Woodies CCI system is a universal trading system that includes a large number of different patterns and signals. The system is based on the indicator of the same name. You can download this indicator for free in the Indicators section of our website. The described version of the system is a narrowly targeted, well-defined strategy trading according to the Famir pattern of the Woodie CCI indicator.

As known, the Woodie CCI system and indicator are practically one whole. All its patterns are determined only within the framework of its indicator. No additional filters are used. In its original state, the system is quite complex and requires months of practice to be applied correctly.

In this version of it, only one pattern is used to search for signals to enter a deal on the EURUSD currency pair on the M15 timeframe. The Famir pattern is considered a fairly reliable pattern and is one of the most accurate in the entire Woodie CCI system.

Strategy settings

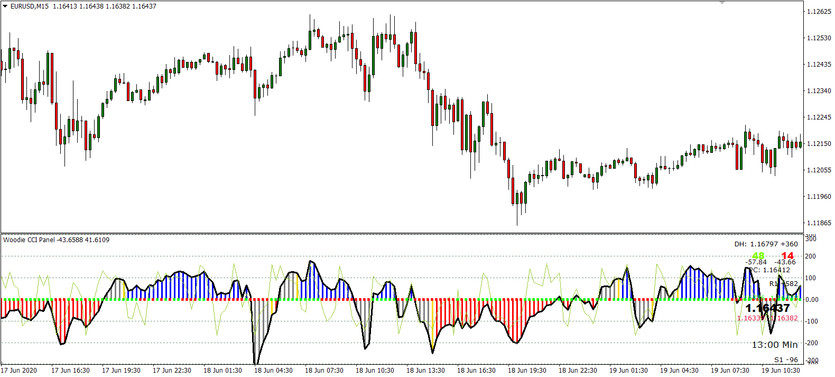

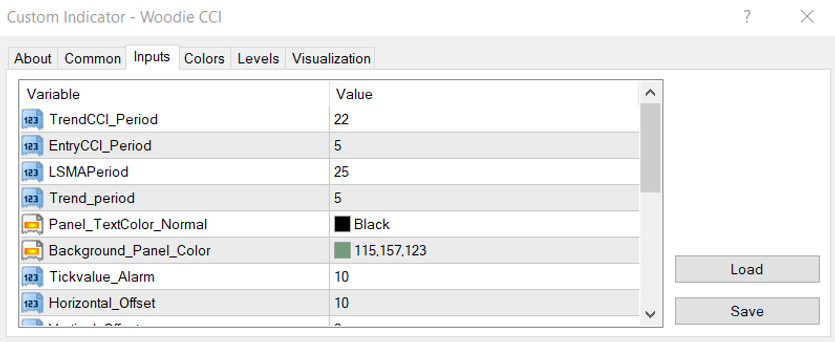

After downloading and installing the Woodie CCI indicator, apply it to the M15 chart of the EURUSD currency pair. Set the following parameter values in the indicator settings: 22 for the TrendCCI_Period parameter and 5 for EntryCCI_Period. Leave all other parameters with their default values.

Famir pattern

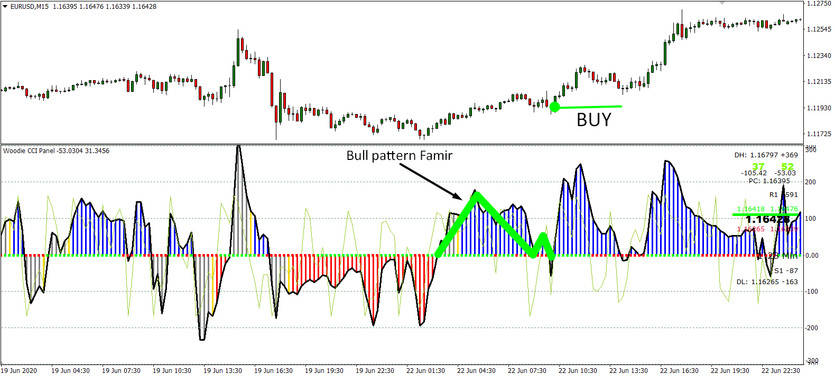

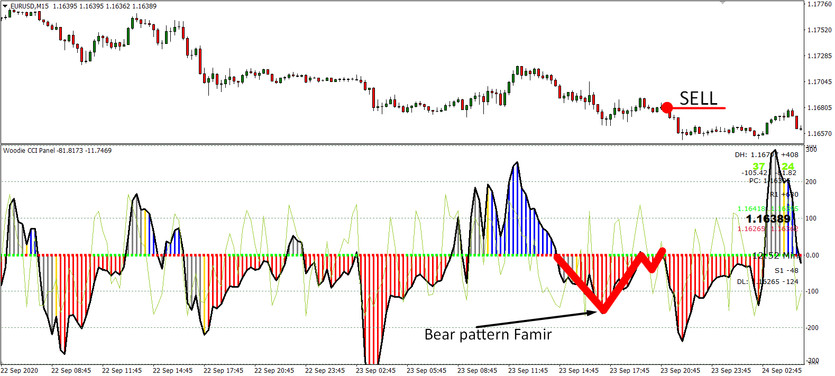

The Famir pattern looks like a false rebound of the CCI line (black indicator line) from the zero-line. The CCI line approaches the zero level, a rebound from it is formed, and at the next candlestick, the CCI line "breaks" and crosses the zero level. When the CCI line crosses the zero level for the second time - after the candle closes, a buy or sell position is opened.

Conditions for opening long positions

To open a buy trade, you need to wait for the emergence of the formed bullish Famir pattern:

The black line of the Woodie CCI indicator has been in the positive zone for at least ten last M15-candles, and the bars of the histogram are colored blue. Then, having touched the zero level from top to bottom, and having pushed off from it, she returned again and crossed it.

When this bullish pattern is detected, a long position is opened.

Conditions for opening short positions

The bearish Famir pattern looks exactly the same as the bullish one but in a mirror image:

The CCI line of the Woodie CCI indicator was in the negative zone, and the bars of the histogram was colored red. Then, having approached the zero level from the bottom up, pushed off and quickly returned, crossed it. After the M15 candle closes, a short position is opened.

Stoploss and TakeProfit

The stop-loss for each position is selected depending on the pattern's location and placed at the nearest local minimum for long positions and at the nearest local maximum for short positions. Take profit should be three times larger than the stop loss. When the price approaches the take profit position, you can also add a trailing stop for further position tracking.

Conclusion

An important criterion for this trading strategy's profitability is the ability to correctly identify the Famir pattern—practice identifying this pattern before using the Woodie CCI strategy on a live account.