility, the strength of reaction to fundamental news, the likelihood of continuation of currency trends. The Volume Spread Analysis theory founders managed to build a separate full-fledged theory of market analysis based on comparisons of the histogram of volumes with candlestick patterns.

Often, a modified Volumes histogram is used to apply it, but a trader does not have to look for another indicator if it works according to a different strategy. Volumes will not be superfluous in any trading system due to the reflection of the current market strength in real time.