The ADX indicator is one of the most popular indicators having much to offer to traders even after so many years. Even if the use of ADX is so popular among traders, one of its top mysteries is based on its non-standard use - the SLOPE .

After general familiarisation with the ADX indicator, traders often become aware of the fact that this is a robust indicator, whose value is in particular in the fact that it shows if the market is in the trend or not. The most frequent public interpretation by ADX is the fact that is the actual ADX value is higher than 25, the market is in the trend (rising or declining trend) and, on the contrary, if the value is lower than 25, the market is considered to move sideways.

As mentioned above, in general, the most important factor at ADX is the actual value of this indicator. On the other hand, the past has often proved us that the ADX declination may be of the same importance at some moments, or even more, than the ADX value itself. This is also confirmed by the fact that before the ADX achieves its needed value, an ascending slope of the line must be achieved.

Based on these facts, any change in the ADX slope may provide trading signals to traders even before the value of the indicator itself does and the slope compensates the delay of the entire ADX indicator to some extent.

ADX slope and its interpretation

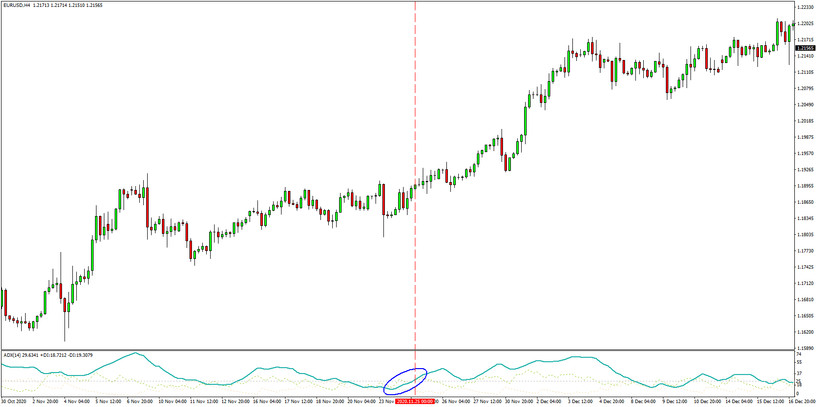

The chart above shows the development at EUR/USD currency pair by the use of hour candles and the bottom panel shows the development of the ADX indicator over the same period of time.

When taking a look on the chart above, it’s clear immediately that the first indications of trend change are coming from technical analysis, formed directly in the chart (crossing the blue trendline) and in the ADX indicator only thereafter.

However, let’s only focus on the ADX indicator and its two specified cases (two red vertical lines -> first line is showing the time, when the ADX slope is changing, while the second shows when the value of 25 is exceeded). If we waited for the ADX to ascend above the 25 value to confirm the trend, then the signal would come with a 12-hour delay in comparison with the signal of an ADX slope, what would mean that we lose the opportunity to gain additional and potential 58 pips.

What should the traders keep in their minds in relation to ADX

Traders should keep in mind that the ADX development (rising or falling) does not correspond to the development of the entire chart. As mentioned above, ADX does not serve for the determination of trend direction, but to determine, if the market keeps its trend !

That means that if the market keeps rising trend, then the ADX could rise probably and stay above the value of 25. However, the same applied to downtrend (an example could be seen on a chart below).

Conclusion

More or less, it’s clear that the ADX slope is not a holy grail as the ADX indicator alone changes its directions very often (provides number of false signals and in such case, it must be important to set the period of indicator used for the calculation of the entire indicator properly). However, if the trader pays sufficient attention to the Price Action and combines the ADX slope with other indicators (e.g. with mentioned trendline or any other indicator) in its trading strategy at the same time, then it’s possible to reduce potential false signals of the ADX indicator to acceptable number very effectively.

If you are interested in our ADX indicator and you would like to combine it with other indicators of technical analysis, don’t hesitate to take advantage thereof and try some of our unique indicators that are completely FOR FREE and can be downloaded here: https://www.purple-trading.com/indicators-for-mt4/

About the Author

Team Purple Trading

Purple Trading is a true and 100% fair ECN / STP forex broker providing direct access to the real market. High speed orders execution, no trade-offs, no limits for any type of trading, the most advanced trading technologies. Explore more about Purple Trading at www.purple-trading.com .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.8% of retail investors lose their capital when trading CFDs with this provider. This value was determined within the period from October 1, 2017 to September 30, 2018. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading forex exchange with margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. You could lose part or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Seek independent advice if you have any doubts.

Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. L.F. Investment Limited will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Purple Trading is a trade name owned and operated by L.F. Investment Limited., a licensed Cyprus Investment Firm regulated by

the CySEC lic. no. 271/15.