Do you feel like you have the potential to earn a lot of money, but you don’t have the time? If time is an issue when it comes to trading, I would like to suggest you venture into the world of forex. For those of you who don’t know about forex trading, it is the most traded market in the world which is virtually open 24/7. The word forex which comes from a combination of foreign and exchange is a globally traded market which never sleeps. Due to such high volatility associated with it, the chances of making profits increases exponentially. It doesn’t matter if you want to be a day trader, a swing trader, position trader, news trader, or something else, you need to keep up with all the latest forex trading strategies so that you make your name in the list of those who earned money rather than those who lost what they had. In this article, I am going to highlight three forex trading strategies that have the highest chances of success so that you can use them in your trading method and earn money.

Position Trading

Position trading is a strategy which requires a lot of patience from the trader’s side. In this strategy, the trader has to hold his trades for a week and sometimes even for a month. As it is a long term trading approach, it is best for people who don’t have much time in their day for trading. All you are going to need to do is some technical analysis of the market so that you can time your entries and exits is a better way. For example, if you analyze a certain pair of currencies and determine that they will be bullish, you wait for the support to come before taking your position in the trade. To conduct this trade, you are going to need a larger capital, and for that, you can take the help of forex brokers.

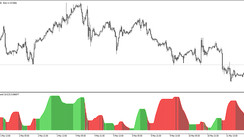

Swing Trading

Just like position trading, in swing trading, you hold your trade, but for a relatively shorter period of time. The timeframes that you will want to trade are going to fluctuate between 1 hour to 4 hours, and your target is to capture the market at a certain point when you can make the maximum profits. In order to get the best out of swing trading, you are going to need to have some knowledge of support and resistance, candlestick patterns, and moving average as you have to make your trades in a matter of hours. Swing trading works best if you have ample time in your day during which you can make your trades. Swing trading also holds the most chances of making a profitable trade as you will have more opportunities.

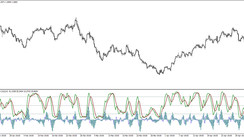

Day Trading

In day trading, the time frame for holding the trade becomes even smaller as you have to make trades in a matter of minutes, ranging from 5 to 15. As a day trading, your main goal is to capitalize on the volatility of the market and catch it at a certain point where it holds the most value. For that to happen, you have to make trades in the most volatile sessions, and that is where the timeframe of minutes come into play. To be a day trader, you won’t need to have much knowledge about the long term effects of the market. Instead, you need to have your focus on areas like identifying your bias for the day and the direction that the trade is taking in each session so that you can capitalize on it.