Creating own indicator strategy can be a great way to trade the markets more effectively. By combining different indicators in different ways, you can create a strategy that is tailored to your own trading style and risk tolerance.

However, creating own indicator strategy is not without its challenges. You need to have a good understanding of how indicators work and how they can be used to identify trading opportunities. You also need to be able to backtest your strategy to make sure that it is profitable.

How to begin

The first step in creating your own indicator strategy is to choose the right indicators. There are a wide variety of indicators available, so it is important to choose ones that are compatible with each other and that will provide you with the information you need to make trading decisions.

Some popular indicators that you may want to consider include:

-Moving averages

-Bollinger bands

-Relative strength index (RSI)

-Stochastic oscillator

-Volume

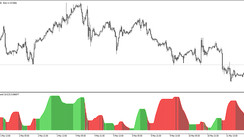

Once you have chosen your indicators, you need to decide how you want to combine them. You can use them individually, or you can combine them in different ways to create a more complex strategy.

For example, you could use a moving average to identify the trend, and then use a Bollinger band to identify overbought or oversold conditions. You could also use a stochastic oscillator to identify divergences, which can be a sign of a trend reversal.

Which indicators fit each other?

There are no hard and fast rules about which indicators fit each other. However, there are some general principles that you can follow. For example, you should generally avoid combining indicators that measure the same thing. For example, you would not want to combine two different moving averages, as this would be redundant.

You should also avoid combining indicators that have different time frames. For example, you would not want to combine a daily moving average with a 15-minute moving average. This is because the daily moving average would be too slow to react to short-term price movements.

How to check it

Once you have created your indicator strategy, you need to backtest it to make sure that it is profitable. Backtesting is the process of simulating your strategy on historical data to see how it would have performed.

Backtesting can be a valuable tool for identifying potential flaws in your strategy. If your strategy does not perform well in backtesting, then you may need to make some adjustments.

Will it be profitable or risky?

Whether or not your indicator strategy will be profitable depends on a number of factors, including the indicators you use, the way you combine them, and the market conditions.

However, in general, indicator strategies can be profitable if they are properly designed and backtested. However, they can also be risky, so it is important to manage your risk carefully.

It is also important to take into account such tips as:

Starting with a simple strategy. Don't try to create a complex strategy right away. Start with a simple strategy that you understand and that you can backtest.

Being patient. It takes time to develop a profitable indicator strategy. Don't expect to become a millionaire overnight.

Being flexible. The markets are constantly changing, so you need to be able to adapt your strategy as needed.

Experimenting. Try different combinations of indicators and different settings to see what works best for you.

Conclusion

Creating your own indicator strategy can be a great way to trade the markets more effectively. However, it is important to do your research and backtest your strategy before you start using it. By following these steps, you can increase your chances of success.