2020 already behind us and we hope that worse times have ended and we may expect only those better ones. In this article today, you will find everything what we may expect from 2021 and which factors you should pay attention to.

The end of crisis and quick recovery?

The entire world is now all about the vaccine, being finally distributed among the population of respective countries and thanks to which, everything should come back to “normal”.

In the event vaccination works as expected, real end to this crisis may seriously come. However, it does not seem as a quick recovery. A much slower distribution of vaccines than expected points to a slower recovery and at this moment, it’s also not clear by when the current restrictions are going to last in different countries, curbing local economies.

Recovery back to normal means new trading opportunities where some of them may bring profits of such amount this year, traders used to wait for over multiple years before. Naturally, also the top global investors are aware thereof. They have already invested in advance, causing that some markets are now seriously overbought and it’s not worthy to invest into them at this moment.

What’s important to monitor:

Coming back to normal may be affected multiple factors we should pay increased attention to.

· Information about vaccine efficiency

The primary factor is e.g. the real efficiency of vaccines. We should always remember that if vaccines are not going to be sufficiently effective (predicted efficiency may differ from the real one), we could only hardly come back to normal and the recovery of economies would be tough.

· Information about unwanted impacts

Naturally, any potential adverse effects could mean a big problem, however, thanks to the fact that there are more vaccines, it should not be such a problem to replace any of them.

· Information about mutations (in particular about those that could be resistant against vaccines)

The worst that we could encounter at this moment is the mutation of a new coronavirus that could be resistant against vaccination. Most probably it would mean a comeback to the most harsh restrictions and at the same, GDPs would drop, not being an ideal condition for investment activities.

When and where to invest this year?

Forex – EUR/USD

If the United States is going to continue in its financial strategy as before, we may expect that value of exchange rate to reach the second or even higher zone (see the chart above). However, it’s not very probable that the top representatives of this powerful country are just going to neglect weakening dollar.

This pair should rather stay within the zone 1 (see the chart above) as after the incoming new president, dollar tends to strengthen and stabilize its value. Another factor supporting this case is that United States has made more steps forward with vaccination that Europe and local economy recovery, so returning back to normal, should come earlier.

Gold

In case of gold, this may represent an opportunity not seen many times. Despite this fact, it’s expected that after the situation calms down, traders will start to reinvest their funds from safe havens (gold etc.) into more risky waters (stock, forex, commodities,…) while expected inflation that will come in respective countries thanks to pandemic, will push gold price higher, so at the end, we may expect that this precious metal is going to reach the zone 2 (zone 2 at the chart above) in case of negative as well as positive outlooks.

If you want to know more about trading strategies for gold, feel free to check our new e-book!

Download the “How to Trade Gold” e-book

S&P500

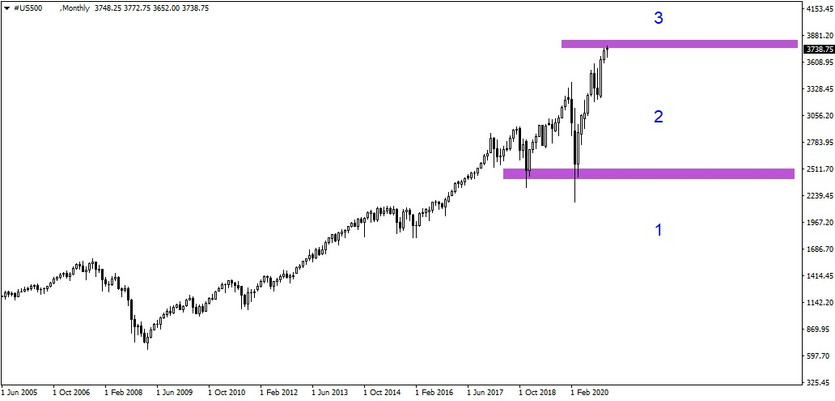

In case of stock indices, so in case of S&P500, we may expect that if everything goes as expected and the crisis from pandemic fades away, then not only the optimism, but also the mentioned inflation is going to push indices upwards. Thus, potentially, S&P500 could soon hit the 3rd zone (see the chart above), but it could also reach the magical threshold of $4,000.

In the second zone, this index is going to stay only if vaccination does not work or an unexpected crisis I going to occur. Conversely, we should probably not see the first zone this year as here, the U.S. economy would find itself in a relatively dire economic situation.

DAX30

As in case of the previous S&P500 index, this positive development should be followed (in case of a positive development of pandemic) also by the German DAX30 index, that should reach the 3rd zone as well (see the chart above).

If you would like to try out trading with top tier trading conditions and professional forex broker, don’t hesitate to try our demo account that may be open on our website completely for free and free of any risk: www.purple-trading.com/cs

We wish you many profitable trades!

Purple Trading team

info@purple-trading.com

+420 228 882 352 Mo-Fr, 8:00 A.M. – 4:00 P.M. (CET)

Tied agent address: Vinohradská 2828/151, Praha 3, Flora

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64.6% of retail investors lose their capital when trading CFDs with this provider.

(This value was determined within the period from January 1, 2020, to December 31, 2020). You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading forex exchange with margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. You could lose part or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Seek independent advice if you have any doubts.